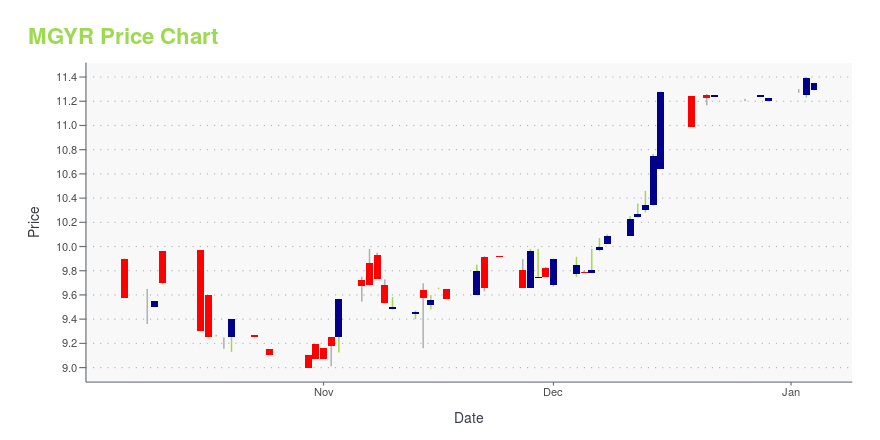

Magyar Bancorp, Inc. (MGYR): Price and Financial Metrics

MGYR Price/Volume Stats

| Current price | $12.50 | 52-week high | $12.71 |

| Prev. close | $12.71 | 52-week low | $9.00 |

| Day low | $12.50 | Volume | 1,491 |

| Day high | $12.60 | Avg. volume | 4,453 |

| 50-day MA | $11.29 | Dividend yield | 1.61% |

| 200-day MA | $10.82 | Market Cap | 82.43M |

MGYR Stock Price Chart Interactive Chart >

Magyar Bancorp, Inc. (MGYR) Company Bio

Magyar Bancorp, Inc. operates as the mid-tier stock holding company for Magyar Bank that provides various banking products and services in New Jersey, the United States. The company's product portfolio includes various deposit products, such as savings, demand, NOW, money market, and retirement accounts, as well as certificates of deposit; and loan products comprise one-to four-family residential mortgage loans, multi-family and commercial real estate mortgage loans, home equity loans and lines of credit, commercial business loans, small business administration loans, and construction loans, as well as consumer loans, which primarily include secured demand loans. It also provides non-deposit investment products and financial planning services, including insurance products, fixed and variable annuities, and retirement planning for individual and commercial customers; and investment securities. Magyar Bancorp, Inc. operates through seven branch offices located in New Brunswick, North Brunswick, South Brunswick, Branchburg, Bridgewater, and Edison; and a loan product office in Keyport, New Jersey. The company was founded in 1922 and is headquartered in New Brunswick, New Jersey. Magyar Bancorp, Inc. is a subsidiary of Magyar Bancorp, MHC.

Latest MGYR News From Around the Web

Below are the latest news stories about MAGYAR BANCORP INC that investors may wish to consider to help them evaluate MGYR as an investment opportunity.

Here's What We Like About Magyar Bancorp's (NASDAQ:MGYR) Upcoming DividendMagyar Bancorp, Inc. ( NASDAQ:MGYR ) stock is about to trade ex-dividend in 4 days. Typically, the ex-dividend date is... |

MAGYAR BANCORP, INC. DECLARES SPECIAL CASH DIVIDENDMagyar Bancorp, Inc. (NASDAQ: MGYR) announced that its Board of Directors has declared a special cash dividend of $0.07, payable December 12, 2023 to shareholders of record on November 28, 2023. |

Magyar Bancorp Independent Director Acquires 8.4% More StockInvestors who take an interest in Magyar Bancorp, Inc. ( NASDAQ:MGYR ) should definitely note that the Independent... |

Magyar Bancorp's (NASDAQ:MGYR) Dividend Will Be Increased To $0.04Magyar Bancorp, Inc. ( NASDAQ:MGYR ) will increase its dividend on the 24th of November to $0.04, which is 33% higher... |

Magyar Bancorp Inc (MGYR) Reports Fiscal Fourth Quarter and Year End Financial ResultsNet income for the year ended September 30, 2023, stands at $7.7 million, a slight decrease from the previous year |

MGYR Price Returns

| 1-mo | 15.21% |

| 3-mo | 10.25% |

| 6-mo | 7.88% |

| 1-year | 15.20% |

| 3-year | 24.68% |

| 5-year | N/A |

| YTD | 12.35% |

| 2023 | -10.74% |

| 2022 | 6.14% |

| 2021 | 27.33% |

| 2020 | -21.63% |

| 2019 | 0.41% |

MGYR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MGYR

Want to see what other sources are saying about Magyar Bancorp Inc's financials and stock price? Try the links below:Magyar Bancorp Inc (MGYR) Stock Price | Nasdaq

Magyar Bancorp Inc (MGYR) Stock Quote, History and News - Yahoo Finance

Magyar Bancorp Inc (MGYR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...