Mastech Digital, Inc (MHH): Price and Financial Metrics

MHH Price/Volume Stats

| Current price | $8.70 | 52-week high | $11.22 |

| Prev. close | $8.77 | 52-week low | $7.15 |

| Day low | $8.58 | Volume | 2,463 |

| Day high | $8.97 | Avg. volume | 5,866 |

| 50-day MA | $7.94 | Dividend yield | N/A |

| 200-day MA | $8.47 | Market Cap | 101.22M |

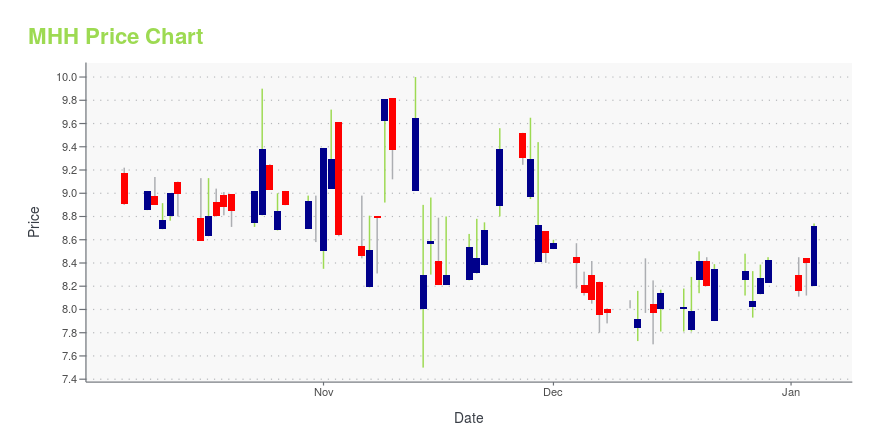

MHH Stock Price Chart Interactive Chart >

Mastech Digital, Inc (MHH) Company Bio

Mastech Digital, Inc. provides information technology staffing and digital transformation services. The Company offers business intelligence, data warehousing, service oriented architecture, web, enterprise resource planning, and customer resource management services. Mastech Digital serves customers worldwide.

Latest MHH News From Around the Web

Below are the latest news stories about MASTECH DIGITAL INC that investors may wish to consider to help them evaluate MHH as an investment opportunity.

Mastech Digital, Inc. (AMEX:MHH) Q3 2023 Earnings Call TranscriptMastech Digital, Inc. (AMEX:MHH) Q3 2023 Earnings Call Transcript November 5, 2023 Operator: Greetings, and welcome to the Mastech Digital Q3 2023 Earnings Call. At this time, all participants are in a listen-only mode. A brief question and answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded. […] |

Q3 2023 Mastech Digital Inc Earnings CallQ3 2023 Mastech Digital Inc Earnings Call |

Mastech Digital Inc (MHH) Reports 24% Revenue Decline in Q3 2023Challenging economic conditions impact both business segments during the quarter |

MHH: Mastech Digital Reports Q3 Revenue DeclineBy Lisa Thompson NYSE:MHH READ THE FULL MHH RESEARCH REPORT Mastech (NYSE:MHH) reported a year-over-year revenue decline of 24% in Q3 as customers, particularly in financial services, continued to pull back due to the worsening economy, inflation woes, the continuing banking crisis, and now the Middle East worries. The good news is that business declines have lessened and started to plateau. |

Mastech Digital Reports a 24% Year-over-Year Revenue Decline in the Third Quarter of 2023Mastech Digital, Inc. (NYSE American: MHH), a leading provider of Digital Transformation IT Services, announced today its financial results for the third quarter ended September 30, 2023. |

MHH Price Returns

| 1-mo | 10.41% |

| 3-mo | -0.34% |

| 6-mo | 0.58% |

| 1-year | -20.98% |

| 3-year | -53.94% |

| 5-year | 58.47% |

| YTD | 3.23% |

| 2023 | -23.45% |

| 2022 | -35.50% |

| 2021 | 7.36% |

| 2020 | 43.63% |

| 2019 | 75.71% |

Continue Researching MHH

Want to see what other sources are saying about Mastech Digital Inc's financials and stock price? Try the links below:Mastech Digital Inc (MHH) Stock Price | Nasdaq

Mastech Digital Inc (MHH) Stock Quote, History and News - Yahoo Finance

Mastech Digital Inc (MHH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...