M/I Homes, Inc. (MHO): Price and Financial Metrics

MHO Price/Volume Stats

| Current price | $165.54 | 52-week high | $167.87 |

| Prev. close | $158.40 | 52-week low | $74.79 |

| Day low | $161.78 | Volume | 372,611 |

| Day high | $167.87 | Avg. volume | 259,648 |

| 50-day MA | $129.34 | Dividend yield | N/A |

| 200-day MA | $119.41 | Market Cap | 4.59B |

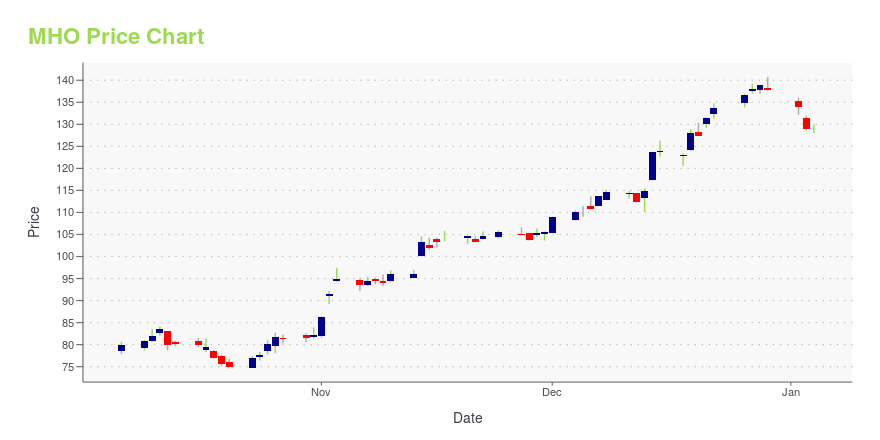

MHO Stock Price Chart Interactive Chart >

M/I Homes, Inc. (MHO) Company Bio

M/I Homes Inc. operates as a builder of single-family homes in Ohio, Indiana, Illinois, Maryland, Virginia, North Carolina, Florida, and Texas, the United States. The company was founded in 1973 and is based in Columbus, Ohio.

Latest MHO News From Around the Web

Below are the latest news stories about M/I HOMES INC that investors may wish to consider to help them evaluate MHO as an investment opportunity.

Why These 3 Sleeper Stocks Should Be on Your Radar in 2024These sleeper stocks have been performing very well lately, and investors should pay much more attention to them. |

Is M/I Homes, Inc.'s (NYSE:MHO) Latest Stock Performance A Reflection Of Its Financial Health?Most readers would already be aware that M/I Homes' (NYSE:MHO) stock increased significantly by 38% over the past three... |

Meritage (MTH) Surges 10.1%: Is This an Indication of Further Gains?Meritage (MTH) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term. |

M/I Homes Announces $100 million Increase to Share Repurchase AuthorizationM/I Homes, Inc. (NYSE:MHO) announced that its Board of Directors approved an increase in its share repurchase authorization by an additional $100 million. As of September 30, 2023, $53 million was available under the previous authorizations. |

There's Been No Shortage Of Growth Recently For M/I Homes' (NYSE:MHO) Returns On CapitalTo find a multi-bagger stock, what are the underlying trends we should look for in a business? Typically, we'll want to... |

MHO Price Returns

| 1-mo | 39.31% |

| 3-mo | 37.87% |

| 6-mo | 26.19% |

| 1-year | 70.29% |

| 3-year | 182.78% |

| 5-year | 386.02% |

| YTD | 20.18% |

| 2023 | 198.27% |

| 2022 | -25.73% |

| 2021 | 40.39% |

| 2020 | 12.55% |

| 2019 | 87.20% |

Continue Researching MHO

Want to do more research on M/I Homes Inc's stock and its price? Try the links below:M/I Homes Inc (MHO) Stock Price | Nasdaq

M/I Homes Inc (MHO) Stock Quote, History and News - Yahoo Finance

M/I Homes Inc (MHO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...