MICT, Inc. (MICT): Price and Financial Metrics

MICT Price/Volume Stats

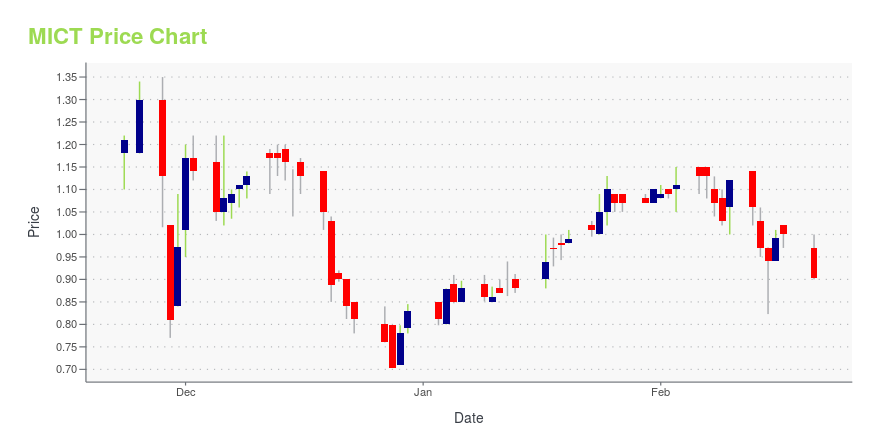

| Current price | $0.93 | 52-week high | $1.35 |

| Prev. close | $0.90 | 52-week low | $0.41 |

| Day low | $0.88 | Volume | 186,000 |

| Day high | $0.94 | Avg. volume | 321,497 |

| 50-day MA | $0.97 | Dividend yield | N/A |

| 200-day MA | $0.79 | Market Cap | 145.81M |

MICT Stock Price Chart Interactive Chart >

MICT, Inc. (MICT) Company Bio

MICT Inc. operates through its subsidiaries. Some of the group's offerings in the Chinese market include retail online brokerage, online investment and wealth management services and the sales of insurance products. MICT's other segment is in mobile computing devices and software that provide fleet operators and field workforces with computing solutions.

Latest MICT News From Around the Web

Below are the latest news stories about MICT INC that investors may wish to consider to help them evaluate MICT as an investment opportunity.

MICT Announces Rebranding and Name Change to Tingo Group, Inc.Stock Symbol to Change to NASDAQ: TIO New Identity Reflects Company’s Focus on Leveraging the Tingo Brand and the Rapid Expansion of the Group’s Consolidated Fintech and Agri-Fintech Businesses MONTVALE, N.J., Feb. 24, 2023 (GLOBE NEWSWIRE) -- MICT, Inc. (NASDAQ: MICT) (“MICT” or the “Company”) announced today that it is changing its name to Tingo Group, Inc. effective prior to the market open on Monday, February 27, 2023. The ticker symbol “MICT” will change to “TIO” and the stock will continue |

MICT, Through its Wholly Owned Subsidiary Tingo Foods Plc, Signs Partnership Agreement with Evtec Energy Plc to Build Zero Emission Solar Energy Plant to Power Food Processing FacilityTechnologically Advanced Solar Power Plant to Provide Low-Cost, Sustainable Energy to Multi-Billion Dollar Food Processing Facility $150 million Evtec Energy Funded 110 Megawatt Solar Power Plant to Achieve Net Zero Carbon Emissions and Considerable Energy Cost Savings MONTVALE, N.J., Feb. 22, 2023 (GLOBE NEWSWIRE) -- MICT, Inc. (NASDAQ: MICT) (“MICT” or the “Company”) announced today that its wholly owned subsidiary, Tingo Foods Plc (“Tingo Foods”), has entered into a partnership with Evtec Ene |

Private companies own 20% of MICT, Inc. (NASDAQ:MICT) shares but individual investors control 55% of the companyKey Insights The considerable ownership by individual investors in MICT indicates that they collectively have a greater... |

Visa and Tingo Mobile, an MICT subsidiary, Launch Partnership to Promote Financial Inclusion and Expand Access to Digital Payment Channels Across AfricaTingo Visa Card and Payment Services Integrated with Revolutionary TingoPay Super App Collaboration on Merchant Services Aims to Transform Commerce and Trade Opportunities for Africa’s Farmers and SME Businesses The TingoPay Super App and Platform Offers Retail Customers Access to a Unique Range of Value-Added Products MONTVALE, N.J., Feb. 14, 2023 (GLOBE NEWSWIRE) -- MICT, Inc. (NASDAQ: MICT) (“MICT”), through its wholly-owned subsidiary Tingo Mobile, and Visa (NYSE: V), the global leader in di |

MICT to Revolutionize Africa’s Food Industry Through Wholly Owned Subsidiary, Tingo Foods, and Commitment to Develop Multi-Billion Dollar Food Processing FacilityAims to be the Largest Food Processing Facility in Africa, Completing the Tingo Agricultural and Food Eco-System from Seed to Sale Farmers and Agricultural Sector in the Continent to Benefit from Significant Expansion of Africa’s Own Processing Capabilities, Delivering Financial Upliftment and Empowerment Expected to Materially Reduce Farmers’ Post-Harvest Losses and Achieve Significant Improvement in World’s Food Security Along with Considerable Environmental Benefits Immediate Material Increas |

MICT Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -50.00% |

| 5-year | 32.38% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 0.00% |

| 2021 | -60.10% |

| 2020 | 133.63% |

| 2019 | 34.89% |

Continue Researching MICT

Here are a few links from around the web to help you further your research on MICT Inc's stock as an investment opportunity:MICT Inc (MICT) Stock Price | Nasdaq

MICT Inc (MICT) Stock Quote, History and News - Yahoo Finance

MICT Inc (MICT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...