Mawson Infrastructure Group Inc. (MIGI): Price and Financial Metrics

MIGI Price/Volume Stats

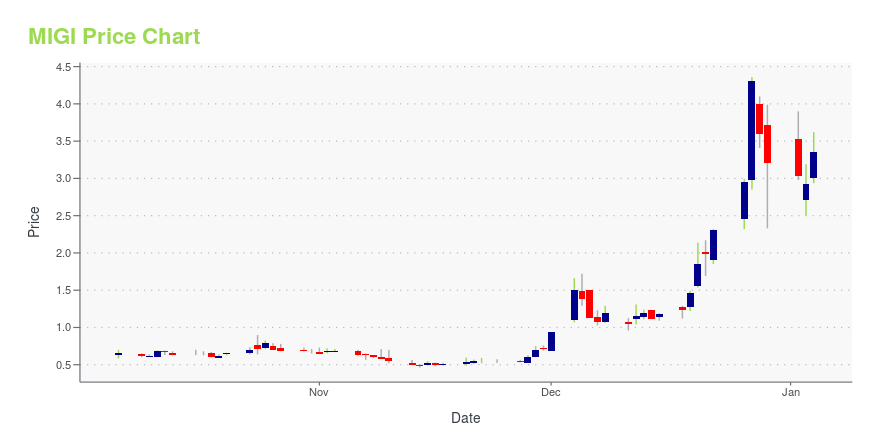

| Current price | $1.30 | 52-week high | $4.40 |

| Prev. close | $1.29 | 52-week low | $0.43 |

| Day low | $1.28 | Volume | 283,067 |

| Day high | $1.42 | Avg. volume | 532,939 |

| 50-day MA | $1.42 | Dividend yield | N/A |

| 200-day MA | $1.48 | Market Cap | 22.77M |

MIGI Stock Price Chart Interactive Chart >

Mawson Infrastructure Group Inc. (MIGI) Company Bio

Mawson Infrastructure Group, Inc. engages in the provision of digital asset infrastructure services. The company is headquartered in North Sydney, Australia.

Latest MIGI News From Around the Web

Below are the latest news stories about MAWSON INFRASTRUCTURE GROUP INC that investors may wish to consider to help them evaluate MIGI as an investment opportunity.

Mawson Infrastructure Group Inc. Announces Monthly Operational Update for November 2023November Total Revenue increased 47% M/M November Total Revenue of Bitcoin Equivalent of 132 BTC1 Completed Co-Location Customer Deployment of ~50 MW and ~15,876 miners Recently Signed Additional Co-Location Customer For ~6 MW and 1764 miners PITTSBURGH, Dec. 20, 2023 (GLOBE NEWSWIRE) -- Mawson Infrastructure Group Inc. (NASDAQ:MIGI) (“Mawson” or the “Company”), a digital infrastructure company, announced today its unaudited business and operational update for November 2023. Rahul Mewawalla, CEO |

Mawson Infrastructure Group Inc. Executes New Customer Co-Location AgreementNew Customer Agreement for 1,764 miners or approximately 6 MW with Provision for Expansion Full Deployment Expected to be Completed by Year-end Once Completed, Mawson expected to have total capacity of 35,624 miners or about 109 MW with hashing capacity of approximately 3.8 EH/s1 PITTSBURGH, Dec. 19, 2023 (GLOBE NEWSWIRE) -- Mawson Infrastructure Group Inc. (NASDAQ:MIGI) (“Mawson” or the “Company”), a digital infrastructure company, is pleased to announce that the Company has signed a new custom |

Rainbows and Unicorns: Mawson Infrastructure Group, Inc. (NASDAQ:MIGI) Analysts Just Became A Lot More OptimisticCelebrations may be in order for Mawson Infrastructure Group, Inc. ( NASDAQ:MIGI ) shareholders, with the analysts... |

Mawson Infrastructure Group Inc. Announces Monthly Operational Update for October 2023October Total Revenue of Bitcoin Equivalent of 110 BTC1 Signed New Co-Location Customer Agreement for ~50 MW and 15,876 miners Company Optimizing Revenue and Margin Across its 3 Primary Businesses – Bitcoin Self-Mining, Co-Location Services, and Energy Management PITTSBURGH, Nov. 17, 2023 (GLOBE NEWSWIRE) -- Mawson Infrastructure Group Inc. (NASDAQ:MIGI) (“Mawson” or the “Company”), a digital infrastructure company, announced today its unaudited business and operational update for October 2023. |

Analysts Are Upgrading Mawson Infrastructure Group, Inc. (NASDAQ:MIGI) After Its Latest ResultsAs you might know, Mawson Infrastructure Group, Inc. ( NASDAQ:MIGI ) last week released its latest third-quarter, and... |

MIGI Price Returns

| 1-mo | -18.75% |

| 3-mo | -5.80% |

| 6-mo | -46.50% |

| 1-year | -26.14% |

| 3-year | -97.54% |

| 5-year | -99.47% |

| YTD | -59.38% |

| 2023 | 131.88% |

| 2022 | -96.53% |

| 2021 | 215.71% |

| 2020 | -88.33% |

| 2019 | -78.82% |

Loading social stream, please wait...