Mirion Technologies, Inc. (MIR): Price and Financial Metrics

MIR Price/Volume Stats

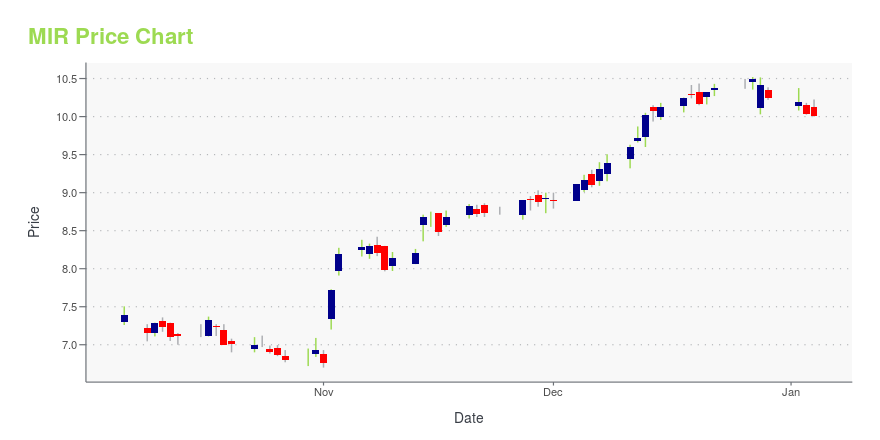

| Current price | $10.80 | 52-week high | $11.78 |

| Prev. close | $10.65 | 52-week low | $6.70 |

| Day low | $10.68 | Volume | 700,500 |

| Day high | $10.91 | Avg. volume | 1,089,550 |

| 50-day MA | $10.67 | Dividend yield | N/A |

| 200-day MA | $9.87 | Market Cap | 2.46B |

MIR Stock Price Chart Interactive Chart >

Mirion Technologies, Inc. (MIR) Company Bio

Mirion Technologies, Inc. provides detection, measurement, analysis, and monitoring solutions to the nuclear, military and civil defense, medical, and research end markets in the United States and internationally. The company's products include medical solutions, such as radiation therapy and diagnostic imaging QA, occupational dosimetry, medical imaging, and nuclear and physical medicine solutions; search, measurement, and analysis instrumentation solution, including laboratory and scientific analysis systems, radiation measurement and health physics instrumentation, and search and radiological security systems, as well as operational and technical support, and consulting services; and reactor safety and control systems comprising radiation monitoring systems, and reactor instrumentation and controls. Its products also have applications in the areas of laboratories, scientific research, analysis, exploration, hospitals, universities, national labs, and other specialized industries. The company was founded in 2005 and is headquartered in Atlanta, Georgia.

Latest MIR News From Around the Web

Below are the latest news stories about MIRION TECHNOLOGIES INC that investors may wish to consider to help them evaluate MIR as an investment opportunity.

Mirion Technologies Signs Agreement with TerraPower for Molten Chloride Reactor ExperimentATLANTA, November 16, 2023--Mirion Technologies (NYSE: MIR), a leading provider of advanced radiation safety solutions, today announced an agreement with nuclear innovation company TerraPower to design and fabricate key components of their Molten Chloride Reactor Experiment (MCRE), the world’s first critical fast-spectrum salt reactor. This collaboration reinforces TerraPower and Mirion’s commitment to fostering sustainable, low-carbon energy solutions that address climate change and support a n |

Mirion Announces Third Quarter 2023 Financial Results and Reiterates Full Year GuidanceATLANTA, November 01, 2023--Mirion ("we" or the "company") (NYSE: MIR), a global provider of radiation detection, measurement, analysis and monitoring solutions to the medical, nuclear, defense, and research end markets, today announced results for the third quarter ended September 30, 2023. Related materials will be available online at ir.mirion.com. On November 1, 2023, Mirion also closed the acquisition of ec2, with a purchase price of $33 million through an all cash purchase. |

Mirion Launches Philanthropic Partnership with RAD-AID InternationalATLANTA, November 01, 2023--Mirion (NYSE: MIR), a leading provider of advanced radiation safety solutions, today announced a philanthropic partnership with RAD-AID International to help bring radiology and radiation safety education and capabilities to underserved populations around the world. |

Mirion to Present at the Baird Global Industrial ConferenceATLANTA, October 31, 2023--Mirion (NYSE: MIR) announced today that Chief Executive Officer, Thomas Logan, and Chief Financial Officer, Brian Schopfer, will present at the Baird Global Industrial Conference in Chicago, IL. The presentation will begin at 10:40 AM ET on Tuesday, November 7, 2023. |

Mirion Announces Departure of Medical Group PresidentATLANTA, October 18, 2023--Mirion ("we" or the "company") (NYSE: MIR), a global provider of radiation detection, measurement, analysis and monitoring solutions to the medical, nuclear, defense, and research end markets, today announced that Michael Rossi has informed the Company of his decision to resign as Medical Group President, effective November 1, 2023, in order to assume a CEO role at another public company. |

MIR Price Returns

| 1-mo | -0.09% |

| 3-mo | -2.61% |

| 6-mo | 13.21% |

| 1-year | 46.34% |

| 3-year | 7.78% |

| 5-year | N/A |

| YTD | 5.37% |

| 2023 | 55.07% |

| 2022 | -36.87% |

| 2021 | -3.94% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...