Markforged Holding Corporation (MKFG): Price and Financial Metrics

MKFG Price/Volume Stats

| Current price | $0.39 | 52-week high | $2.30 |

| Prev. close | $0.39 | 52-week low | $0.39 |

| Day low | $0.39 | Volume | 259,853 |

| Day high | $0.41 | Avg. volume | 355,534 |

| 50-day MA | $0.44 | Dividend yield | N/A |

| 200-day MA | $0.67 | Market Cap | 79.34M |

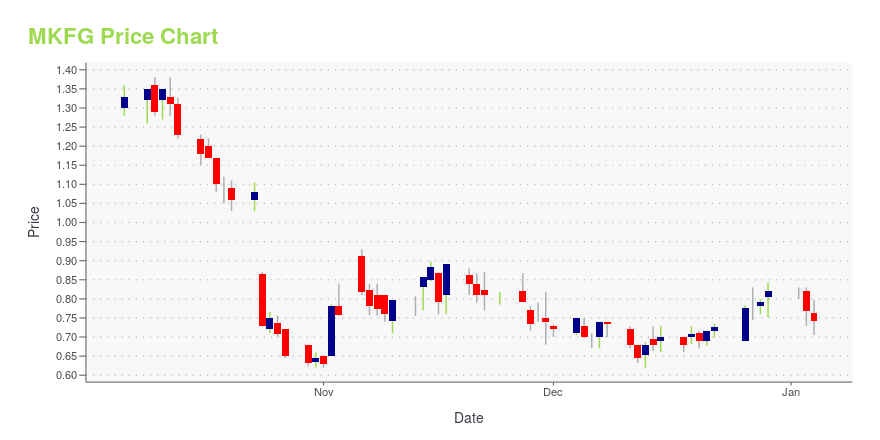

MKFG Stock Price Chart Interactive Chart >

Markforged Holding Corporation (MKFG) Company Bio

MarkForged, Inc. designs, develops, and manufactures industrial 3D printers. The company offers end-to-end metal and carbon fiber 3D printers; 3D printer for continuous fiberglass reinforced parts; refined FFF 3D printer for micro carbon fiber filled nylon parts; fiber composite 3D printer; and FFF desktop 3D printer for micro carbon fiber filled nylon parts. It also offers 3D printing software. The company was incorporated in 2013 and is based in Watertown, Massachusetts with European headquarters in Dublin, Ireland.

Latest MKFG News From Around the Web

Below are the latest news stories about MARKFORGED HOLDING CORP that investors may wish to consider to help them evaluate MKFG as an investment opportunity.

Markforged Receives Continued Listing Standards Notice from the NYSEWALTHAM, Mass., November 20, 2023--Markforged Holding Corporation (NYSE: MKFG) ("Markforged" or "the Company"), the company strengthening manufacturing resiliency by enabling industrial production at the point of need, was notified on November 17, 2023 by the New York Stock Exchange ("NYSE") that the Company is not in compliance with Rule 802.01C of the NYSE’s Listed Company Manual ("Rule 802.01C") relating to the minimum average closing price of the Company’s common stock required over a consec |

Markforged Announces Third Quarter 2023 ResultsWALTHAM, Mass., November 13, 2023--Markforged Holding Corporation (NYSE: MKFG) (the "Company"), the company strengthening manufacturing resiliency by enabling industrial production at the point of need, today announced its financial results for the third quarter and nine months ended September 30, 2023. |

Markforged Introduces FX10, The Most Versatile Tool Designed For The Factory FloorWALTHAM, Mass., November 07, 2023--Markforged Holding Corporation (NYSE: MKFG), the company strengthening manufacturing resiliency by enabling industrial production at the point of need, today unveiled its newest industrial 3D printer, the FX10. Continuing Markforged’s heritage of reliable printers that deliver strong, precise parts, the FX10 is designed to supercharge manufacturing line productivity and profitability. The FX10 empowers users to print the right part when and where it is needed, |

Markforged Releases Vega™, an Ultra High Performance Material Designed for 3D Printing Aerospace Components on the FX20™WALTHAM, Mass., November 07, 2023--Markforged Holding Corporation (NYSE: MKFG), the company strengthening manufacturing resiliency by enabling industrial production at the point of need, today released Vega™, an ultra high performance filament designed for aerospace manufacturing on Markforged’s FX20™ printer. Vega not only offers exceptional strength but also is expected to bring customers substantial advantages in weight reduction, cost efficiency, and lead time savings. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayWe're starting off Tuesday with a breakdown of the biggest pre-market stock movers investors will want to know about this morning! |

MKFG Price Returns

| 1-mo | -4.88% |

| 3-mo | -42.20% |

| 6-mo | -47.31% |

| 1-year | -79.79% |

| 3-year | -96.18% |

| 5-year | N/A |

| YTD | -52.44% |

| 2023 | -29.31% |

| 2022 | -78.40% |

| 2021 | -50.14% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...