Meta Materials Inc. (MMAT): Price and Financial Metrics

MMAT Price/Volume Stats

| Current price | $2.48 | 52-week high | $27.50 |

| Prev. close | $2.47 | 52-week low | $1.80 |

| Day low | $2.40 | Volume | 66,700 |

| Day high | $2.60 | Avg. volume | 610,250 |

| 50-day MA | $3.04 | Dividend yield | N/A |

| 200-day MA | $5.60 | Market Cap | 16.60M |

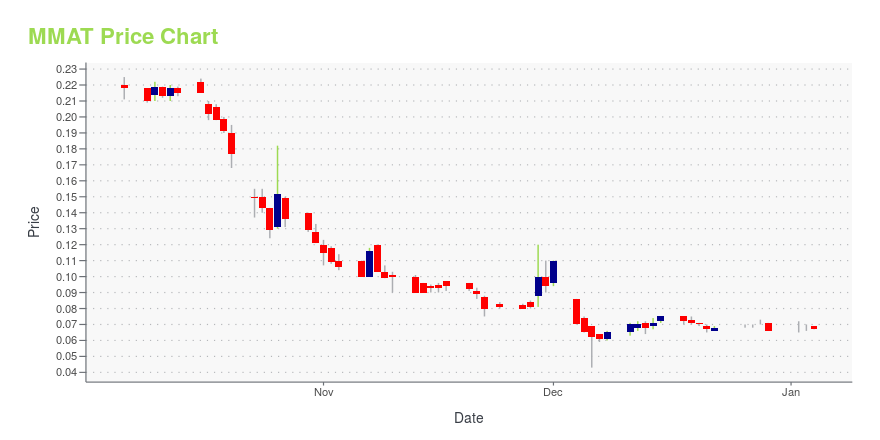

MMAT Stock Price Chart Interactive Chart >

Meta Materials Inc. (MMAT) Company Bio

Meta Materials, Inc. engages in the manufacture and development of functional materials. Its technology platform enables the global brands to deliver products to customers in consumer electronics, 5G communications, health and wellness, aerospace, automotive, and clean energy. The company was founded by George Palikaras and Themos Kallos on August 15, 2011 and is headquartered in Nova Scotia, Canada.

Latest MMAT News From Around the Web

Below are the latest news stories about META MATERIALS INC that investors may wish to consider to help them evaluate MMAT as an investment opportunity.

Meta Materials Announces Proposed Class Actions SettlementHALIFAX, NS / ACCESSWIRE / December 21, 2023 / Meta Materials Inc. (the "Company" or "META") (NASDAQ:MMAT), an advanced materials and nanotechnology company, today announced a proposed settlement in two class action cases, following a successful mediation. ... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's time to start the final day of trading this week with a breakdown of the biggest pre-market stock movers for Friday! |

Meta Materials Releases Board Letter to ShareholdersHALIFAX, NS / ACCESSWIRE / December 8, 2023 / Meta Materials Inc. (the "Company" or "META") (NASDAQ:MMAT), an advanced materials and nanotechnology company, today released the following message to shareholders.From: META Board of DirectorsTo: META ... |

MMAT Stock: Meta Materials Speaks Out on Reverse Stock Split ProposalA reverse stock split could be on the way for MMAT stock. |

Meta Materials Clarifies Potential Impacts of Reverse Stock Split ProposalHALIFAX, NS / ACCESSWIRE / December 5, 2023 / Meta Materials Inc. (the "Company" or "META") (NASDAQ:MMAT), an advanced materials and nanotechnology company, today provided some clarification of the potential impacts of Proposal 3: Approval of a Reverse ... |

MMAT Price Returns

| 1-mo | -18.95% |

| 3-mo | -21.52% |

| 6-mo | -57.39% |

| 1-year | -88.05% |

| 3-year | -99.24% |

| 5-year | -99.59% |

| YTD | -62.42% |

| 2023 | -94.45% |

| 2022 | -51.63% |

| 2021 | 75.71% |

| 2020 | -53.95% |

| 2019 | 34.51% |

Loading social stream, please wait...