Marsh & McLennan Cos. (MMC): Price and Financial Metrics

MMC Price/Volume Stats

| Current price | $217.97 | 52-week high | $221.71 |

| Prev. close | $216.06 | 52-week low | $184.02 |

| Day low | $216.36 | Volume | 1,616,100 |

| Day high | $219.81 | Avg. volume | 1,694,666 |

| 50-day MA | $212.01 | Dividend yield | 1.3% |

| 200-day MA | $201.17 | Market Cap | 107.40B |

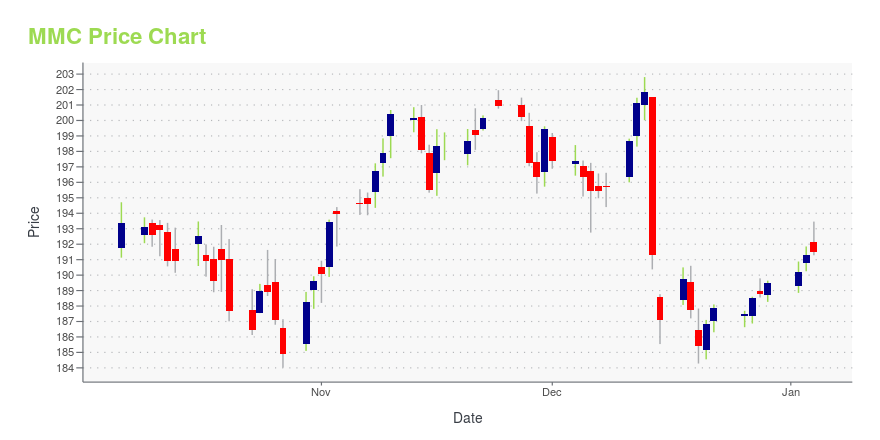

MMC Stock Price Chart Interactive Chart >

Marsh & McLennan Cos. (MMC) Company Bio

Marsh McLennan (formerly known as Marsh & McLennan Companies) is a global professional services firm, headquartered in New York City with businesses in insurance brokerage, risk management, reinsurance services, talent management, investment advisory, and management consulting. Its four main operating companies are Marsh, Guy Carpenter, Mercer, and Oliver Wyman. (Source:Wikipedia)

Latest MMC News From Around the Web

Below are the latest news stories about MARSH & MCLENNAN COMPANIES INC that investors may wish to consider to help them evaluate MMC as an investment opportunity.

Brown & Brown (BRO) Expands in Florida With Caton-Hosey BuyoutBrown & Brown (BRO) signs an agreement to acquire Caton-Hosey, boosting its presence in Florida. |

Marsh & McLennan's (MMC) Unit Divests Atlas to Stoch AnalyticsMarsh & McLennan's (MMC) Oliver Wyman sells its Atlas Software business to Stoch Analytics, aiming to serve its clients better with an independent software company. |

Stoch Analytics Acquires Atlas Software Business from Oliver WymanToday Stoch Analytics Limited, a newly formed private company headquartered in Ireland, acquired the proprietary Atlas software suite from Oliver Wyman, a global management consulting firm and a business of Marsh McLennan [NYSE: MMC]. Chris Stiefeling has left Oliver Wyman to be the new company's CEO. |

Marsh & McLennan (MMC) Unit Boosts Aviation Business With SeaTecMarsh & McLennan's (MMC) Oliver Wyman is expected to boost its presence in Aviation consulting with the acquisition of SeaTec. |

Marsh McLennan's Oliver Wyman to Acquire SeaTec Consulting Inc.Oliver Wyman, a global leader in management consulting, and a business of Marsh McLennan (NYSE:MMC) announced today that it has entered into an agreement to acquire SeaTec Consulting Inc. a leading provider of consulting, engineering, and digital expertise across the aviation, aerospace and defense, and transportation industries. SeaTec will join CAVOK, a division of Oliver Wyman, focused on aviation services. |

MMC Price Returns

| 1-mo | 3.72% |

| 3-mo | 10.53% |

| 6-mo | 14.96% |

| 1-year | 17.11% |

| 3-year | 57.10% |

| 5-year | 128.15% |

| YTD | 16.29% |

| 2023 | 16.15% |

| 2022 | -3.45% |

| 2021 | 50.83% |

| 2020 | 6.86% |

| 2019 | 42.33% |

MMC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MMC

Want to see what other sources are saying about Marsh & Mclennan Companies Inc's financials and stock price? Try the links below:Marsh & Mclennan Companies Inc (MMC) Stock Price | Nasdaq

Marsh & Mclennan Companies Inc (MMC) Stock Quote, History and News - Yahoo Finance

Marsh & Mclennan Companies Inc (MMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...