Martin Midstream Partners L.P. (MMLP): Price and Financial Metrics

MMLP Price/Volume Stats

| Current price | $3.51 | 52-week high | $3.82 |

| Prev. close | $3.53 | 52-week low | $2.04 |

| Day low | $3.46 | Volume | 62,543 |

| Day high | $3.58 | Avg. volume | 71,751 |

| 50-day MA | $3.30 | Dividend yield | 0.56% |

| 200-day MA | $2.70 | Market Cap | 136.89M |

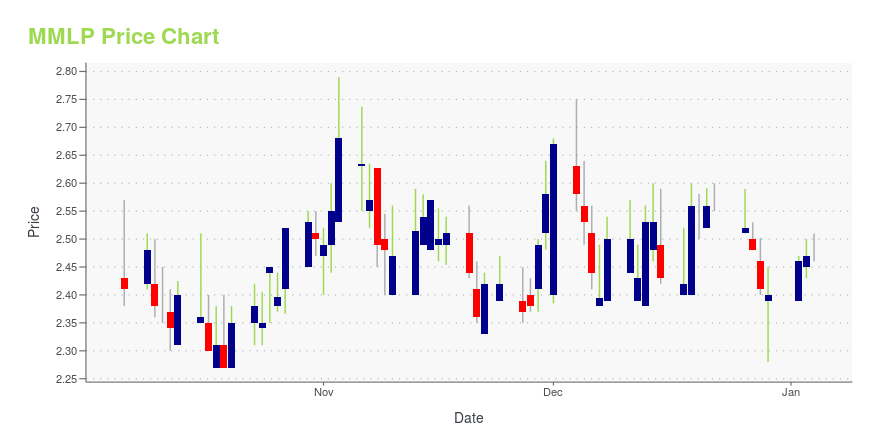

MMLP Stock Price Chart Interactive Chart >

Martin Midstream Partners L.P. (MMLP) Company Bio

Martin Midstream Partners LP collects, transports, stores, and markets petroleum products and by-products in the United States Gulf Coast region. The Company operates through four business segments: Terminalling and Storage, Natural Gas Services, Sulfur Services and Marine Transportation. The company was founded in 2002 and is based in Kilgore, Texas.

Latest MMLP News From Around the Web

Below are the latest news stories about MARTIN MIDSTREAM PARTNERS LP that investors may wish to consider to help them evaluate MMLP as an investment opportunity.

Martin Midstream Partners L.P. to Participate in the 2023 Wells Fargo Midstream and Utilities SymposiumKILGORE, Texas, December 04, 2023--Martin Midstream Partners L.P. (NASDAQ: MMLP) ("MMLP" or the "Partnership") announced today that members of executive management will participate in the 2023 Wells Fargo Midstream and Utilities Symposium taking place Wednesday, December 6 and Thursday, December 7, 2023. A copy of the Partnership’s presentation will be available by visiting the Partnership’s website at www.MMLP.com. |

Martin Midstream Partners L.P. (NASDAQ:MMLP) Q3 2023 Earnings Call TranscriptMartin Midstream Partners L.P. (NASDAQ:MMLP) Q3 2023 Earnings Call Transcript October 19, 2023 Operator: Good morning. My name is Audra, and I will be your conference operator today. At this time, I would like to welcome everyone to the MMLP’s Third Quarter Earnings Conference Call. Today’s conference is being recorded. All lines have been placed […] |

Q3 2023 Martin Midstream Partners LP Earnings CallQ3 2023 Martin Midstream Partners LP Earnings Call |

Martin Midstream Partners LP (MMLP) Reports Q3 2023 Financial Results and Declares Quarterly ...Despite a net loss, MMLP reaffirms 2023 Annual Adjusted EBITDA Guidance of $115.4 million |

Martin Midstream Partners Reports Third Quarter 2023 Financial Results and Declares Quarterly Cash DistributionKILGORE, Texas, October 18, 2023--Martin Midstream Partners L.P. (Nasdaq:MMLP) ("MMLP" or the "Partnership") today announced its financial results for the third quarter of 2023. |

MMLP Price Returns

| 1-mo | 4.46% |

| 3-mo | 31.69% |

| 6-mo | 55.96% |

| 1-year | 53.84% |

| 3-year | 35.21% |

| 5-year | -28.57% |

| YTD | 46.86% |

| 2023 | -19.39% |

| 2022 | 13.39% |

| 2021 | 87.58% |

| 2020 | -62.44% |

| 2019 | -53.96% |

MMLP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MMLP

Here are a few links from around the web to help you further your research on Martin Midstream Partners Lp's stock as an investment opportunity:Martin Midstream Partners Lp (MMLP) Stock Price | Nasdaq

Martin Midstream Partners Lp (MMLP) Stock Quote, History and News - Yahoo Finance

Martin Midstream Partners Lp (MMLP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...