Monmouth Real Estate Investment Corporation (MNR): Price and Financial Metrics

MNR Price/Volume Stats

| Current price | $19.10 | 52-week high | $21.19 |

| Prev. close | $19.22 | 52-week low | $14.40 |

| Day low | $19.00 | Volume | 60,812 |

| Day high | $19.65 | Avg. volume | 118,840 |

| 50-day MA | $19.53 | Dividend yield | 15.66% |

| 200-day MA | $0.00 | Market Cap | 1.81B |

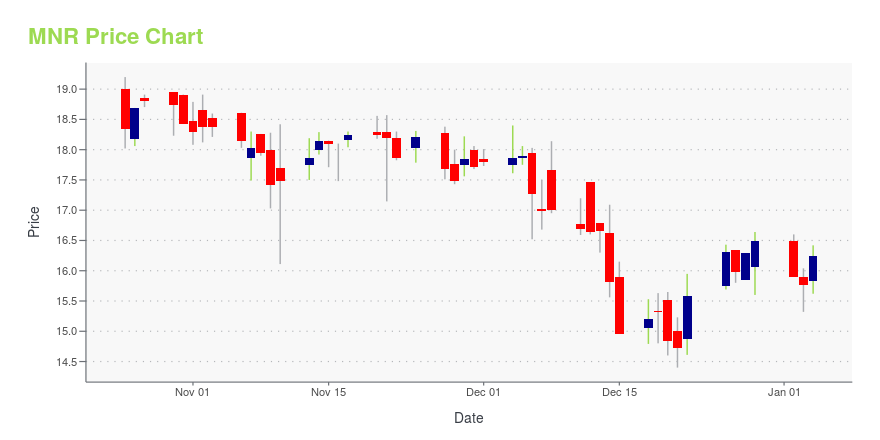

MNR Stock Price Chart Interactive Chart >

Monmouth Real Estate Investment Corporation (MNR) Company Bio

Monmouth Real Estate Investment Corporation primarily invests in industrial properties and holds a portfolio of REIT securities. The company was founded in 1968 and is based in Freehold, New Jersey.

Latest MNR News From Around the Web

Below are the latest news stories about MACH NATURAL RESOURCES LP that investors may wish to consider to help them evaluate MNR as an investment opportunity.

Mach Natural Resources LP Reports Strong Q3 2023 Earnings and Upcoming AcquisitionNet Income Hits $94 Million with Sales Volumes Averaging 66,280 Boe per Day |

Mach Natural Resources LP Announces Third-Quarter 2023 Financial and Operating ResultsMach Natural Resources LP (NYSE: MNR) ("Mach" or the "Company") today reported financial and operating results for the three and nine months ended September 30, 2023, and additional Company updates. |

Mach Natural Resources LP Announces Earnings Release and Conference Call Schedule for Third Quarter 2023Mach Natural Resources LP (NYSE: MNR) (the "Company") will release its third quarter 2023 results after the close of trading on the New York Stock Exchange on Wednesday, December 6, 2023. |

/C O R R E C T I O N -- Mach Natural Resources/Mach Natural Resources LP (NYSE: MNR) ("Mach" or the "Company") signed an agreement with Paloma Partners IV, LLC, a privately-held Delaware limited liability company backed by EnCap Investments and its affiliated companies (the "Sellers"), to acquire certain interests in oil and gas properties, rights and related assets located in certain counties in Oklahoma for a total cash consideration of $815 million, subject to customary terms, conditions, and closing price adjustments (the "Acquisition"). |

MNR Price Returns

| 1-mo | -0.83% |

| 3-mo | -4.16% |

| 6-mo | 15.19% |

| 1-year | N/A |

| 3-year | 11.91% |

| 5-year | 70.12% |

| YTD | 26.44% |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 25.95% |

| 2020 | 25.68% |

| 2019 | 22.62% |

MNR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MNR

Here are a few links from around the web to help you further your research on Monmouth Real Estate Investment Corp's stock as an investment opportunity:Monmouth Real Estate Investment Corp (MNR) Stock Price | Nasdaq

Monmouth Real Estate Investment Corp (MNR) Stock Quote, History and News - Yahoo Finance

Monmouth Real Estate Investment Corp (MNR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...