Model N, Inc. (MODN): Price and Financial Metrics

MODN Price/Volume Stats

| Current price | $30.00 | 52-week high | $35.96 |

| Prev. close | $29.97 | 52-week low | $20.90 |

| Day low | $29.97 | Volume | 1,508,200 |

| Day high | $30.00 | Avg. volume | 643,815 |

| 50-day MA | $29.81 | Dividend yield | N/A |

| 200-day MA | $26.57 | Market Cap | 1.18B |

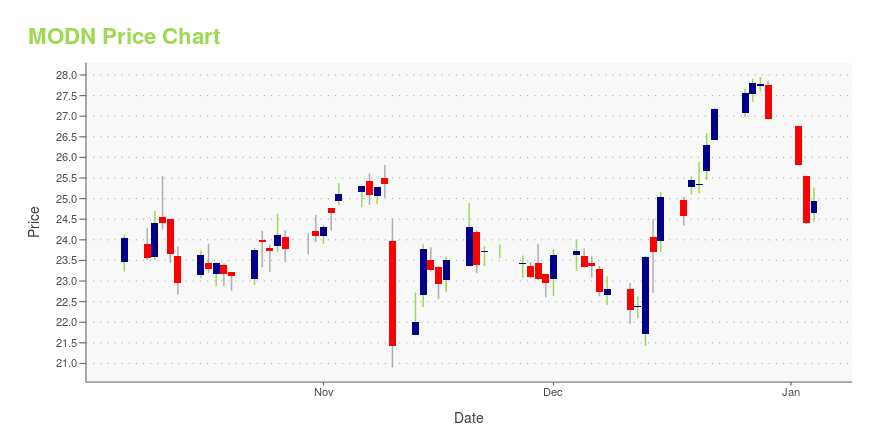

MODN Stock Price Chart Interactive Chart >

Model N, Inc. (MODN) Company Bio

Model N, Inc. provides revenue management solutions for the life science and technology industries. It develops applications, such as managed care and government pricing for life science companies; and channel incentives based on design wins for technology companies. The company was founded in 1999 and is based in Redwood City, California.

Latest MODN News From Around the Web

Below are the latest news stories about MODEL N INC that investors may wish to consider to help them evaluate MODN as an investment opportunity.

Ericsson (ERIC) Deploys 5G SA in Ireland to Accelerate InnovationThree Ireland selects Ericsson's (ERIC) portfolio to implement 5G Standalone and develop advanced applications for various industries. |

Viasat (VSAT) Launches Data Plans for Small-Scale EnterprisesViasat (VSAT) introduces high-speed Internet service plans to support rural businesses with robust broadband connectivity. |

Ericsson (ERIC) to Deploy Private 5G Networks Across SpainOrange Spain selects Ericsson's (ERIC) dual-mode 5G core and Local Packet Gateway solution to deploy private 5G networks for the B2B sector. |

Nokia (NOK) Divests Non-Core Assets to Optimize CNS PortfolioNokia (NOK) inks disinvestment deal to offload its Device Management and Software Management business. The company aims to drive investment in key growth areas such as SaaS, 5G core and Network as a Code. |

Some Shareholders Feeling Restless Over Model N, Inc.'s (NYSE:MODN) P/S RatioIt's not a stretch to say that Model N, Inc.'s ( NYSE:MODN ) price-to-sales (or "P/S") ratio of 3.9x right now seems... |

MODN Price Returns

| 1-mo | N/A |

| 3-mo | 1.21% |

| 6-mo | 6.95% |

| 1-year | -7.98% |

| 3-year | -7.06% |

| 5-year | 37.11% |

| YTD | 11.40% |

| 2023 | -33.60% |

| 2022 | 35.06% |

| 2021 | -15.84% |

| 2020 | 1.74% |

| 2019 | 165.08% |

Continue Researching MODN

Want to see what other sources are saying about Model N Inc's financials and stock price? Try the links below:Model N Inc (MODN) Stock Price | Nasdaq

Model N Inc (MODN) Stock Quote, History and News - Yahoo Finance

Model N Inc (MODN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...