Motus GI Holdings, Inc. (MOTS): Price and Financial Metrics

MOTS Price/Volume Stats

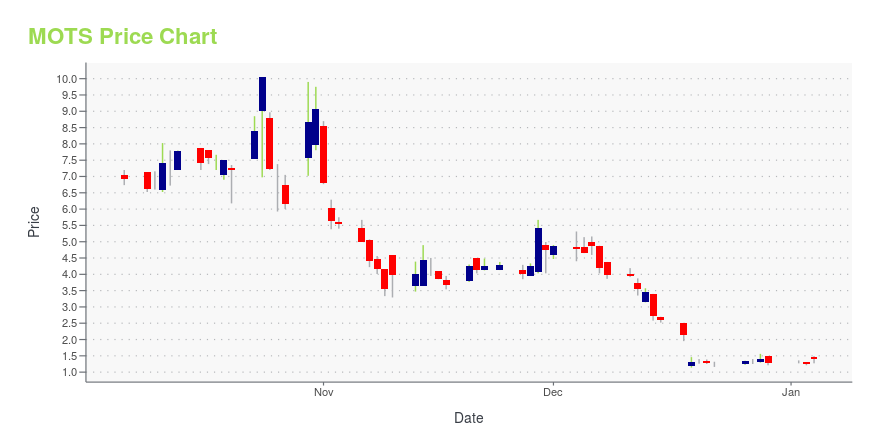

| Current price | $0.07 | 52-week high | $10.05 |

| Prev. close | $0.06 | 52-week low | $0.03 |

| Day low | $0.05 | Volume | 16,200 |

| Day high | $0.07 | Avg. volume | 844,078 |

| 50-day MA | $0.08 | Dividend yield | N/A |

| 200-day MA | $1.66 | Market Cap | 386.52K |

MOTS Stock Price Chart Interactive Chart >

Motus GI Holdings, Inc. (MOTS) Company Bio

Motus GI Holdings, Inc., a development stage company, engages in developing single-use medical device systems in the United States. It is developing Pure-Vu system that integrates with existing colonoscopes to cleanse poorly prepped colons during the colonoscopy procedure. The company is based in Tirat Carmel, Israel.

Latest MOTS News From Around the Web

Below are the latest news stories about MOTUS GI HOLDINGS INC that investors may wish to consider to help them evaluate MOTS as an investment opportunity.

Investors in Motus Holdings (JSE:MTH) have seen splendid returns of 101% over the past three yearsBy buying an index fund, you can roughly match the market return with ease. But if you pick the right individual... |

Arm Layoffs 2024: What to Know About the Latest ARM Job CutsArm layoffs are coming for 70 of the semiconductor company's software engineers in China but 15 of those workers will be relocated. |

Enphase Energy Layoffs 2023: What to Know About the Latest ENPH Job CutsEnphase Energy layoffs are a hot topic on Tuesday as the solar power company prepares to cut 10% of its global workforce! |

Why Is Etao International (ETAO) Stock Down 37% Today?Etao International stock is falling hard on Tuesday as investor sin ETAO react to a new delisting update from the Nasdaq Exchange. |

Why Is Motus GI (MOTS) Stock Down 44% Today?Motus GI stock is falling on Tuesday after the medical technology company announced pricing for a public offering of MOTS shares. |

MOTS Price Returns

| 1-mo | 16.67% |

| 3-mo | -13.58% |

| 6-mo | -92.68% |

| 1-year | -99.22% |

| 3-year | -99.97% |

| 5-year | -99.99% |

| YTD | -94.51% |

| 2023 | -89.88% |

| 2022 | -91.01% |

| 2021 | -50.74% |

| 2020 | -58.60% |

| 2019 | -26.37% |

Continue Researching MOTS

Want to see what other sources are saying about Motus GI Holdings Inc's financials and stock price? Try the links below:Motus GI Holdings Inc (MOTS) Stock Price | Nasdaq

Motus GI Holdings Inc (MOTS) Stock Quote, History and News - Yahoo Finance

Motus GI Holdings Inc (MOTS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...