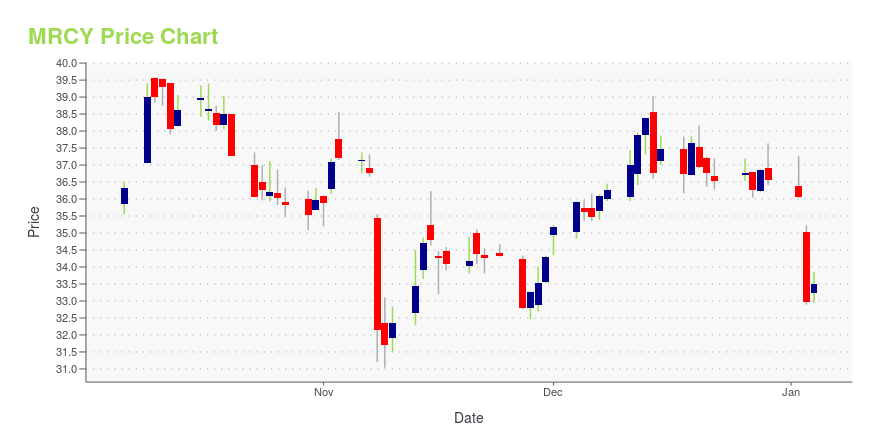

Mercury Systems Inc (MRCY): Price and Financial Metrics

MRCY Price/Volume Stats

| Current price | $35.34 | 52-week high | $40.95 |

| Prev. close | $34.55 | 52-week low | $25.31 |

| Day low | $34.75 | Volume | 696,655 |

| Day high | $35.60 | Avg. volume | 598,627 |

| 50-day MA | $30.62 | Dividend yield | N/A |

| 200-day MA | $31.69 | Market Cap | 2.10B |

MRCY Stock Price Chart Interactive Chart >

Mercury Systems Inc (MRCY) Company Bio

Mercury Systems provides open sensor processing systems and services. The company operates through two segments, Mercury Commercial Electronics (MCE) and Mercury Defense Systems (MDS). The company was founded in 1981 and is based in Chelmsford, Massachusetts.

Latest MRCY News From Around the Web

Below are the latest news stories about MERCURY SYSTEMS INC that investors may wish to consider to help them evaluate MRCY as an investment opportunity.

Red Alert: 3 Defense Stocks to Sell Before They DeclineThe defense sector is seeing some action. |

Mercury Introduces First Commercial Air-to-Ground SAR Radar Flight Testing SimulatorMercury's ARES-SAR Mercury's ARES-SAR product is the first commercially available flight testing simulator for air-to-ground synthetic aperture radar (SAR) systems. ANDOVER, Mass., Dec. 11, 2023 (GLOBE NEWSWIRE) -- Mercury Systems, Inc. (NASDAQ: MRCY, www.mrcy.com), a technology company that delivers mission-critical processing power to the edge, today introduced the first commercially available flight testing simulator for air-to-ground synthetic aperture radar (SAR) systems. The ARES-SAR produ |

Mercury Systems (MRCY) Up 10.3% Since Last Earnings Report: Can It Continue?Mercury Systems (MRCY) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Is the Options Market Predicting a Spike in Mercury Systems (MRCY) Stock?Investors need to pay close attention to Mercury Systems (MRCY) stock based on the movements in the options market lately. |

Insider Spends US$1.2m Buying More Shares In Mercury SystemsMercury Systems, Inc. ( NASDAQ:MRCY ) shareholders (or potential shareholders) will be happy to see that the... |

MRCY Price Returns

| 1-mo | 29.88% |

| 3-mo | 21.53% |

| 6-mo | 15.53% |

| 1-year | -3.18% |

| 3-year | -46.09% |

| 5-year | -50.22% |

| YTD | -3.36% |

| 2023 | -18.26% |

| 2022 | -18.74% |

| 2021 | -37.47% |

| 2020 | 27.42% |

| 2019 | 46.14% |

Continue Researching MRCY

Want to do more research on Mercury Systems Inc's stock and its price? Try the links below:Mercury Systems Inc (MRCY) Stock Price | Nasdaq

Mercury Systems Inc (MRCY) Stock Quote, History and News - Yahoo Finance

Mercury Systems Inc (MRCY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...