Motorola Solutions, Inc. (MSI): Price and Financial Metrics

MSI Price/Volume Stats

| Current price | $393.71 | 52-week high | $399.62 |

| Prev. close | $385.65 | 52-week low | $269.64 |

| Day low | $385.60 | Volume | 408,100 |

| Day high | $395.85 | Avg. volume | 655,015 |

| 50-day MA | $380.17 | Dividend yield | 0.99% |

| 200-day MA | $338.28 | Market Cap | 65.67B |

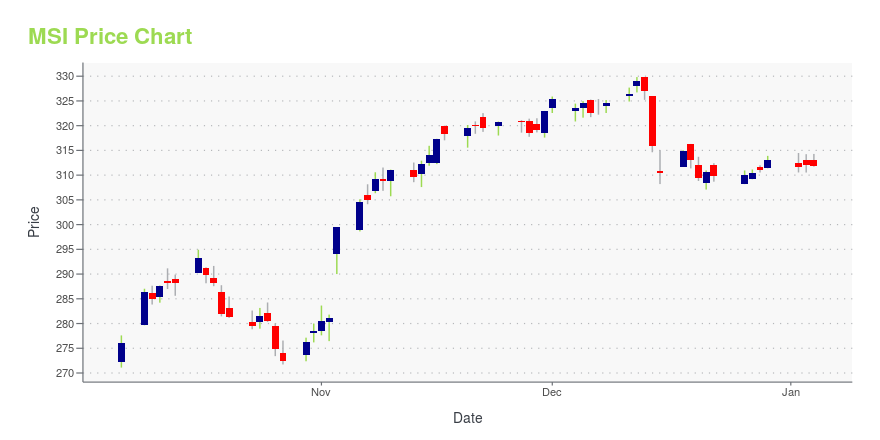

MSI Stock Price Chart Interactive Chart >

Motorola Solutions, Inc. (MSI) Company Bio

Motorola Solutions offers a portfolio of network infrastructure, devices, accessories, and software for government, public safety and first-responder agencies, municipalities, and commercial and industrial customers. The company also provides integration services, such as implementation, optimization, and integration of networks, devices, software, and applications; and lifecycle support services, such as lifecycle planning, software and hardware maintenance, security patches and upgrades, call center support, network monitoring, and repair services. The company was established in 2011 and is based in Schaumburg, Illinois.

Latest MSI News From Around the Web

Below are the latest news stories about MOTOROLA SOLUTIONS INC that investors may wish to consider to help them evaluate MSI as an investment opportunity.

Insiders At Motorola Solutions Sold US$19m In Stock, Alluding To Potential WeaknessIn the last year, many Motorola Solutions, Inc. ( NYSE:MSI ) insiders sold a substantial stake in the company which may... |

The 10 Best Telecom Companies to Invest InIn this article we will take a look at the 10 best telecom companies to invest in. You can skip our industry analysis and see the 5 best telecom companies to invest in here. Telecom industry is going through rough times these days because of the heavy ongoing investments into 5G infrastructure as well as […] |

UPDATE 2-UK antitrust regulator wins appeal over Motorola's Airwave network probeBritain's Competition Appeal Tribunal has upheld the antitrust watchdog's findings that U.S.-based walkie-talkie maker Motorola Solutions was overcharging UK emergency services for its radio network Airwave, the Competition and Markets Authority (CMA) said on Friday. The tribunal had dismissed Motorola's appeal, which claimed the antitrust regulator had erred in assessing the Airwave Network's profitability and its competition in the relevant market. Motorola bought Airwave, the private mobile radio communications network the police, fire, ambulance and other emergency services use to communicate securely, in 2016. |

5 Technology Stocks That Hiked Dividends to Watch in 2024Motorola (MSI), Qualcomm (QCOM), Universal Display (OLED), Broadcom (AVGO) and ATN International (ATNI) are some technology stocks to watch for healthy dividend hike in 2024. |

Calculating The Fair Value Of Motorola Solutions, Inc. (NYSE:MSI)Key Insights The projected fair value for Motorola Solutions is US$309 based on 2 Stage Free Cash Flow to Equity... |

MSI Price Returns

| 1-mo | 1.89% |

| 3-mo | 13.93% |

| 6-mo | 21.15% |

| 1-year | 36.85% |

| 3-year | 84.66% |

| 5-year | 150.17% |

| YTD | 26.44% |

| 2023 | 23.04% |

| 2022 | -3.81% |

| 2021 | 61.90% |

| 2020 | 7.35% |

| 2019 | 42.19% |

MSI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MSI

Want to see what other sources are saying about Motorola Solutions Inc's financials and stock price? Try the links below:Motorola Solutions Inc (MSI) Stock Price | Nasdaq

Motorola Solutions Inc (MSI) Stock Quote, History and News - Yahoo Finance

Motorola Solutions Inc (MSI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...