Matrix Service Company (MTRX): Price and Financial Metrics

MTRX Price/Volume Stats

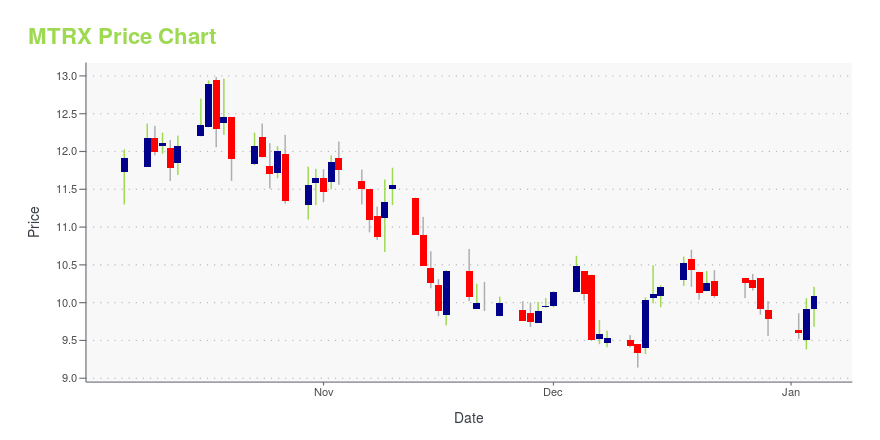

| Current price | $10.44 | 52-week high | $13.90 |

| Prev. close | $10.40 | 52-week low | $6.02 |

| Day low | $10.40 | Volume | 97,827 |

| Day high | $10.64 | Avg. volume | 245,845 |

| 50-day MA | $10.48 | Dividend yield | N/A |

| 200-day MA | $11.02 | Market Cap | 285.11M |

MTRX Stock Price Chart Interactive Chart >

Matrix Service Company (MTRX) Company Bio

Matrix Service Company provides engineering, fabrication, construction and maintenance services to Electrical Infrastructure, Oil Gas & Chemical, Storage Solutions and Industrial markets. The company was founded in 1984 and is based in Tulsa, Oklahoma.

Latest MTRX News From Around the Web

Below are the latest news stories about MATRIX SERVICE CO that investors may wish to consider to help them evaluate MTRX as an investment opportunity.

Matrix Service Company (NASDAQ:MTRX) is largely controlled by institutional shareholders who own 70% of the companyKey Insights Institutions' substantial holdings in Matrix Service implies that they have significant influence over the... |

Sidoti Events, LLC’s Virtual November Micro-Cap ConferenceNEW YORK, NY / ACCESSWIRE / November 14, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day November Micro-Cap Conference taking place Wednesday and Thursday, November ... |

Matrix Service Company (NASDAQ:MTRX) Q1 2024 Earnings Call TranscriptMatrix Service Company (NASDAQ:MTRX) Q1 2024 Earnings Call Transcript November 9, 2023 Operator: Good morning and welcome to the Matrix Service Company Conference Call to discuss Results for the First Quarter of Fiscal 2024. Currently, all participants are in a listen-only mode. [Operator Instructions] As a reminder this conference call is being recorded. I would […] |

Q1 2024 Matrix Service Co Earnings CallQ1 2024 Matrix Service Co Earnings Call |

Matrix Service Company Reports First Quarter Fiscal 2024 ResultsTULSA, Okla., Nov. 08, 2023 (GLOBE NEWSWIRE) -- Matrix Service Company (Nasdaq: MTRX), through its subsidiaries, is a leading North American industrial engineering, construction, and maintenance contractor headquartered in Tulsa, Oklahoma with offices located throughout the United States and Canada, as well as Sydney, Australia and Seoul, South Korea. Key highlights: Project awards in the quarter of $497.4 million, the highest quarterly award total in five years, resulting in a book-to-bill rati |

MTRX Price Returns

| 1-mo | 3.47% |

| 3-mo | -9.45% |

| 6-mo | 8.86% |

| 1-year | 69.21% |

| 3-year | -2.06% |

| 5-year | -42.92% |

| YTD | 6.75% |

| 2023 | 57.23% |

| 2022 | -17.29% |

| 2021 | -31.76% |

| 2020 | -51.84% |

| 2019 | 27.54% |

Continue Researching MTRX

Here are a few links from around the web to help you further your research on Matrix Service Co's stock as an investment opportunity:Matrix Service Co (MTRX) Stock Price | Nasdaq

Matrix Service Co (MTRX) Stock Quote, History and News - Yahoo Finance

Matrix Service Co (MTRX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...