Manitowoc Company, Inc. (The) (MTW): Price and Financial Metrics

MTW Price/Volume Stats

| Current price | $12.98 | 52-week high | $19.48 |

| Prev. close | $12.86 | 52-week low | $10.01 |

| Day low | $12.85 | Volume | 298,846 |

| Day high | $13.46 | Avg. volume | 267,873 |

| 50-day MA | $11.58 | Dividend yield | N/A |

| 200-day MA | $13.65 | Market Cap | 461.32M |

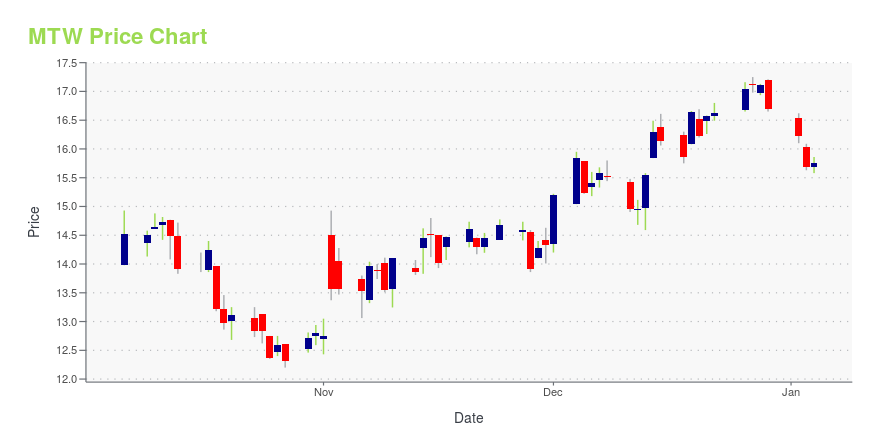

MTW Stock Price Chart Interactive Chart >

Manitowoc Company, Inc. (The) (MTW) Company Bio

Manitowoc Company designs, manufactures, and sells cranes and related products, and foodservice equipment worldwide. The company was founded in 1853 and is based in Manitowoc, Wisconsin.

Latest MTW News From Around the Web

Below are the latest news stories about MANITOWOC CO INC that investors may wish to consider to help them evaluate MTW as an investment opportunity.

Manitowoc (MTW) Rallies 87% in a Year: More Room to Run?Manitowoc (MTW) is expected to maintain its momentum backed by solid demand as well as its focus on product innovation and efforts to grow its higher-margin aftermarket business. |

Manitowoc Named One of "America’s Most Responsible Companies" for Second Consecutive YearMILWAUKEE, December 18, 2023--The Manitowoc Company, Inc. (NYSE: MTW), (the "Company" or "Manitowoc") a leading global manufacturer of cranes and lifting solutions, announced today that it was named one of America’s Most Responsible Companies for the second consecutive year by Newsweek. This prestigious award is presented by Newsweek and Statista Inc., the statistics portal and industry-ranking provider. The awards list was announced on December 6, 2023, and can be viewed on Newsweek's website. |

Little Excitement Around The Manitowoc Company, Inc.'s (NYSE:MTW) RevenuesWhen you see that almost half of the companies in the Machinery industry in the United States have price-to-sales... |

Here's Why The Manitowoc Company, Inc. (MTW) is a Strong Momentum StockThe Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage. |

Reasons to Hold Manitowoc (MTW) Stock in Your PortfolioManitowoc (MTW) is well-poised to gain from solid demand, focus on product innovation and efforts to grow its higher-margin aftermarket business. |

MTW Price Returns

| 1-mo | 21.31% |

| 3-mo | 2.69% |

| 6-mo | -20.47% |

| 1-year | -26.91% |

| 3-year | -42.39% |

| 5-year | -27.12% |

| YTD | -22.23% |

| 2023 | 82.21% |

| 2022 | -50.73% |

| 2021 | 39.67% |

| 2020 | -23.94% |

| 2019 | 18.48% |

Continue Researching MTW

Here are a few links from around the web to help you further your research on Manitowoc Co Inc's stock as an investment opportunity:Manitowoc Co Inc (MTW) Stock Price | Nasdaq

Manitowoc Co Inc (MTW) Stock Quote, History and News - Yahoo Finance

Manitowoc Co Inc (MTW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...