Minerals Technologies Inc. (MTX): Price and Financial Metrics

MTX Price/Volume Stats

| Current price | $80.50 | 52-week high | $90.29 |

| Prev. close | $88.25 | 52-week low | $48.61 |

| Day low | $80.39 | Volume | 319,854 |

| Day high | $87.92 | Avg. volume | 163,494 |

| 50-day MA | $84.15 | Dividend yield | 0.45% |

| 200-day MA | $71.48 | Market Cap | 2.60B |

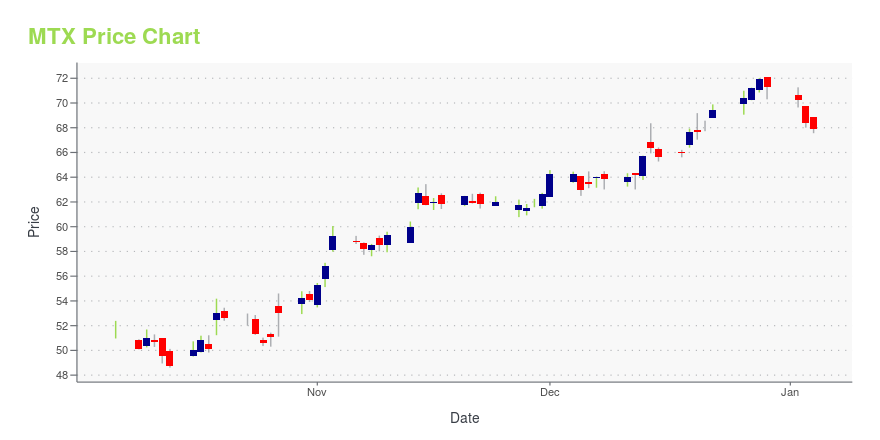

MTX Stock Price Chart Interactive Chart >

Minerals Technologies Inc. (MTX) Company Bio

Minerals Technologies develops, produces and markets a broad range of specialty mineral, mineral-based and synthetic mineral products and related systems and services. The company serves the paper, foundry, steel, environmental, energy, polymer and consumer products industries. The company was founded in 1968 and is based in New York, New York.

Latest MTX News From Around the Web

Below are the latest news stories about MINERALS TECHNOLOGIES INC that investors may wish to consider to help them evaluate MTX as an investment opportunity.

An Intrinsic Calculation For Minerals Technologies Inc. (NYSE:MTX) Suggests It's 47% UndervaluedKey Insights The projected fair value for Minerals Technologies is US$124 based on 2 Stage Free Cash Flow to Equity... |

All You Need to Know About Minerals Technologies (MTX) Rating Upgrade to BuyMinerals Technologies (MTX) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

Should Value Investors Buy Minerals Technologies (MTX) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

Barretts Minerals Fights to Keep Bankruptcy Case in TexasTalc supplier Barretts Minerals is challenging an effort by creditors, including tort claimants, to move its chapter 11 bankruptcy case from Texas to Montana, where the business is based. |

MTX Price Returns

| 1-mo | -2.48% |

| 3-mo | 9.35% |

| 6-mo | 22.16% |

| 1-year | 36.52% |

| 3-year | 4.49% |

| 5-year | 50.53% |

| YTD | 13.18% |

| 2023 | 17.96% |

| 2022 | -16.73% |

| 2021 | 18.07% |

| 2020 | 8.20% |

| 2019 | 12.68% |

MTX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MTX

Here are a few links from around the web to help you further your research on Minerals Technologies Inc's stock as an investment opportunity:Minerals Technologies Inc (MTX) Stock Price | Nasdaq

Minerals Technologies Inc (MTX) Stock Quote, History and News - Yahoo Finance

Minerals Technologies Inc (MTX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...