MVB Financial Corporation (MVBF): Price and Financial Metrics

MVBF Price/Volume Stats

| Current price | $24.77 | 52-week high | $27.23 |

| Prev. close | $24.91 | 52-week low | $17.51 |

| Day low | $24.36 | Volume | 68,600 |

| Day high | $25.24 | Avg. volume | 27,703 |

| 50-day MA | $19.48 | Dividend yield | 2.76% |

| 200-day MA | $20.64 | Market Cap | 319.19M |

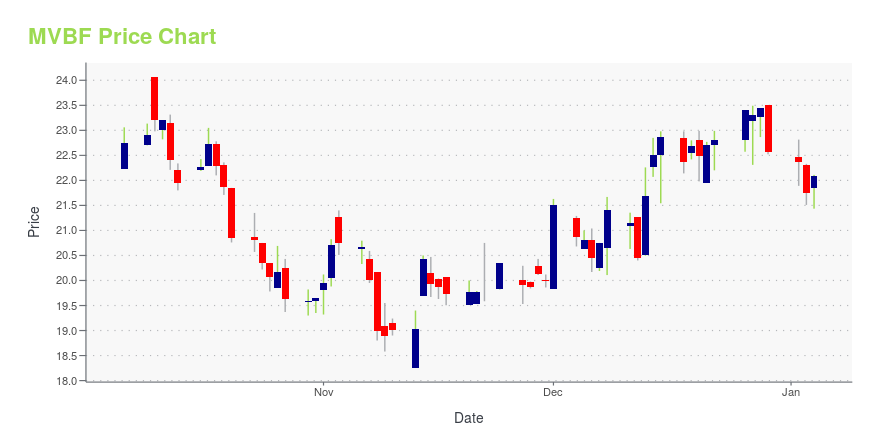

MVBF Stock Price Chart Interactive Chart >

MVB Financial Corporation (MVBF) Company Bio

MVB Financial Corporation is a bank holding company. The Company operates banks in parts of West Virginia. MVB offers a range of products and services including, checking & savings accounts, time certificates of deposit, commercial real estate and residential real estate mortgage loans, debit cards, and safe deposit rental facilities.

Latest MVBF News From Around the Web

Below are the latest news stories about MVB FINANCIAL CORP that investors may wish to consider to help them evaluate MVBF as an investment opportunity.

MVB Financial Corp. (NASDAQ:MVBF) is definitely on the radar of institutional investors who own 46% of the companyKey Insights Institutions' substantial holdings in MVB Financial implies that they have significant influence over the... |

MVB Financial Corp. (NASDAQ:MVBF) Looks Interesting, And It's About To Pay A DividendRegular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see MVB Financial... |

MVB Financial's (NASDAQ:MVBF) Dividend Will Be $0.17MVB Financial Corp.'s ( NASDAQ:MVBF ) investors are due to receive a payment of $0.17 per share on 15th of December... |

MVB Financial Corp. Declares Fourth Quarter 2023 DividendFAIRMONT, W.Va., November 21, 2023--MVB Financial Corp. (NASDAQ: MVBF) ("MVB Financial," "MVB," or the "Company") has declared a quarterly cash dividend of $0.17 per share. |

MVB Bank Named One of American Banker’s 2023 Best Banks to Work ForFAIRMONT, W.Va., November 20, 2023--MVB Bank has been named one of American Banker Magazine’s Best Banks to Work For. MVB placed number 16 among the 90 U.S. banks in the ranking. |

MVBF Price Returns

| 1-mo | 37.61% |

| 3-mo | 27.30% |

| 6-mo | 10.45% |

| 1-year | -1.28% |

| 3-year | -35.52% |

| 5-year | 63.52% |

| YTD | 11.72% |

| 2023 | 5.68% |

| 2022 | -45.83% |

| 2021 | 85.48% |

| 2020 | -7.02% |

| 2019 | 39.64% |

MVBF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MVBF

Want to see what other sources are saying about Mvb Financial Corp's financials and stock price? Try the links below:Mvb Financial Corp (MVBF) Stock Price | Nasdaq

Mvb Financial Corp (MVBF) Stock Quote, History and News - Yahoo Finance

Mvb Financial Corp (MVBF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...