MUELLER WATER PRODUCTS (MWA): Price and Financial Metrics

MWA Price/Volume Stats

| Current price | $20.70 | 52-week high | $20.82 |

| Prev. close | $20.38 | 52-week low | $12.11 |

| Day low | $20.35 | Volume | 1,172,500 |

| Day high | $20.82 | Avg. volume | 1,227,131 |

| 50-day MA | $18.56 | Dividend yield | 1.25% |

| 200-day MA | $15.57 | Market Cap | 3.22B |

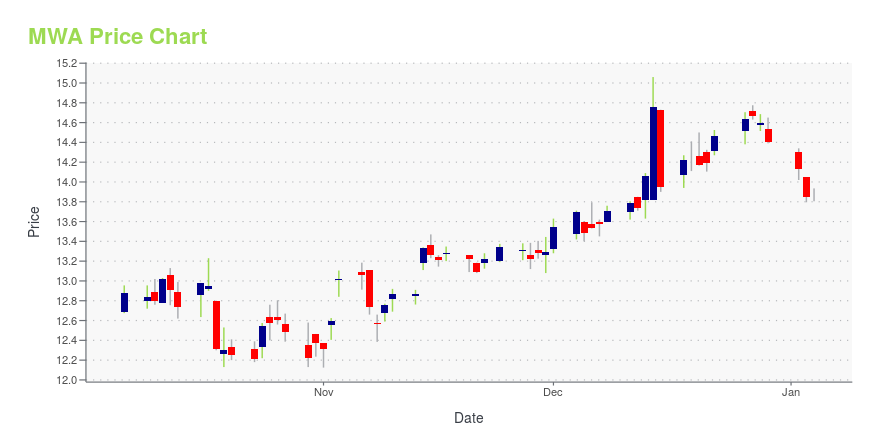

MWA Stock Price Chart Interactive Chart >

MUELLER WATER PRODUCTS (MWA) Company Bio

Mueller Water Products is a manufacturer and marketer of products and services used in the transmission, distribution and measurement of water in North America. The product portfolio includes engineered valves, fire hydrants, metering products and systems, leak detection and pipe condition assessment. The company is founded in 1857 and is based in in Atlanta, Georgia.

Latest MWA News From Around the Web

Below are the latest news stories about MUELLER WATER PRODUCTS INC that investors may wish to consider to help them evaluate MWA as an investment opportunity.

Company News for Dec 15, 2023Companies In The News Are: NDSN, MWA, JBL, INTC. |

Q4 2023 Mueller Water Products Inc Earnings CallQ4 2023 Mueller Water Products Inc Earnings Call |

MWA Stock Earnings: Mueller Water Products Beats EPS, Beats Revenue for Q4 2023MWA stock results show that Mueller Water Products beat analyst estimates for earnings per share and beat on revenue for the fourth quarter of 2023. |

How To Earn $500 A Month From Mueller Water Products Stock Following Earnings BeatMueller Water Products, Inc. (NYSE: MWA) posted better-than-expected results for its fourth quarter on Wednesday. The Atlanta-based company posted adjusted earnings of 19 cents per share, beating market estimates of 10 cents per share. The company’s quarterly sales came in at $301.40 million versus expectations of $272.74 million. Mueller also said it sees first-quarter consolidated net sales of $245 million to $255 million. With the recent buzz around Mueller Water Products following upbeat ear |

Mueller Water Products (MWA) Tops Q4 Earnings and Revenue EstimatesMueller Water Products (MWA) delivered earnings and revenue surprises of 72.73% and 5.35%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

MWA Price Returns

| 1-mo | 17.55% |

| 3-mo | 29.98% |

| 6-mo | 47.79% |

| 1-year | 31.83% |

| 3-year | 49.83% |

| 5-year | 126.55% |

| YTD | 44.91% |

| 2023 | 36.27% |

| 2022 | -23.81% |

| 2021 | 18.06% |

| 2020 | 5.44% |

| 2019 | 34.31% |

MWA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MWA

Want to do more research on Mueller Water Products Inc's stock and its price? Try the links below:Mueller Water Products Inc (MWA) Stock Price | Nasdaq

Mueller Water Products Inc (MWA) Stock Quote, History and News - Yahoo Finance

Mueller Water Products Inc (MWA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...