MaxLinear, Inc. (MXL): Price and Financial Metrics

MXL Price/Volume Stats

| Current price | $12.78 | 52-week high | $26.59 |

| Prev. close | $14.02 | 52-week low | $12.48 |

| Day low | $12.48 | Volume | 4,268,900 |

| Day high | $14.28 | Avg. volume | 826,294 |

| 50-day MA | $19.90 | Dividend yield | N/A |

| 200-day MA | $19.89 | Market Cap | 1.06B |

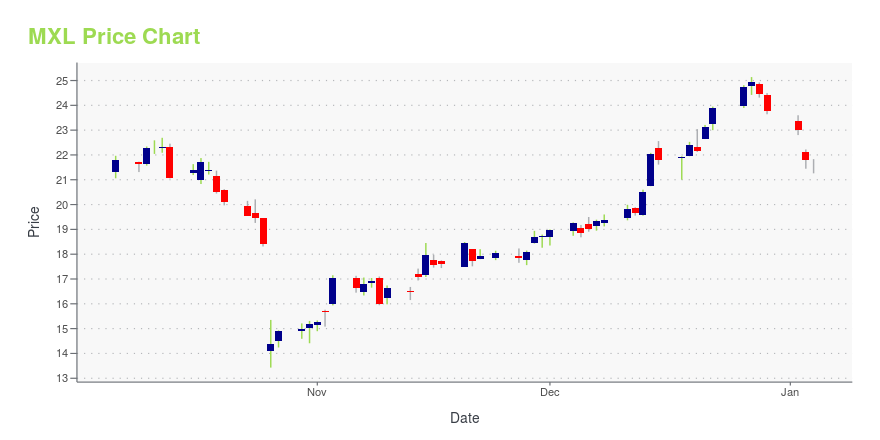

MXL Stock Price Chart Interactive Chart >

MaxLinear, Inc. (MXL) Company Bio

MaxLinear Inc. provides integrated, radio-frequency (RF) and mixed-signal circuits for broadband communication and data center, metro, and long-haul transport network applications worldwide. The company was founded in 2003 and is based in Carlsbad, California.

Latest MXL News From Around the Web

Below are the latest news stories about MAXLINEAR INC that investors may wish to consider to help them evaluate MXL as an investment opportunity.

12 Best Tech Stocks To Buy On the DipIn this article, we discuss the 12 best tech stocks to buy on the dip. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Tech Stocks To Buy On the Dip. Technology stocks were the winners of the pandemic, climbing to record highs during lockdowns as businesses scrambled […] |

Strength Seen in MaxLinear (MXL): Can Its 7.4% Jump Turn into More Strength?MaxLinear (MXL) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

A Look At The Fair Value Of MaxLinear, Inc. (NASDAQ:MXL)Key Insights Using the 2 Stage Free Cash Flow to Equity, MaxLinear fair value estimate is US$19.41 With US$19.35 share... |

Not Worth It! 3 Risky Stocks to Get Rid Of NowEven though U.S. markets may be entering rally territory, equities investors should avoid these 3 risky stocks. |

What Does MaxLinear, Inc.'s (NASDAQ:MXL) Share Price Indicate?MaxLinear, Inc. ( NASDAQ:MXL ), is not the largest company out there, but it received a lot of attention from a... |

MXL Price Returns

| 1-mo | -37.48% |

| 3-mo | -37.93% |

| 6-mo | -42.28% |

| 1-year | -43.33% |

| 3-year | -69.11% |

| 5-year | -44.94% |

| YTD | -46.23% |

| 2023 | -29.99% |

| 2022 | -54.97% |

| 2021 | 97.41% |

| 2020 | 79.97% |

| 2019 | 20.57% |

Continue Researching MXL

Want to do more research on Maxlinear Inc's stock and its price? Try the links below:Maxlinear Inc (MXL) Stock Price | Nasdaq

Maxlinear Inc (MXL) Stock Quote, History and News - Yahoo Finance

Maxlinear Inc (MXL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...