Mylan N.V. (MYL): Price and Financial Metrics

MYL Price/Volume Stats

| Current price | $15.86 | 52-week high | $23.11 |

| Prev. close | $15.55 | 52-week low | $12.75 |

| Day low | $15.34 | Volume | 26,574,100 |

| Day high | $16.15 | Avg. volume | 6,488,034 |

| 50-day MA | $15.21 | Dividend yield | N/A |

| 200-day MA | $16.31 | Market Cap | 8.59B |

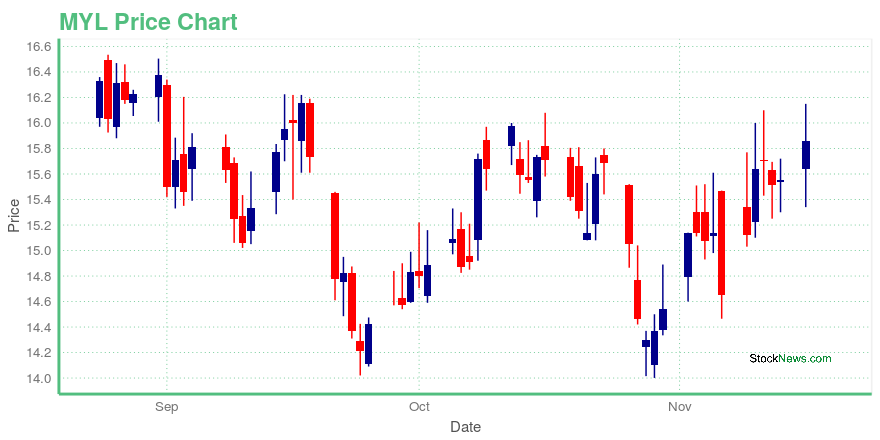

MYL Stock Price Chart Interactive Chart >

Mylan N.V. (MYL) Company Bio

Mylan NV develops, licenses, manufactures, markets, and distributes generic, branded generic, and specialty pharmaceuticals worldwide. The company was founded in 1961 and is based in Potters Bar, Hertfordshire.

Latest MYL News From Around the Web

Below are the latest news stories about Mylan NV that investors may wish to consider to help them evaluate MYL as an investment opportunity.

Global Reversible Airway Diseases Treatment Market 2020: Covering Competitive Scenario And Dynamics By Mylan N.V., Boehringer Ingelheim International GmbH, Regeneron, Sanofi, Genentech, Inc. (F. HoffmannLa Roche Ltd), Novartis AGData Bridge Market Research has provides the Qualitative and informative knowledge by adding titled “Global Reversible Airway Diseases Treatment Market, By Type (Bronchodilators, Cytotoxic Drugs, Antibiotics, Others), Treatment (Chest X Ray, CT Scan, Lung Therapies, Surgery Transplant and Medications), Diseases |

Carboplatin Market In-Depth Analysis Of Competitive Landscape, Executive Summary, Development Factors 2026(Fresenius Kabi, Mylan, Qilu)Los Angeles, United State, – – QY Research recently added a research report, Global Carboplatin Market Research Report 2020 to its ever-increasing repository. The research report discusses the future of the global Carboplatin market. It highlights the drivers and restraints |

Drug Addiction Treatment Market Strategic Insights 2020 with analysis of Leading Players: Pfizer, Indivior, Novartis, Alkermes, Cipla, Mylan, Dr. Reddy's Laboratorie, etc.The Global Drug Addiction Treatment Market research study takes a comprehensive approach towards studying the key trends influencing the growth of this sector. The report comprises data that offers an in-depth insight into the business sector. The research report focuses |

Outstanding Growth of Opioids Drug Market is estimated to reach $11.8 Billion by 2025 | International Company’s - J&J, Teva, Mylan, Pfizer, MallinckrodtGlobal Opioids Drug Market Synopsis: The Opioids Drug Market has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Opioids Drug Market size to maintain the average annual growth rate of 0.83% from $11.1 |

Calcium Folinate Market 2020: Growing Demand for Efficient Management Observes Report Till 2025 with Merck, Teva, MylanThe Calcium Folinate market 2020 research report is a detailed view of market opportunity by end-user segments, product Type segments, sales channels, key countries. It also provides market credentials such as history, various development and trends, market overview, regional |

MYL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | -23.68% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | 0.00% |

| 2019 | -26.64% |

Continue Researching MYL

Here are a few links from around the web to help you further your research on Mylan NV's stock as an investment opportunity:Mylan NV (MYL) Stock Price | Nasdaq

Mylan NV (MYL) Stock Quote, History and News - Yahoo Finance

Mylan NV (MYL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...