My Size Inc. (MYSZ): Price and Financial Metrics

MYSZ Price/Volume Stats

| Current price | $2.86 | 52-week high | $21.92 |

| Prev. close | $2.75 | 52-week low | $2.35 |

| Day low | $2.60 | Volume | 118,050 |

| Day high | $3.21 | Avg. volume | 60,731 |

| 50-day MA | $3.18 | Dividend yield | N/A |

| 200-day MA | $4.20 | Market Cap | 1.83M |

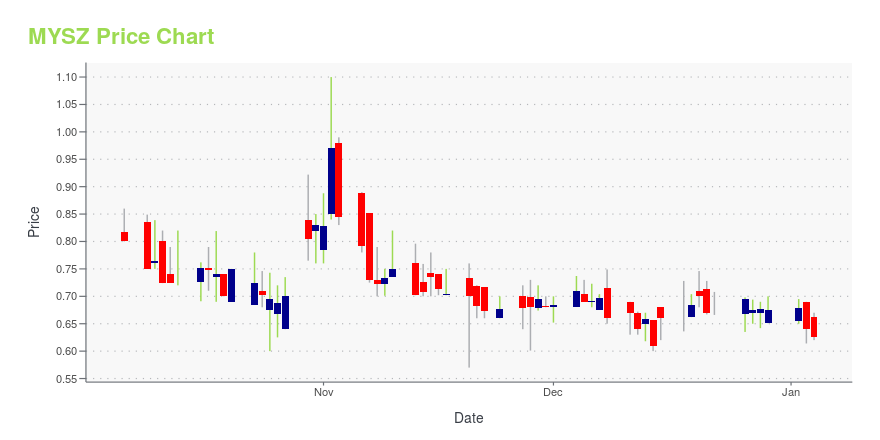

MYSZ Stock Price Chart Interactive Chart >

My Size Inc. (MYSZ) Company Bio

My Size Inc. develops measurement technology based on sophisticated algorithms and technology with broad applications. The Company offers an application that enables consumers to create a secure, online profile of their personal measurements to get the right fit.

Latest MYSZ News From Around the Web

Below are the latest news stories about MY SIZE INC that investors may wish to consider to help them evaluate MYSZ as an investment opportunity.

Major retailers use AI to slash number of clothing returns when shopping onlineOne company is making a splash in the retail space by using artificial intelligence to limit online shopping returns. |

Fox Business Network TV show, Varney and Company Interviews MySize CEO Ronen LuzonMySize, Inc. (Nasdaq: MYSZ) (TASE: MYSZ.TA) ("MySize" or the "Company"), an omnichannel e-commerce platform and provider of AI-driven measurement solutions to drive revenue growth and reduce costs for its business clients, today announced that Ronen Luzon, the Company's Founder and CEO, appeared on the Fox Business Network TV show, Varney and Company, to discuss how its size and fit technologies are helping more than 100 fashion retailers to reduce returns and increase conversion rates. |

MySize Reports Third Quarter 2023 Financial Results: Record Nine-Month Revenues and Gross ProfitsMySize, Inc. (Nasdaq: MYSZ) (TASE: MYSZ.TA) ("MySize" or the "Company"), an omnichannel e-commerce platform and provider of AI-driven measurement solutions to drive revenue growth and reduce costs for its business clients, today reported financial and operational results for the three months ended September 30, 2023. |

MySize's Naiz Fit Launches New Product for $33 Billion Workwear & Uniforms Market -- Several New Clients SignedMySize, Inc. (Nasdaq: MYSZ) (TASE: MYSZ.TA) ("MySize" or the "Company"), an omnichannel e-commerce platform and provider of AI-driven measurement solutions to drive revenue growth and reduce costs for its business clients, today announced its Spain-based Naiz Fit has launched a new sizing solution product—Naiz Fit Workforce—specifically addressing the needs of the $33 billion global workwear and uniforms market. Based on the Company's AI-driven sizing solutions technology platform, Naiz Fit Work |

MySize Issues Shareholder Update: Revised 2023 Revenue Guidance of ~ $8 MillionMySize, Inc. (NASDAQ: MYSZ) (TASE: MYSZ.TA) ("MySize" or the "Company"), an omnichannel e-commerce platform and provider of AI-driven measurement solutions to drive revenue growth and reduce costs for its business clients, today issued a shareholder update from its Founder and CEO, Ronen Luzon. |

MYSZ Price Returns

| 1-mo | 5.93% |

| 3-mo | -22.70% |

| 6-mo | -12.59% |

| 1-year | -66.83% |

| 3-year | -98.81% |

| 5-year | -99.84% |

| YTD | -47.04% |

| 2023 | -75.18% |

| 2022 | -78.46% |

| 2021 | -64.18% |

| 2020 | -57.48% |

| 2019 | -71.29% |

Continue Researching MYSZ

Here are a few links from around the web to help you further your research on My Size Inc's stock as an investment opportunity:My Size Inc (MYSZ) Stock Price | Nasdaq

My Size Inc (MYSZ) Stock Quote, History and News - Yahoo Finance

My Size Inc (MYSZ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...