NanoVibronix, Inc. (NAOV): Price and Financial Metrics

NAOV Price/Volume Stats

| Current price | $0.75 | 52-week high | $4.23 |

| Prev. close | $0.73 | 52-week low | $0.67 |

| Day low | $0.73 | Volume | 53,992 |

| Day high | $0.77 | Avg. volume | 64,310 |

| 50-day MA | $0.76 | Dividend yield | N/A |

| 200-day MA | $0.92 | Market Cap | 2.09M |

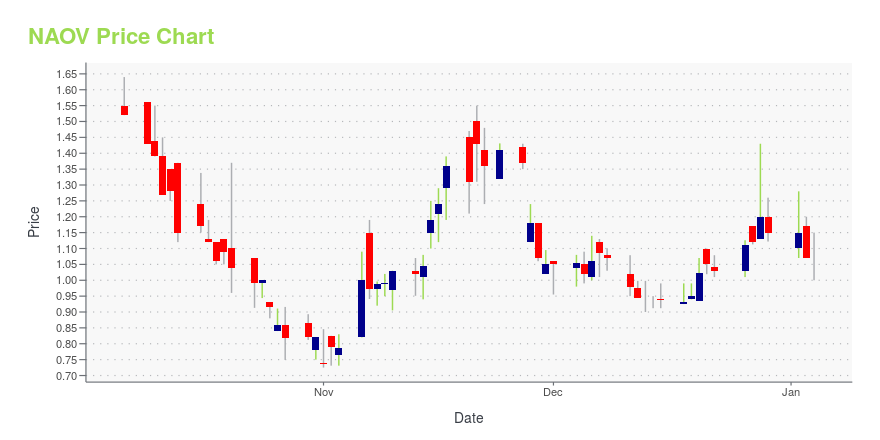

NAOV Stock Price Chart Interactive Chart >

NanoVibronix, Inc. (NAOV) Company Bio

NanoVibronix, Inc. operates as a medical device company. The Company focuses on non-invasive biological response-activating devices that target wound healing and pain therapy. NanoVibronix develops medical devices based on its proprietary therapeutic ultrasound technology.

Latest NAOV News From Around the Web

Below are the latest news stories about NANOVIBRONIX INC that investors may wish to consider to help them evaluate NAOV as an investment opportunity.

NanoVibronix Featured in Your Bladder Health MagazineELMSFORD, N.Y., December 06, 2023--NanoVibronix, Inc., (NASDAQ: NAOV), a medical device company that produces the UroShield®, PainShield® and WoundShield® Surface Acoustic Wave (SAW) Portable Ultrasonic Therapeutic Devices, today announced that its UroShield is featured in Issue 103 of Your Bladder Health Magazine in an article titled ‘UroShield Prevention is better than cure.’ The article highlights the effectiveness of using UroShield in the prevention of catheter associated urinary tract infe |

NanoVibronix Enters into Letter of Intent with APOGEPHA Arzneimittel GmbH to Explore European Distribution OpportunityELMSFORD, N.Y., December 04, 2023--NanoVibronix, Inc. (NASDAQ: NAOV), a medical device company that produces the UroShield®, PainShield® and WoundShield® Surface Acoustic Wave (SAW) Portable Ultrasonic Therapeutic Devices, today announced that it has entered into a non-binding letter of intent (the "LOI") with APOGEPHA Arzneimittel GmbH ("APOGEPHA") in which both parties will analyze the potential for APOGEPHA to distribute NanoVibronix’s premiere UroShield product in Germany and other European |

NanoVibronix Announces Agreement for Clinical Study of UroShield at the University of MichiganELMSFORD, N.Y., November 28, 2023--NanoVibronix, Inc. (Nasdaq: NAOV), a medical device company that produces the UroShield®, PainShield® and WoundShield® Surface Acoustic Wave (SAW) Portable Ultrasonic Therapeutic Devices, today announced it has signed a Research Agreement with the Regents of the University of Michigan for a Randomized Control Trial ("RCT") study of UroShield. |

NanoVibronix Regains Nasdaq ComplianceELMSFORD, N.Y., November 21, 2023--NanoVibronix, Inc., (NASDAQ: NAOV) (the "Company"), a medical device company that produces the UroShield® and PainShield® Surface Acoustic Wave (SAW) Portable Ultrasonic Therapeutic Devices, today announced that on November 20, 2023, the Company received official notice from The Nasdaq Stock Market LLC that the Company has evidenced compliance with all applicable criteria for continued listing on The Nasdaq Capital Market, including the minimum stockholders’ eq |

NanoVibronix Issues Letter to ShareholdersELMSFORD, N.Y., November 14, 2023--NanoVibronix, Inc., (NASDAQ: NAOV), a medical device company that produces the UroShield®, PainShield® and WoundShield® Surface Acoustic Wave (SAW) Portable Ultrasonic Therapeutic Devices, today issued a letter to shareholders from its Chief Executive Officer, Brian Murphy, providing a review of the third quarter 2023 and recent business developments. |

NAOV Price Returns

| 1-mo | 1.35% |

| 3-mo | -1.12% |

| 6-mo | -29.91% |

| 1-year | -76.85% |

| 3-year | -97.45% |

| 5-year | N/A |

| YTD | -34.78% |

| 2023 | -77.18% |

| 2022 | -75.77% |

| 2021 | 36.11% |

| 2020 | -73.19% |

| 2019 | -21.27% |

Continue Researching NAOV

Here are a few links from around the web to help you further your research on NanoVibronix Inc's stock as an investment opportunity:NanoVibronix Inc (NAOV) Stock Price | Nasdaq

NanoVibronix Inc (NAOV) Stock Quote, History and News - Yahoo Finance

NanoVibronix Inc (NAOV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...