Navient Corporation (NAVI): Price and Financial Metrics

NAVI Price/Volume Stats

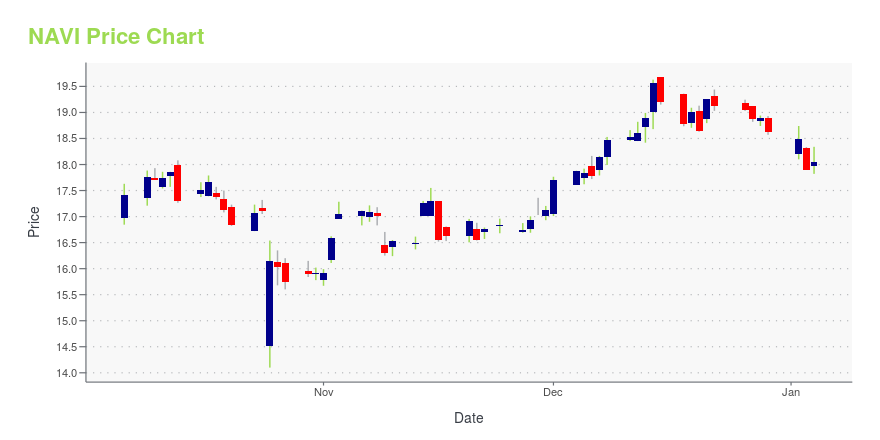

| Current price | $15.95 | 52-week high | $19.68 |

| Prev. close | $15.60 | 52-week low | $13.95 |

| Day low | $15.66 | Volume | 1,079,800 |

| Day high | $16.03 | Avg. volume | 876,069 |

| 50-day MA | $14.83 | Dividend yield | 4.12% |

| 200-day MA | $16.42 | Market Cap | 1.78B |

NAVI Stock Price Chart Interactive Chart >

Navient Corporation (NAVI) Company Bio

Navient Corporation provides financial products and services in the United States. The company operates in four segments: FFELP Loans, Private Education Loans, Business Services, and Other. The company was founded in 2014 and is based in Wilmington, Delaware.

Latest NAVI News From Around the Web

Below are the latest news stories about NAVIENT CORP that investors may wish to consider to help them evaluate NAVI as an investment opportunity.

5 Best Breakout Stocks to Invest in for Attractive ReturnsGrifols (GRFS), Denison Mine Corp (DNN), NGL Energy Partners (NGL), Macatawa Bank (MCBC) and Navient (NAVI) have been selected as the breakout stocks for today. |

Zacks Industry Outlook Highlights Mr. Cooper Group and NavientMr. Cooper Group and Navient have been highlighted in this Industry Outlook article. |

2 Consumer Loan Stocks to Buy Amid Gloomy Industry ProspectsThough subdued consumer sentiments and poor asset quality are likely to hurt the Zacks Consumer Loans industry, the digitization of operations and easing lending standards are likely to support Cooper Group (COOP) and Navient (NAVI). |

Navient recognized as Adoption Advocate by Dave Thomas Foundation for AdoptionHERNDON, Va., Nov. 29, 2023 (GLOBE NEWSWIRE) -- Navient (Nasdaq: NAVI), a leader in technology-enabled education finance and business processing solutions, is proud to announce that it has been recognized as an Adoption Advocate by the Dave Thomas Foundation for Adoption. The list recognizes organizations with robust adoption benefits programs and celebrates employers that help support working adoptive parents. “The Foundation is thrilled to see a growing number of organizations offering robust |

Navient (NASDAQ:NAVI) Will Pay A Dividend Of $0.16Navient Corporation ( NASDAQ:NAVI ) has announced that it will pay a dividend of $0.16 per share on the 15th of... |

NAVI Price Returns

| 1-mo | 12.32% |

| 3-mo | 2.58% |

| 6-mo | -10.34% |

| 1-year | -12.28% |

| 3-year | -10.03% |

| 5-year | 40.69% |

| YTD | -12.50% |

| 2023 | 17.58% |

| 2022 | -19.35% |

| 2021 | 124.11% |

| 2020 | -23.13% |

| 2019 | 63.11% |

NAVI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NAVI

Want to do more research on Navient Corp's stock and its price? Try the links below:Navient Corp (NAVI) Stock Price | Nasdaq

Navient Corp (NAVI) Stock Quote, History and News - Yahoo Finance

Navient Corp (NAVI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...