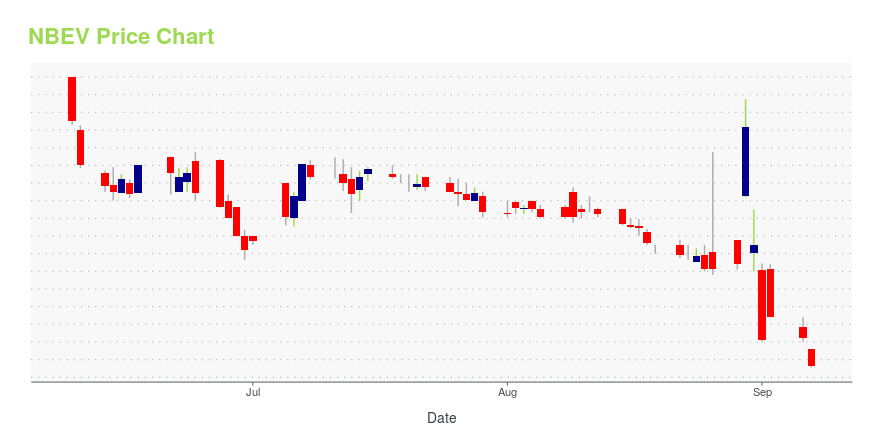

New Age Beverages Corporation (NBEV): Price and Financial Metrics

NBEV Price/Volume Stats

| Current price | $0.09 | 52-week high | $1.75 |

| Prev. close | $0.13 | 52-week low | $0.09 |

| Day low | $0.09 | Volume | 49,119,300 |

| Day high | $0.11 | Avg. volume | 4,663,287 |

| 50-day MA | $0.26 | Dividend yield | N/A |

| 200-day MA | $0.57 | Market Cap | 12.79M |

NBEV Stock Price Chart Interactive Chart >

New Age Beverages Corporation (NBEV) Company Bio

New Age Beverages Corporation operates as a healthy functional beverage company. It offers ready to drink tea, kombucha, energy drinks, and functional waters under XingTea, XingEnergy, Aspen Pure, and Bucha Live Kombucha brand names. The company is based in Denver, Colorado.

Latest NBEV News From Around the Web

Below are the latest news stories about NEWAGE INC that investors may wish to consider to help them evaluate NBEV as an investment opportunity.

7 Penny Stocks to Sell Before They Go to ZeroThese penny stocks to sell have had a horrible run at the stock market and its all for good reason |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're starting off the final trading day of the week with an overview of the biggest pre-market stock movers for Friday! |

Is the Stock Market Closed on Labor Day 2022?Labor Day weekend is upon us and it has some traders wondering if the stock market is closed on Monday. |

What Is Going on With NewAge (NBEV) Stock Today?NewAge (NBEV) stock is rising higher on Friday as it bounces back from a dip caused by its bankruptcy filing earlier this week. |

What Is Going on With Nio (NIO) Stock Today?Nio (NIO) stock isn't doing so hot as recent delivery news continues to drag the electric vehicle (EV) company's shares down today. |

NBEV Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -95.48% |

| 5-year | -97.57% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | -60.84% |

| 2020 | 44.51% |

| 2019 | -65.00% |

Continue Researching NBEV

Want to do more research on New Age Beverages Corp's stock and its price? Try the links below:New Age Beverages Corp (NBEV) Stock Price | Nasdaq

New Age Beverages Corp (NBEV) Stock Quote, History and News - Yahoo Finance

New Age Beverages Corp (NBEV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...