Nabriva Therapeutics plc - Ordinary Shares (NBRV): Price and Financial Metrics

NBRV Price/Volume Stats

| Current price | $1.42 | 52-week high | $8.45 |

| Prev. close | $1.42 | 52-week low | $1.22 |

| Day low | $1.35 | Volume | 717,200 |

| Day high | $1.90 | Avg. volume | 29,344 |

| 50-day MA | $1.55 | Dividend yield | N/A |

| 200-day MA | $1.78 | Market Cap | 45.46M |

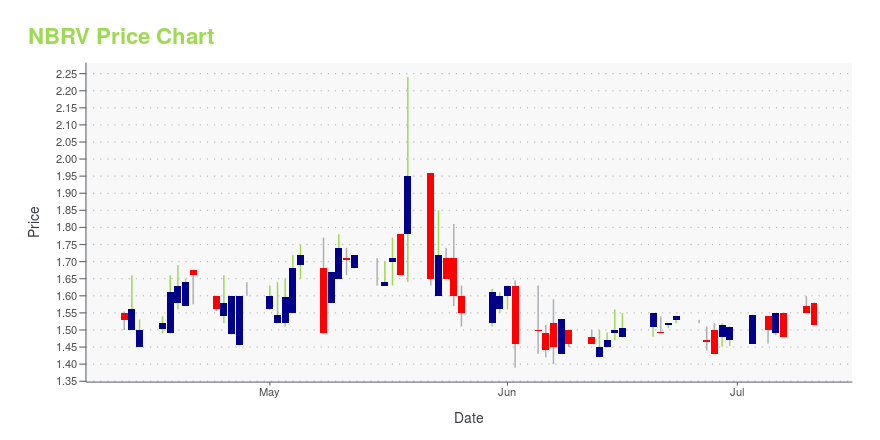

NBRV Stock Price Chart Interactive Chart >

Nabriva Therapeutics plc - Ordinary Shares (NBRV) Company Bio

Nabriva is a clinical-stage biopharmaceutical company engaged in the research and development of novel antibiotics to treat serious infections, with a focus on the pleuromutilin class of antibiotics. The company was founded in 2006 and is based in Wien, Austria.

Latest NBRV News From Around the Web

Below are the latest news stories about NABRIVA THERAPEUTICS PLC that investors may wish to consider to help them evaluate NBRV as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayWe're starting off Wednesday with a breakdown of the biggest pre-market stock movers traders need to know about this morning! |

7 Stocks to Sell as Banks Melt DownAlthough the internet encourages you to buy the red ink, sometimes you should consider stocks to sell as just that. |

Nabriva Therapeutics Provides Corporate Update-Company To Focus on Preserving Cash to Fund Orderly Wind Down of Operations- -Company To Continue Work With Torreya Capital On Asset Monetization- DUBLIN, Ireland, Jan. 06, 2023 (GLOBE NEWSWIRE) -- Nabriva Therapeutics plc (NASDAQ: NBRV) today announced that, after an assessment of strategic options, its Board of Directors approved a plan to preserve cash in order to adequately fund an orderly wind down of the Company’s operations. As previously disclosed, the Company engaged Torreya Capital to |

Nabriva (NBRV) Posts Positive Data From Cystic Fibrosis StudyNabriva (NBRV) posts positive top-line data from the phase I study evaluating oral and intravenous Xenleta (lefamulin) in adult patients with cystic fibrosis. Shares down. |

Nabriva's antibiotic shows promise as a potential cystic fibrosis treatmentThe Phase 1 study is testing the safety of oral and intravenous versions of lefamulin, the active ingredient in Xenleta, in adult patients with the condition. |

NBRV Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -2.41% |

| 3-year | -94.74% |

| 5-year | -99.76% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -87.38% |

| 2021 | -75.25% |

| 2020 | -81.67% |

| 2019 | -9.59% |

Continue Researching NBRV

Want to do more research on Nabriva Therapeutics plc's stock and its price? Try the links below:Nabriva Therapeutics plc (NBRV) Stock Price | Nasdaq

Nabriva Therapeutics plc (NBRV) Stock Quote, History and News - Yahoo Finance

Nabriva Therapeutics plc (NBRV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...