NCS Multistage Holdings, Inc. (NCSM): Price and Financial Metrics

NCSM Price/Volume Stats

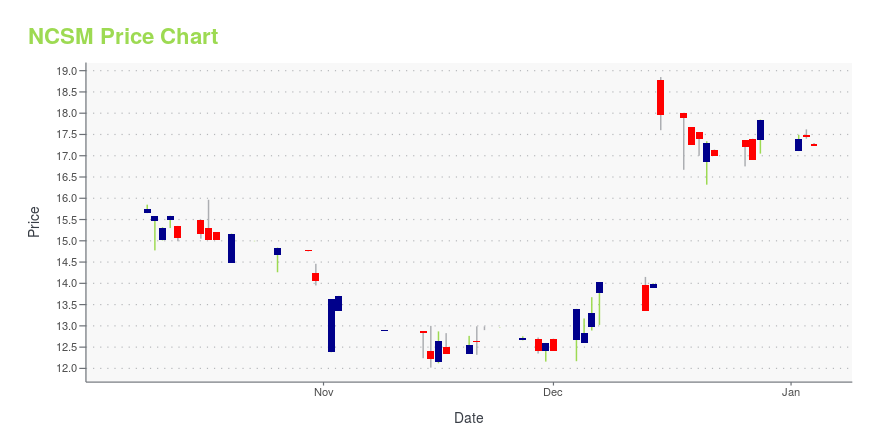

| Current price | $17.45 | 52-week high | $21.15 |

| Prev. close | $17.39 | 52-week low | $12.02 |

| Day low | $17.16 | Volume | 2,600 |

| Day high | $18.34 | Avg. volume | 2,994 |

| 50-day MA | $17.28 | Dividend yield | N/A |

| 200-day MA | $15.98 | Market Cap | 43.68M |

NCSM Stock Price Chart Interactive Chart >

NCS Multistage Holdings, Inc. (NCSM) Company Bio

NCS Multistage Holdings, Inc. provides engineered products and support services for oil and natural gas well completions and field development strategies in the United States and internationally. The company was founded in 2006 and is based in Houston, Texas.

Latest NCSM News From Around the Web

Below are the latest news stories about NCS MULTISTAGE HOLDINGS INC that investors may wish to consider to help them evaluate NCSM as an investment opportunity.

NCS Multistage Holdings, Inc. (NASDAQ:NCSM) Q3 2023 Earnings Call TranscriptNCS Multistage Holdings, Inc. (NASDAQ:NCSM) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good day and thank you for standing by and welcome to the Q3 2023 NCS Multistage Earnings Conference Call. At this time, all participants are in a listen-only mode. After the speaker’s presentation, there will be a question-and-answer session. [Operator Instructions] […] |

Q3 2023 NCS Multistage Holdings Inc Earnings CallQ3 2023 NCS Multistage Holdings Inc Earnings Call |

NCS Multistage Holdings Inc (NCSM) Q3 2023 Earnings: Revenue Decreases by 22% Amid Market HeadwindsDespite a decrease in revenue, the company maintains a robust gross margin percentage and strong balance sheet |

NCS Multistage Holdings, Inc. Announces Third Quarter 2023 ResultsThird Quarter Results Total revenues of $38.3 million, a 22% year-over-year decreaseNet income of $4.4 million and earnings per diluted share of $1.77, compared to net income of $3.9 million and earnings per diluted share of $1.58 in the same quarter of 2022Adjusted EBITDA of $6.8 million, a decrease of $1.6 million from the third quarter of 2022; Adjusted EBITDA margin of 18%, an increase compared to the same quarter of 2022$11.4 million in cash and $8.3 million of total debt as of September 30 |

NCS Multistage Holdings, Inc. Schedules Third Quarter 2023 Earnings Release and Conference CallHOUSTON, Oct. 24, 2023 (GLOBE NEWSWIRE) -- NCS Multistage Holdings, Inc. (“NCS” or the “Company”) (NASDAQ:NCSM) will host a conference call to discuss its third quarter 2023 results on Tuesday, October 31, 2023 at 7:30 a.m. Central Time (8:30 a.m. Eastern Time). NCS will issue its third quarter 2023 earnings release the evening prior to the conference call. The conference call will be available via a live audio webcast. Participants who wish to ask questions may register for the call here to rec |

NCSM Price Returns

| 1-mo | 5.76% |

| 3-mo | 6.73% |

| 6-mo | 8.86% |

| 1-year | N/A |

| 3-year | -39.91% |

| 5-year | -72.39% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -13.76% |

| 2021 | 28.79% |

| 2020 | -46.40% |

| 2019 | -58.74% |

Continue Researching NCSM

Want to see what other sources are saying about NCS Multistage Holdings Inc's financials and stock price? Try the links below:NCS Multistage Holdings Inc (NCSM) Stock Price | Nasdaq

NCS Multistage Holdings Inc (NCSM) Stock Quote, History and News - Yahoo Finance

NCS Multistage Holdings Inc (NCSM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...