Ingevity Corporation (NGVT): Price and Financial Metrics

NGVT Price/Volume Stats

| Current price | $46.20 | 52-week high | $66.18 |

| Prev. close | $45.84 | 52-week low | $36.66 |

| Day low | $45.28 | Volume | 129,200 |

| Day high | $46.50 | Avg. volume | 228,398 |

| 50-day MA | $46.13 | Dividend yield | N/A |

| 200-day MA | $44.91 | Market Cap | 1.68B |

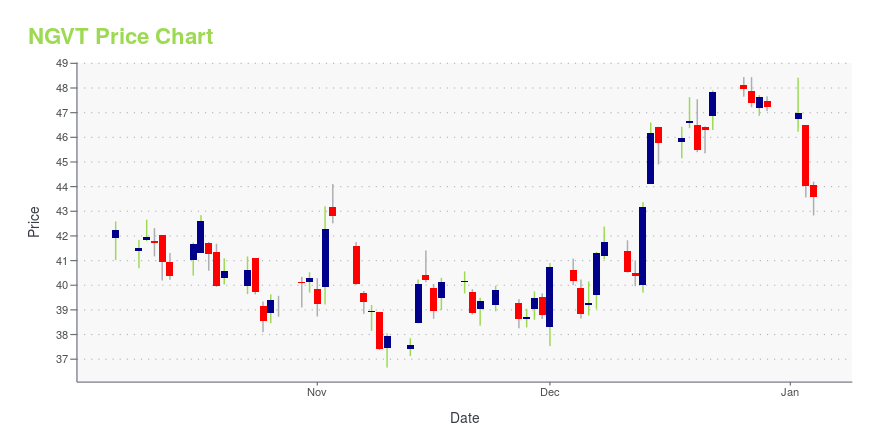

NGVT Stock Price Chart Interactive Chart >

Ingevity Corporation (NGVT) Company Bio

Ingevity Corporation manufactures and sells specialty chemicals and carbon materials in the United States and internationally. It operates through two segments, Performance Chemicals and Performance Materials.

Latest NGVT News From Around the Web

Below are the latest news stories about INGEVITY CORP that investors may wish to consider to help them evaluate NGVT as an investment opportunity.

Ingevity (NYSE:NGVT) shareholders have endured a 49% loss from investing in the stock five years agoThe main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more... |

Why Is Ingevity (NGVT) Down 8.3% Since Last Earnings Report?Ingevity (NGVT) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Ingevity (NGVT) Extends Distributorship With TRiiSO for CapaTRiiSO's technical support strengths complement Ingevity's (NGVT) commitment to providing solutions to challenging formulation issues. |

Ingevity extends partnership with TRiiSO, LLC, expands Capa® distribution footprint for customers in the United States and CanadaNORTH CHARLESTON, S.C., November 28, 2023--Ingevity announced an extension of the distributorship with TRiiSO LLC to expand Ingevity's Capa® product distribution throughout North America. |

Ingevity Corporation (NYSE:NGVT) Analysts Are More Bearish Than They Used To BeThe analysts covering Ingevity Corporation ( NYSE:NGVT ) delivered a dose of negativity to shareholders today, by... |

NGVT Price Returns

| 1-mo | 4.43% |

| 3-mo | -4.76% |

| 6-mo | 0.65% |

| 1-year | -28.16% |

| 3-year | -44.23% |

| 5-year | -53.89% |

| YTD | -2.16% |

| 2023 | -32.96% |

| 2022 | -1.76% |

| 2021 | -5.32% |

| 2020 | -13.33% |

| 2019 | 4.41% |

Continue Researching NGVT

Want to do more research on Ingevity Corp's stock and its price? Try the links below:Ingevity Corp (NGVT) Stock Price | Nasdaq

Ingevity Corp (NGVT) Stock Quote, History and News - Yahoo Finance

Ingevity Corp (NGVT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...