Annaly Capital Management Inc (NLY): Price and Financial Metrics

NLY Price/Volume Stats

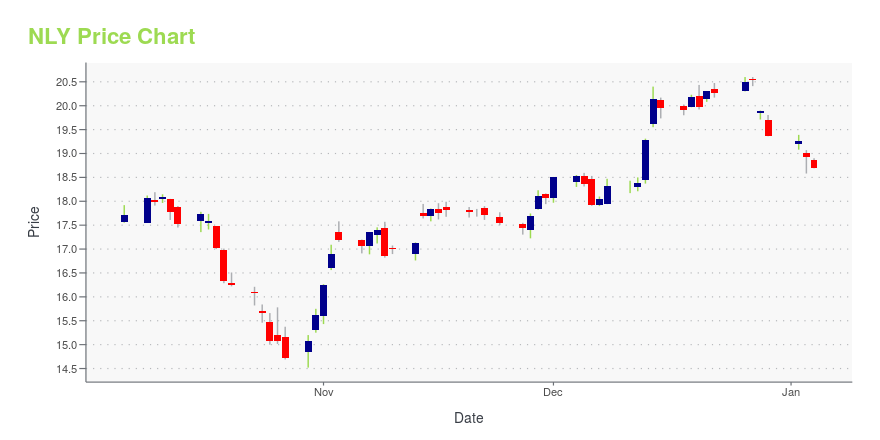

| Current price | $19.86 | 52-week high | $21.07 |

| Prev. close | $19.64 | 52-week low | $14.52 |

| Day low | $19.63 | Volume | 2,894,811 |

| Day high | $19.93 | Avg. volume | 3,557,383 |

| 50-day MA | $19.81 | Dividend yield | 12.8% |

| 200-day MA | $18.95 | Market Cap | 9.94B |

NLY Stock Price Chart Interactive Chart >

Annaly Capital Management Inc (NLY) Company Bio

Annaly Capital Management Inc was founded in 1996 by a group of entrepreneurs, including Michael A. J. Farrell and Wellington J. Denahan. A year later, Annaly Capital completed a 102 million dollar initial public offering and is headquartered in New York City. The company is a real estate investment trust (REIT)and is a part of the real estate sector. As a mortgage real estate investment trust, it owns a portfolio of real estate related investments, including mortgage pass-through certificates and collateralized mortgage obligations. With $14 billion dollars in permanent capital, Annaly operates in two main sectors of the real estate economy: housing and commercial business. David L. Finklestein serves as the company’s Chief Investment Officer and Chief Executive Officer.

Latest NLY News From Around the Web

Below are the latest news stories about ANNALY CAPITAL MANAGEMENT INC that investors may wish to consider to help them evaluate NLY as an investment opportunity.

Annaly Capital Management, Inc. (NYSE:NLY) is largely controlled by institutional shareholders who own 52% of the companyKey Insights Institutions' substantial holdings in Annaly Capital Management implies that they have significant... |

Here's Why Annaly (NLY) Stock is a Solid Investment Pick NowAnnaly (NLY) is a wise investment option at present due to its exposure to high-quality MBS, decent liquidity and attractive ROE. |

Annaly Capital Management (NLY) Surpasses Market Returns: Some Facts Worth KnowingIn the most recent trading session, Annaly Capital Management (NLY) closed at $20.53, indicating a +0.15% shift from the previous trading day. |

Investors Heavily Search Annaly Capital Management Inc (NLY): Here is What You Need to KnowZacks.com users have recently been watching Annaly (NLY) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects. |

3 Things You Need to Know If You Buy Annaly Capital TodayAnnaly Capital has a huge dividend yield, but that has proven to be a trap for income investors in the past. |

NLY Price Returns

| 1-mo | 3.10% |

| 3-mo | 8.78% |

| 6-mo | 8.30% |

| 1-year | 13.11% |

| 3-year | -12.02% |

| 5-year | -1.71% |

| YTD | 9.64% |

| 2023 | 4.94% |

| 2022 | -21.41% |

| 2021 | 2.49% |

| 2020 | 2.38% |

| 2019 | 7.22% |

NLY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NLY

Want to see what other sources are saying about Annaly Capital Management Inc's financials and stock price? Try the links below:Annaly Capital Management Inc (NLY) Stock Price | Nasdaq

Annaly Capital Management Inc (NLY) Stock Quote, History and News - Yahoo Finance

Annaly Capital Management Inc (NLY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...