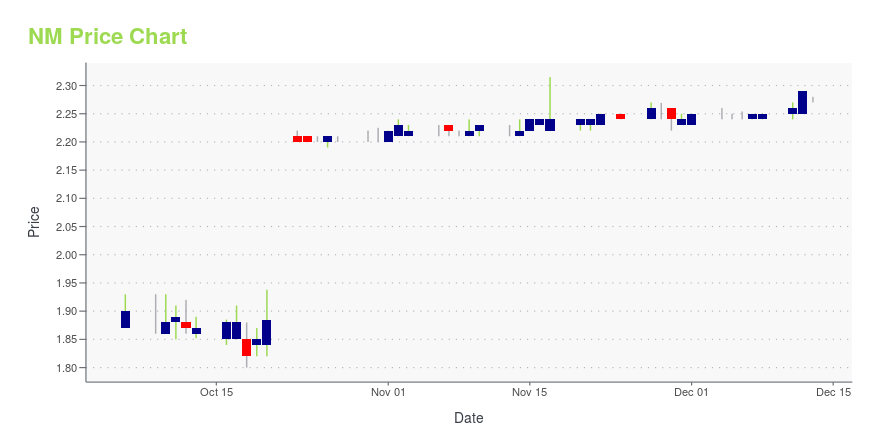

Navios Maritime Holdings Inc. (NM): Price and Financial Metrics

NM Price/Volume Stats

| Current price | $2.27 | 52-week high | $2.97 |

| Prev. close | $2.29 | 52-week low | $1.47 |

| Day low | $2.27 | Volume | 43,600 |

| Day high | $2.28 | Avg. volume | 111,122 |

| 50-day MA | $2.14 | Dividend yield | N/A |

| 200-day MA | $1.90 | Market Cap | 51.82M |

NM Stock Price Chart Interactive Chart >

Navios Maritime Holdings Inc. (NM) Company Bio

Navios Maritime Holdings Inc. operates as a seaborne shipping and logistics company. The company focuses on the transportation and transshipment of dry bulk commodities, including iron ore, coal, and grains. It operates in two segments, Dry Bulk Vessel Operations and Logistics Business. The company is based in Monaco.

Latest NM News From Around the Web

Below are the latest news stories about NAVIOS MARITIME HOLDINGS INC that investors may wish to consider to help them evaluate NM as an investment opportunity.

Navios Maritime Holdings Inc. Announces Completion of Acquisition by N Logistics Holdings CorporationGRAND CAYMAN, Cayman Islands and PIRAEUS, Greece, Dec. 14, 2023 (GLOBE NEWSWIRE) -- Navios Maritime Holdings Inc. (the “Company”) (NYSE: NM) and N Logistics Holdings Corporation (“NLHC”), a company affiliated with the Company’s Chairwoman and Chief Executive Officer, Angeliki Frangou, announced today the completion of the transaction contemplated by the previously announced Agreement and Plan of Merger (the “Merger Agreement”), dated as of October 22, 2023, pursuant to which NLHC acquired all of |

Live Webinar on the Tanker Sector: Tuesday, November 28, 2023, at 10 a.m. ETShipping Executives to Discuss the Tanker Sector's Current Trends & OutlookNEW YORK, Nov. 20, 2023 (GLOBE NEWSWIRE) -- Capital Link will host a complimentary webinar on November 28, 2023, at 10 a.m. Eastern Time on the Tanker shipping sector. REGISTRATIONOnline attendance is complimentary. Please click on the link below to register.https://webinars.capitallink.com/2023/shipping/ FEATURED PANELISTS Paolo d’Amico, Chairman and CEO of d’Amico International Shipping (OTCQX: DMCOF) (Borsa Italiana: D |

Navios Maritime Partners L.P. (NYSE:NMM) Q3 2023 Earnings Call TranscriptNavios Maritime Partners L.P. (NYSE:NMM) Q3 2023 Earnings Call Transcript November 4, 2023 Operator: Thank you for joining us for Navios Maritime Partners Third Quarter 2020 Earnings Conference Call. With us today from the Company are Chairwoman and CEO, Ms. Angeliki Frangou; Chief Operating Officer, Mr. Efstratios Desypris; Chief Financial Officer, Ms. Erifili Tsironi; and […] |

Investors in Navios Maritime Holdings (NYSE:NM) from five years ago are still down 59%, even after 17% gain this past weekWhile not a mind-blowing move, it is good to see that the Navios Maritime Holdings Inc. ( NYSE:NM ) share price has... |

Navios Maritime Holdings Inc. Announces Definitive Merger AgreementShareholders to Receive $2.28 Per Common Share in CashGRAND CAYMAN, Cayman Islands and PIRAEUS, Greece, Oct. 23, 2023 (GLOBE NEWSWIRE) -- Navios Maritime Holdings Inc. (the “Company”) (NYSE: NM) and N Logistics Holdings Corporation (“NLHC”), a company controlled by the Company’s Chairwoman and Chief Executive Officer, Angeliki Frangou, announced today that they entered into a definitive merger agreement (the “Merger Agreement”), pursuant to which NLHC will acquire all of the outstanding shares o |

NM Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 26.11% |

| 3-year | -48.53% |

| 5-year | -67.89% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -52.57% |

| 2021 | 64.00% |

| 2020 | -49.78% |

| 2019 | 65.93% |

Continue Researching NM

Want to see what other sources are saying about Navios Maritime Holdings Inc's financials and stock price? Try the links below:Navios Maritime Holdings Inc (NM) Stock Price | Nasdaq

Navios Maritime Holdings Inc (NM) Stock Quote, History and News - Yahoo Finance

Navios Maritime Holdings Inc (NM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...