Nemaura Medical Inc. (NMRD): Price and Financial Metrics

NMRD Price/Volume Stats

| Current price | $0.03 | 52-week high | $1.00 |

| Prev. close | $0.03 | 52-week low | $0.03 |

| Day low | $0.03 | Volume | 5,400 |

| Day high | $0.06 | Avg. volume | 60,118 |

| 50-day MA | $0.04 | Dividend yield | N/A |

| 200-day MA | $0.12 | Market Cap | 1.30M |

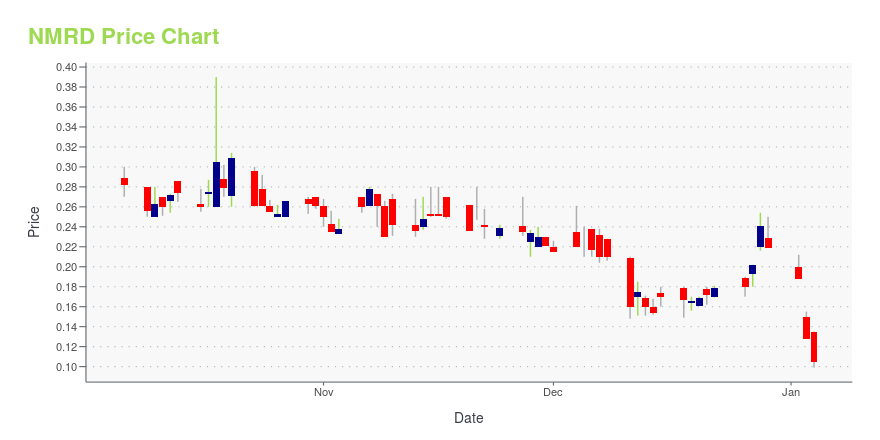

NMRD Stock Price Chart Interactive Chart >

Nemaura Medical Inc. (NMRD) Company Bio

Nemaura Medical Inc. designs and develops proprietary drug delivery platforms. The Company produces therapeutic delivery systems including patches and injectors. Nemaura Medical offers its products to the pharmaceutical and healthcare industries.

Latest NMRD News From Around the Web

Below are the latest news stories about NEMAURA MEDICAL INC that investors may wish to consider to help them evaluate NMRD as an investment opportunity.

Nemaura Medical Inc. Receives Positive Nasdaq Listing DecisionLoughborough, UK, Dec. 13, 2023 (GLOBE NEWSWIRE) -- Nemaura Medical Inc. (NASDAQ: NMRD) (“Nemaura Medical” or the “Company”), developer of a daily wear non-invasive glucose sensor, and digital healthcare programs is pleased to announce that the Nasdaq Hearings Panel granted the Company’s request for continued listing pursuant to an exception, including certain interim milestones, that ultimately expires on April 1st, 2024, to evidence compliance with all applicable criteria for continued listing |

Nemaura Medical Inc. Secures $10 Million Non-Dilutive Credit Facility to Fuel Strategic GrowthLoughborough, UK, Nov. 21, 2023 (GLOBE NEWSWIRE) -- Nemaura Medical Inc. (NASDAQ: NMRD) (“Nemaura Medical” or the “Company”), developer of a daily wear non-invasive glucose sensor, and digital healthcare programs is pleased to announce the execution of a strategic agreement for a $10 million credit facility which is expected to support the Company’s strategic growth plans. Recognizing the challenges associated with equity sales, particularly in the small-cap landscape on the Nasdaq, Nemaura Medi |

Nemaura (NMRD) to Expand in UK With Metabolic Health ProgramThe latest program leverages Nemaura's (NMRD) world-first daily wear non-invasive CGM technology, providing individuals with real-time insights into their body's glucose dynamics. |

Nemaura Medical First Half 2024 Earnings: US$0.13 loss per share (vs US$0.33 loss in 1H 2023)Nemaura Medical ( NASDAQ:NMRD ) First Half 2024 Results Key Financial Results Net loss: US$3.81m (loss narrowed by 52... |

Sidoti Events, LLC’s Virtual November Micro-Cap ConferenceNEW YORK, NY / ACCESSWIRE / November 14, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day November Micro-Cap Conference taking place Wednesday and Thursday, November ... |

NMRD Price Returns

| 1-mo | N/A |

| 3-mo | -44.65% |

| 6-mo | -67.53% |

| 1-year | -96.70% |

| 3-year | -99.62% |

| 5-year | -99.65% |

| YTD | -86.30% |

| 2023 | -87.25% |

| 2022 | -62.34% |

| 2021 | 20.95% |

| 2020 | 7.71% |

| 2019 | -61.11% |

Loading social stream, please wait...