Newmark Group, Inc. - (NMRK): Price and Financial Metrics

NMRK Price/Volume Stats

| Current price | $12.30 | 52-week high | $16.10 |

| Prev. close | $12.39 | 52-week low | $9.65 |

| Day low | $12.25 | Volume | 215,003 |

| Day high | $12.53 | Avg. volume | 1,088,730 |

| 50-day MA | $11.66 | Dividend yield | 0.98% |

| 200-day MA | $0.00 | Market Cap | 2.27B |

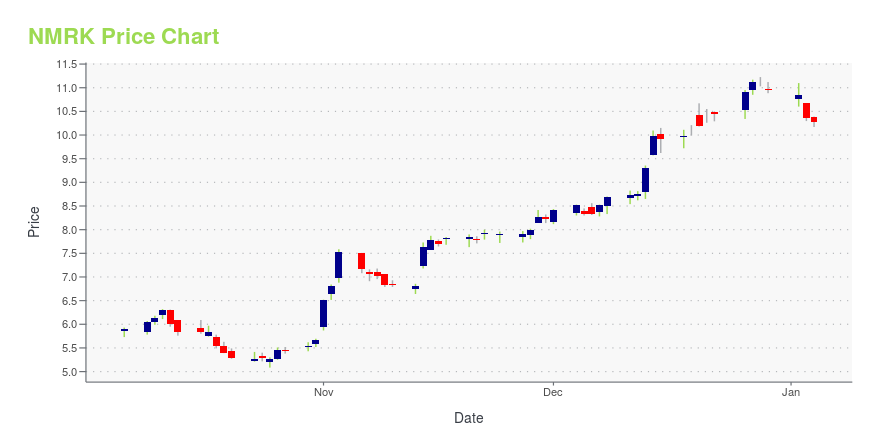

NMRK Stock Price Chart Interactive Chart >

Newmark Group, Inc. - (NMRK) Company Bio

Newmark Group, Inc. provides commercial real estate services in the United States. Its investor/owner services and products include capital markets, which consist of investment sales, debt and structured finance and loan sales, agency leasing, property management, valuation and advisory, and loan servicing; and diligence and underwriting and government sponsored entity lending. The company’s occupier services and products comprise tenant representation, real estate management technology systems, workplace and occupancy strategy, global corporate services consulting, project management, lease administration, and facilities management. It serves occupiers/real estate tenants, owners/landlords, and developers of real estate in the United States; and corporations and institutional investors internationally. The company was founded in 1929 and is based in New York, New York. Newmark Group, Inc. is a subsidiary of BGC Partners, Inc.

NMRK Price Returns

| 1-mo | 9.24% |

| 3-mo | N/A |

| 6-mo | -7.02% |

| 1-year | 4.74% |

| 3-year | 16.58% |

| 5-year | 210.30% |

| YTD | -3.54% |

| 2024 | 18.06% |

| 2023 | 39.87% |

| 2022 | -56.96% |

| 2021 | 157.32% |

| 2020 | -44.91% |

NMRK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NMRK

Want to do more research on Newmark Group Inc's stock and its price? Try the links below:Newmark Group Inc (NMRK) Stock Price | Nasdaq

Newmark Group Inc (NMRK) Stock Quote, History and News - Yahoo Finance

Newmark Group Inc (NMRK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...