North American Construction Group Ltd. (NOA): Price and Financial Metrics

NOA Price/Volume Stats

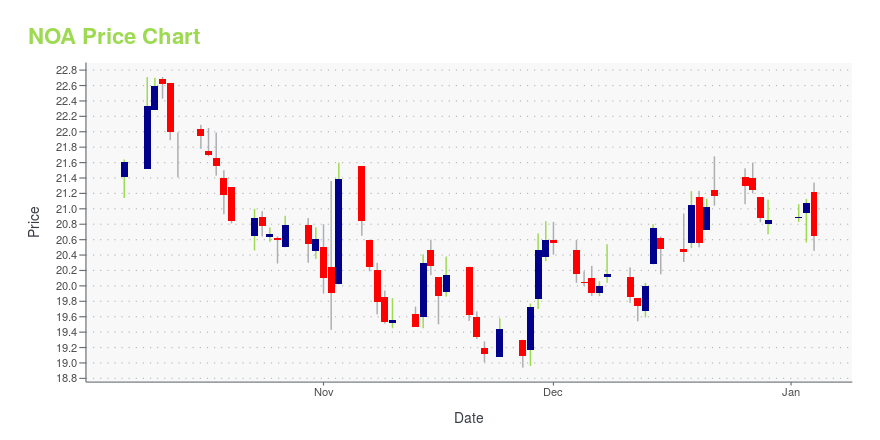

| Current price | $19.78 | 52-week high | $26.30 |

| Prev. close | $19.53 | 52-week low | $18.92 |

| Day low | $19.57 | Volume | 38,479 |

| Day high | $19.81 | Avg. volume | 65,293 |

| 50-day MA | $19.97 | Dividend yield | 1.49% |

| 200-day MA | $21.37 | Market Cap | 528.86M |

NOA Stock Price Chart Interactive Chart >

North American Construction Group Ltd. (NOA) Company Bio

North American Energy Partners Inc., through its subsidiaries, provides a range of mining and heavy construction services to customers in the resource development and industrial construction sectors primarily in Western Canada. The company was founded in 1953 and is based in Edmonton, Canada.

Latest NOA News From Around the Web

Below are the latest news stories about NORTH AMERICAN CONSTRUCTION GROUP LTD that investors may wish to consider to help them evaluate NOA as an investment opportunity.

North American Construction Group Ltd. Announces Record Results for the Third Quarter Ended September 30, 2023ACHESON, Alberta, Nov. 01, 2023 (GLOBE NEWSWIRE) -- North American Construction Group Ltd. ("NACG") today announced results for the third quarter ended September 30, 2023. Unless otherwise indicated, financial figures are expressed in Canadian dollars, and comparisons are to the prior period ended September 30, 2022. Third Quarter 2023 Highlights: Reported revenue of $194.7 million, compared to $191.4 million in the same period last year, was generated primarily by the heavy equipment fleet in t |

Why North American Construction (NOA) is Poised to Beat Earnings Estimates AgainNorth American Construction (NOA) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report. |

North American Construction Group Ltd. Third Quarter Results Conference Call and Webcast NotificationACHESON, Alberta, Oct. 19, 2023 (GLOBE NEWSWIRE) -- North American Construction Group Ltd. (“NACG” or “the Company”) (TSX:NOA.TO/NYSE:NOA) announced today that it will release its financial results for the third quarter ended September 30, 2023 on Wednesday, November 1, 2023 after markets close. Following the release of its financial results, NACG will hold a conference call and webcast on Thursday, November 2, 2023, at 7:00 a.m. Mountain Time (9:00 a.m. Eastern Time). The call can be accessed b |

North American Construction (NOA) Expected to Beat Earnings Estimates: Can the Stock Move Higher?North American Construction (NOA) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

North American Construction Group Closes Acquisition of MacKellar Group and Establishes Transition TeamACHESON, Alberta, Oct. 04, 2023 (GLOBE NEWSWIRE) -- North American Construction Group Ltd. (“NACG” or the “Company”) (TSX:NOA) today announced the closing of its acquisition of MacKellar Group (“MacKellar”), with an effective date of October 1, 2023. Total expected consideration is $395 million (the “Consideration”), with the final Consideration amount to be determined based on MacKellar’s audited financial statements as of September 30, 2023, which will be reflected in the Company’s financial s |

NOA Price Returns

| 1-mo | 3.72% |

| 3-mo | -10.07% |

| 6-mo | -16.74% |

| 1-year | -19.34% |

| 3-year | 36.72% |

| 5-year | 111.13% |

| YTD | -4.52% |

| 2023 | 58.31% |

| 2022 | -9.77% |

| 2021 | 53.52% |

| 2020 | -17.25% |

| 2019 | 37.27% |

NOA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NOA

Here are a few links from around the web to help you further your research on North American Construction Group Ltd's stock as an investment opportunity:North American Construction Group Ltd (NOA) Stock Price | Nasdaq

North American Construction Group Ltd (NOA) Stock Quote, History and News - Yahoo Finance

North American Construction Group Ltd (NOA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...