NI Holdings, Inc. (NODK): Price and Financial Metrics

NODK Price/Volume Stats

| Current price | $16.14 | 52-week high | $16.55 |

| Prev. close | $16.20 | 52-week low | $12.01 |

| Day low | $16.02 | Volume | 22,440 |

| Day high | $16.27 | Avg. volume | 13,440 |

| 50-day MA | $15.41 | Dividend yield | N/A |

| 200-day MA | $14.09 | Market Cap | 332.95M |

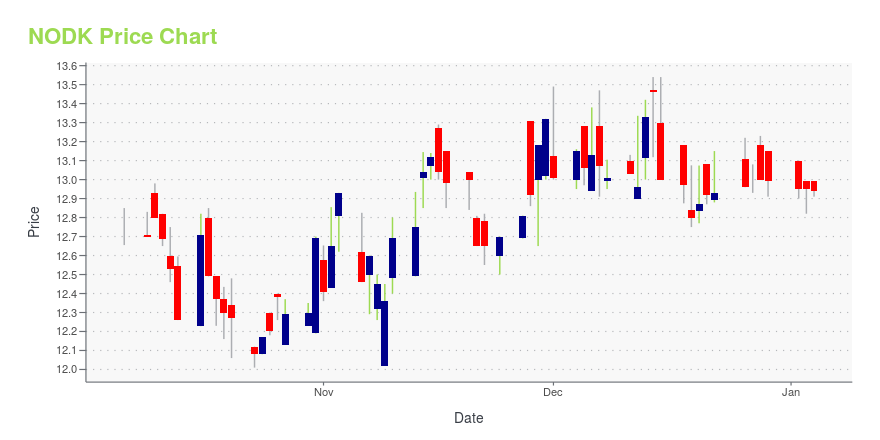

NODK Stock Price Chart Interactive Chart >

NI Holdings, Inc. (NODK) Company Bio

NI Holdings, Inc. underwrites property and casualty insurance products in North Dakota, South Dakota, Nevada, Arizona, and Minnesota. The companys products include private passenger automobile, homeowners, farm owners, commercial multi-peril crop, crop hail, and commercial property and liability insurance policies. It distributes its insurance products through independent producers and agents. The company was founded in 1946 and is based in Fargo, North Dakota.

Latest NODK News From Around the Web

Below are the latest news stories about NI HOLDINGS INC that investors may wish to consider to help them evaluate NODK as an investment opportunity.

NI Holdings, Inc. Reports Results for Third Quarter Ended September 30, 2023FARGO, N.D., Nov. 07, 2023 (GLOBE NEWSWIRE) -- NI Holdings, Inc. (NASDAQ: NODK) announced today results for the quarter ended September 30, 2023. Summary of Third Quarter 2023 Results(All comparisons vs. the third quarter of 2022, unless noted otherwise) Direct written premiums of $81.2 million, flat to prior year, driven by increases in Non-Standard Auto (17.9%), Private Passenger Auto (10.4%) and Home and Farm (7.1%), offset by a decrease in Crop.Net earned premiums of $90.8 million, up 1.4%.C |

Shareholders in NI Holdings (NASDAQ:NODK) are in the red if they invested three years agoAs an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock... |

NI Holdings, Inc. Reports Results for Second Quarter Ended June 30, 2023FARGO, N.D., Aug. 08, 2023 (GLOBE NEWSWIRE) -- NI Holdings, Inc. (NASDAQ: NODK) announced today results for the quarter ended June 30, 2023. Summary of Second Quarter 2023 Results(All comparisons vs. the second quarter of 2022, unless noted otherwise) Direct written premiums of $144.3 million, flat to prior year, driven by a 10.4% increase in Private Passenger Auto, offset by a 13.8% decrease in Non-Standard Auto.Net earned premiums of $94.2 million, up 11.4%.Combined Ratio of 114.0% versus 159. |

NI Holdings (NASDAQ:NODK) shareholders have endured a 21% loss from investing in the stock a year agoPassive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active... |

NI Holdings, Inc. Reports Results for First Quarter Ended March 31, 2023FARGO, N.D., May 08, 2023 (GLOBE NEWSWIRE) -- NI Holdings, Inc. (NASDAQ: NODK) announced today results for the quarter ended March 31, 2023. Summary of First Quarter 2023 Results(All comparisons vs. the first quarter of 2022, unless noted otherwise) Direct written premiums of $90.6 million, up 19.9%, driven by Non-Standard Auto up 52.0%, Commercial up 19.9% and Private Passenger Auto up 10.7%Net earned premiums of $77.6 million, up 11.6%Combined ratio of 112.2% versus 91.3%, driven by elevated l |

NODK Price Returns

| 1-mo | 7.53% |

| 3-mo | 7.82% |

| 6-mo | 20.72% |

| 1-year | 15.70% |

| 3-year | -18.28% |

| 5-year | -2.89% |

| YTD | 24.25% |

| 2023 | -2.11% |

| 2022 | -29.83% |

| 2021 | 15.16% |

| 2020 | -4.53% |

| 2019 | 9.35% |

Continue Researching NODK

Want to see what other sources are saying about NI Holdings Inc's financials and stock price? Try the links below:NI Holdings Inc (NODK) Stock Price | Nasdaq

NI Holdings Inc (NODK) Stock Quote, History and News - Yahoo Finance

NI Holdings Inc (NODK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...