Northern Oil and Gas, Inc. (NOG): Price and Financial Metrics

NOG Price/Volume Stats

| Current price | $40.19 | 52-week high | $43.75 |

| Prev. close | $39.46 | 52-week low | $31.13 |

| Day low | $39.00 | Volume | 1,906,711 |

| Day high | $40.24 | Avg. volume | 1,308,078 |

| 50-day MA | $39.00 | Dividend yield | 4.12% |

| 200-day MA | $37.95 | Market Cap | 4.06B |

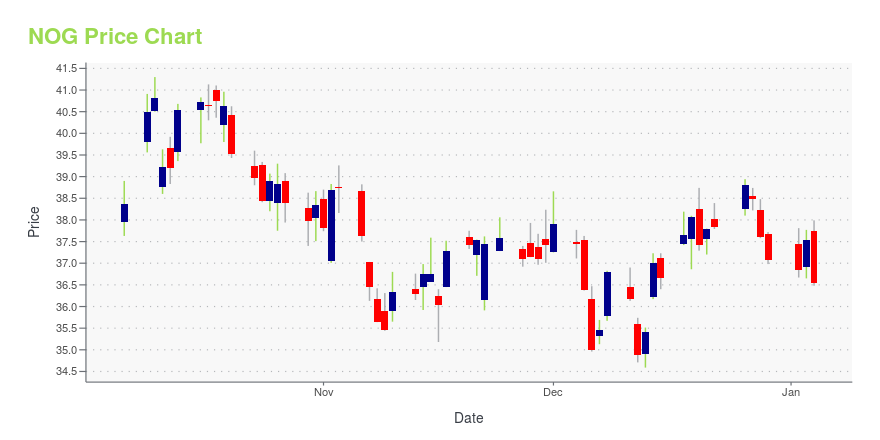

NOG Stock Price Chart Interactive Chart >

Northern Oil and Gas, Inc. (NOG) Company Bio

Northern Oil and Gas, Inc. engages in the acquisition, exploration, development, and production of oil and natural gas properties in the United States. The company is based in Wayzata, Minnesota.

Latest NOG News From Around the Web

Below are the latest news stories about NORTHERN OIL & GAS INC that investors may wish to consider to help them evaluate NOG as an investment opportunity.

Northern Oil & Gas Inc's Dividend AnalysisAs investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Northern Oil & Gas Inc's dividend performance and assess its sustainability. |

Zacks Industry Outlook Highlights EOG Resources, Matador Resources, Northern Oil and Gas and Evolution PetroleumEOG Resources, Matador Resources, Northern Oil and Gas and Evolution Petroleum have been highlighted in this Industry Outlook article. |

4 Stocks in the U.S. Upstream Industry Worth a Closer LookFollowing a careful analysis of the Zacks Oil and Gas - Exploration and Production - United States industry, we advise focusing on companies like EOG, MTDR, NOG and EPM. |

Northern Oil and Gas (NYSE:NOG) Is Paying Out A Larger Dividend Than Last YearNorthern Oil and Gas, Inc. ( NYSE:NOG ) will increase its dividend from last year's comparable payment on the 31st of... |

Why Is Northern Oil and Gas (NOG) Down 3.3% Since Last Earnings Report?Northern Oil and Gas (NOG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

NOG Price Returns

| 1-mo | 5.57% |

| 3-mo | -6.14% |

| 6-mo | 17.71% |

| 1-year | 8.65% |

| 3-year | 171.74% |

| 5-year | 183.60% |

| YTD | 10.69% |

| 2023 | 25.54% |

| 2022 | 54.51% |

| 2021 | 136.72% |

| 2020 | -62.56% |

| 2019 | 3.54% |

NOG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NOG

Here are a few links from around the web to help you further your research on Northern Oil & Gas Inc's stock as an investment opportunity:Northern Oil & Gas Inc (NOG) Stock Price | Nasdaq

Northern Oil & Gas Inc (NOG) Stock Quote, History and News - Yahoo Finance

Northern Oil & Gas Inc (NOG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...