NOV Inc. (NOV): Price and Financial Metrics

NOV Price/Volume Stats

| Current price | $19.85 | 52-week high | $21.91 |

| Prev. close | $18.67 | 52-week low | $16.77 |

| Day low | $19.19 | Volume | 10,994,980 |

| Day high | $20.98 | Avg. volume | 3,737,801 |

| 50-day MA | $18.41 | Dividend yield | 1.61% |

| 200-day MA | $18.95 | Market Cap | 7.85B |

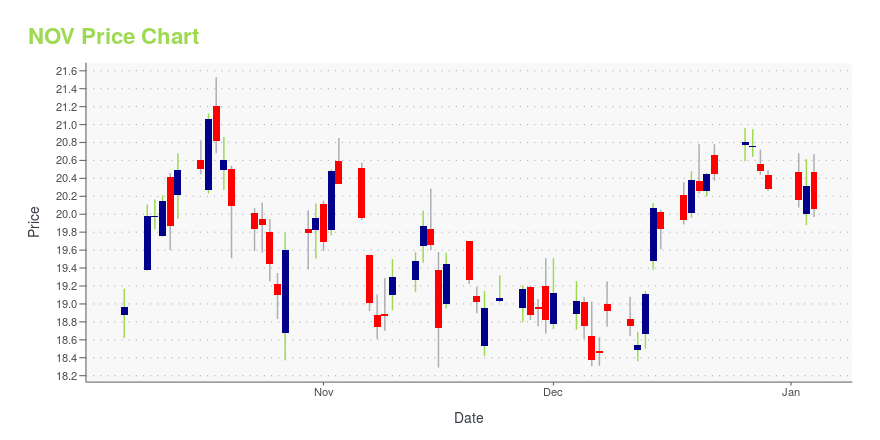

NOV Stock Price Chart Interactive Chart >

NOV Inc. (NOV) Company Bio

NOV Inc., formerly National Oilwell Varco, is an American multinational corporation based in Houston, Texas. It is a worldwide provider of equipment and components used in oil and gas drilling and production operations, oilfield services, and supply chain integration services to the upstream oil and gas industry. The company conducts operations in more than 500 locations across six continents, operating through three reporting segments: Rig Technologies, Wellbore Technologies, and Completion & Production Solutions. (Source:Wikipedia)

Latest NOV News From Around the Web

Below are the latest news stories about NOV INC that investors may wish to consider to help them evaluate NOV as an investment opportunity.

NOV Inc.'s (NYSE:NOV) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?Most readers would already be aware that NOV's (NYSE:NOV) stock increased significantly by 7.2% over the past month. We... |

NOV upgraded at J.P. Morgan even with limited upside for oil pricesMore on NOV Inc. |

NOV's (NYSE:NOV) Returns On Capital Are Heading HigherDid you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world... |

Do Options Traders Know Something About NOV Stock We Don't?Investors need to pay close attention to NOV stock based on the movements in the options market lately. |

NOV (NYSE:NOV) Has Announced A Dividend Of $0.05NOV Inc. ( NYSE:NOV ) will pay a dividend of $0.05 on the 22nd of December. This payment means the dividend yield will... |

NOV Price Returns

| 1-mo | 5.31% |

| 3-mo | 5.64% |

| 6-mo | -4.72% |

| 1-year | 8.43% |

| 3-year | 45.83% |

| 5-year | -4.74% |

| YTD | -1.43% |

| 2023 | -1.83% |

| 2022 | 55.71% |

| 2021 | -0.89% |

| 2020 | -44.93% |

| 2019 | -1.69% |

NOV Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NOV

Here are a few links from around the web to help you further your research on National Oilwell Varco Inc's stock as an investment opportunity:National Oilwell Varco Inc (NOV) Stock Price | Nasdaq

National Oilwell Varco Inc (NOV) Stock Quote, History and News - Yahoo Finance

National Oilwell Varco Inc (NOV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...