ServiceNow Inc. (NOW): Price and Financial Metrics

NOW Price/Volume Stats

| Current price | $827.61 | 52-week high | $850.33 |

| Prev. close | $828.79 | 52-week low | $527.24 |

| Day low | $818.07 | Volume | 2,409,746 |

| Day high | $846.86 | Avg. volume | 1,332,475 |

| 50-day MA | $744.61 | Dividend yield | N/A |

| 200-day MA | $717.09 | Market Cap | 169.66B |

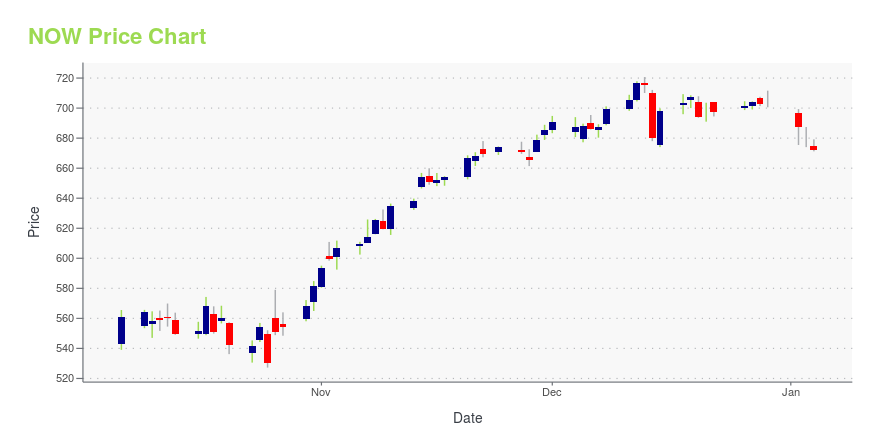

NOW Stock Price Chart Interactive Chart >

ServiceNow Inc. (NOW) Company Bio

ServiceNow (Service-now in 2011) is an American software company based in Santa Clara, California that develops a cloud computing platform to help companies manage digital workflows for enterprise operations. Founded in 2004 by Fred Luddy, ServiceNow is listed on the New York Stock Exchange and is a constituent of the Russell 1000 Index and S&P 500 Index. In 2018, Forbes magazine named it number one on its list of the world's most innovative companies. (Source:Wikipedia)

Latest NOW News From Around the Web

Below are the latest news stories about SERVICENOW INC that investors may wish to consider to help them evaluate NOW as an investment opportunity.

Rising Stars in Tech: 3 Cutting-Edge Companies to Invest in for 2024These top tech stocks for 2024 showcase the sector's strength and potential, benefiting from AI innovations and a positive economic outlook. |

Top 3 Tech Stock Picks for the New YearThese tech stocks are leading innovators that will see earnings momentum in 2024 as they capitalize on artificial intelligence. |

Cloud Computing Kings: 7 Stocks Dominating the Digital SkyCloud computing stocks have outperformed the market and these seven look like they can continue the trend. |

ServiceNow (NOW) Outpaces Stock Market Gains: What You Should KnowServiceNow (NOW) closed at $703.76 in the latest trading session, marking a +0.36% move from the prior day. |

Nvidia stock still looks cheap despite 200%-plus surge: StrategistThe valuation on chip king Nvidia doesn't look too out of whack with future reality, contends one veteran tech analyst. |

NOW Price Returns

| 1-mo | 9.78% |

| 3-mo | 14.38% |

| 6-mo | 7.56% |

| 1-year | 47.82% |

| 3-year | 42.13% |

| 5-year | 186.04% |

| YTD | 17.14% |

| 2023 | 81.96% |

| 2022 | -40.18% |

| 2021 | 17.93% |

| 2020 | 94.97% |

| 2019 | 58.56% |

Continue Researching NOW

Want to see what other sources are saying about ServiceNow Inc's financials and stock price? Try the links below:ServiceNow Inc (NOW) Stock Price | Nasdaq

ServiceNow Inc (NOW) Stock Quote, History and News - Yahoo Finance

ServiceNow Inc (NOW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...