Nortech Systems Incorporated (NSYS): Price and Financial Metrics

NSYS Price/Volume Stats

| Current price | $14.81 | 52-week high | $19.15 |

| Prev. close | $14.72 | 52-week low | $7.45 |

| Day low | $14.57 | Volume | 4,200 |

| Day high | $15.55 | Avg. volume | 9,000 |

| 50-day MA | $12.75 | Dividend yield | N/A |

| 200-day MA | $11.62 | Market Cap | 40.83M |

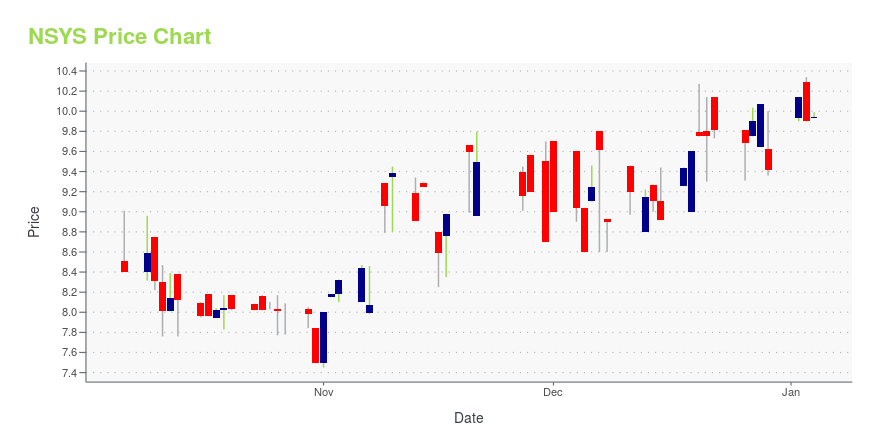

NSYS Stock Price Chart Interactive Chart >

Nortech Systems Incorporated (NSYS) Company Bio

Nortech Systems Incorporated operates as an electronic manufacturing services company in the United States, Mexico, and China. It offers a range of value added engineering, technical and manufacturing, and support services, including project management, designing, testing, prototyping, supply chain management, and post-market services. The company also provides manufacturing and engineering services for medical devices, printed circuit board assemblies, wire and cable assemblies, and higher level electromechanical assemblies. In addition, it offers repair services. The company serves original equipment manufacturers in the aerospace and defense, medical, and industrial markets through business development teams and independent manufacturers' representatives. Nortech Systems Incorporated was founded in 1990 and is headquartered in Maple Grove, Minnesota.

Latest NSYS News From Around the Web

Below are the latest news stories about NORTECH SYSTEMS INC that investors may wish to consider to help them evaluate NSYS as an investment opportunity.

Do Its Financials Have Any Role To Play In Driving Nortech Systems Incorporated's (NASDAQ:NSYS) Stock Up Recently?Nortech Systems' (NASDAQ:NSYS) stock is up by a considerable 10% over the past week. Given that stock prices are... |

Nortech Systems Names Andrew LaFrence CFO and Senior Vice President of FinanceMINNEAPOLIS, December 05, 2023--Nortech Systems, Inc., (Nasdaq: NSYS), a leading provider of engineering and manufacturing solutions for complex electromedical and electromechanical products announced today Andrew LaFrence has been named CFO and Senior Vice President of Finance. |

Nortech Systems Incorporated (NASDAQ:NSYS) Q3 2023 Earnings Call TranscriptNortech Systems Incorporated (NASDAQ:NSYS) Q3 2023 Earnings Call Transcript November 11, 2023 Operator: Greetings. Welcome to Nortech’s Third Quarter 2023 Earnings Call. [Operator Instructions] Please note this conference is being recorded. I will now turn the conference over to your host, Alan Nordstrom, Acting CFO at Nortech. Alan, you may begin. Alan Nordstrom: Alright. Thank […] |

Q3 2023 Nortech Systems Inc Earnings CallQ3 2023 Nortech Systems Inc Earnings Call |

Nortech Systems Inc (NSYS) Reports Mixed Q3 2023 Results Amid Strong BacklogYear-to-Date Revenue Grows Despite Third Quarter Challenges |

NSYS Price Returns

| 1-mo | 7.01% |

| 3-mo | -14.44% |

| 6-mo | 52.37% |

| 1-year | 50.36% |

| 3-year | 44.07% |

| 5-year | 281.77% |

| YTD | 57.22% |

| 2023 | -23.10% |

| 2022 | 18.36% |

| 2021 | 44.35% |

| 2020 | 47.23% |

| 2019 | 37.18% |

Continue Researching NSYS

Here are a few links from around the web to help you further your research on Nortech Systems Inc's stock as an investment opportunity:Nortech Systems Inc (NSYS) Stock Price | Nasdaq

Nortech Systems Inc (NSYS) Stock Quote, History and News - Yahoo Finance

Nortech Systems Inc (NSYS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...