Natura & Co. Holding S.A. ADR (NTCO): Price and Financial Metrics

NTCO Price/Volume Stats

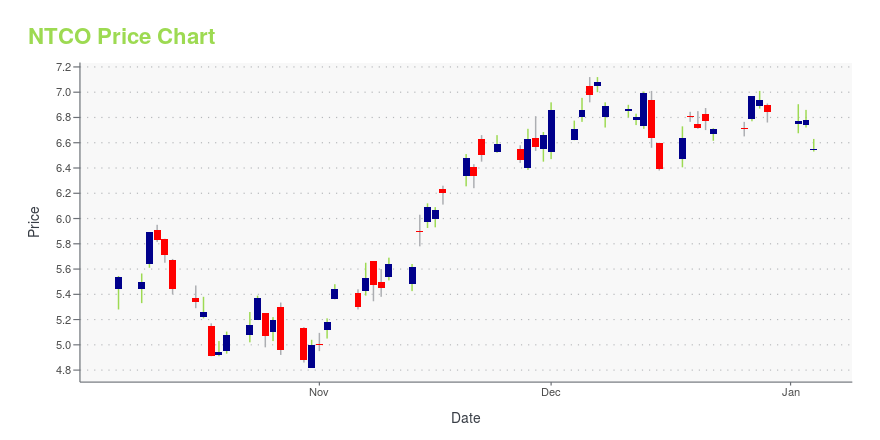

| Current price | $6.57 | 52-week high | $7.68 |

| Prev. close | $6.57 | 52-week low | $4.05 |

| Day low | $6.47 | Volume | 1,561,400 |

| Day high | $6.61 | Avg. volume | 1,579,196 |

| 50-day MA | $6.71 | Dividend yield | N/A |

| 200-day MA | $6.23 | Market Cap | 4.56B |

NTCO Stock Price Chart Interactive Chart >

Natura & Co. Holding S.A. ADR (NTCO) Company Bio

Natura & Co is a Brazilian global personal care cosmetics group headquartered in São Paulo. The Natura & Co Group currently includes Natura Cosméticos, Aesop, The Body Shop and Avon Products. The Group is present in 73 countries across all continents except Antarctica. Natura Cosméticos, the parent company, was founded in 1969 by Antônio Luiz Seabra and became a public company listed on São Paulo Stock Exchange in 2004. Currently the company is the largest Brazilian cosmetics company by revenue. In May 2019 Natura & Co announced that it had entered into definitive agreement to acquire Avon Products, Inc. The transaction was approved by Brazilian regulations authorities in the beginning of November 2019 and was completed in January 2020, making Natura & Co the 4th largest pure-play beauty company in the world.(Source:Wikipedia)

Latest NTCO News From Around the Web

Below are the latest news stories about NATURA & CO HOLDING SA that investors may wish to consider to help them evaluate NTCO as an investment opportunity.

Leadership transition in Avon InternationalNatura &Co (NYSE – NTCO; B3 – NTCO3) announces Kristof Neirynck, currently the Global Chief Marketing Officer and Managing Director for Western Europe, as the new CEO of Avon. After a landmark 25 years with the company, Angela Cretu will continue to support and contribute to the Avon business, as an advisor. |

Natura &Co to sell The Body Shop to AureliusNatura &Co (NYSE – NTCO; B3 – NTCO3) announces that it has reached agreement to sell The Body Shop to international private equity group Aurelius, marking a new step in the Group's strategy to simplify and refocus its operations. |

Natura &Co: Consistent adjusted EBITDA margin improvement alongside strengthened balance sheet in Q3Natura &Co (NYSE – NTCO; B3 – NTCO3) continued to improve its profit margins in the third quarter, while deleveraging its balance sheet thanks to the proceeds of the sale of Aesop, which closed on August 30th. |

Natura &Co closes sale of AesopNatura &Co (NYSE – NTCO; B3 – NTCO3) announces that it has completed the sale of Aesop to L'Oréal for a final enterprise value of US$2.58 billion after obtaining all customary regulatory approvals. |

Natura &Co Holding S.A. (NYSE:NTCO) Q2 2023 Earnings Call TranscriptNatura &Co Holding S.A. (NYSE:NTCO) Q2 2023 Earnings Call Transcript August 15, 2023 Operator: Good morning, and welcome to Natura &Co’s Second Quarter 2023 Earnings. On this call today are Fabio Barbosa, CEO of Natura &Co; and Guilherme Castellan, CFO of Natura &Co. Joao Paulo Ferreira, CEO of Natura &Co Latin America, will join for […] |

NTCO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 1.70% |

| 1-year | -11.69% |

| 3-year | -70.85% |

| 5-year | N/A |

| YTD | -3.95% |

| 2023 | 57.97% |

| 2022 | -53.03% |

| 2021 | -53.65% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...