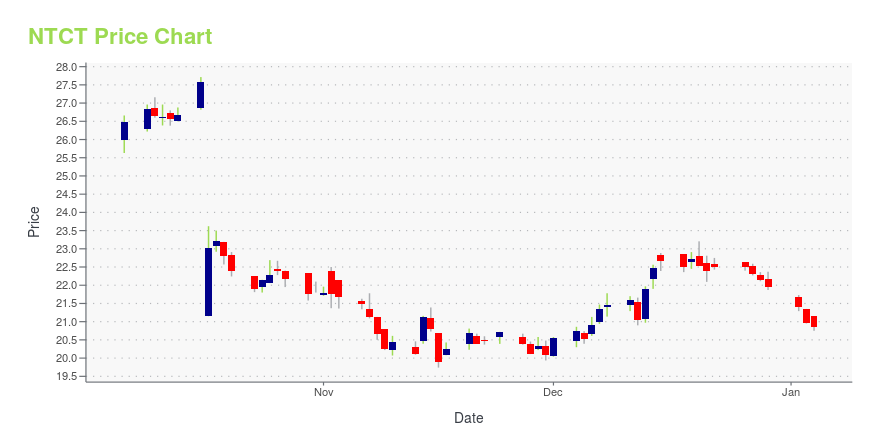

NetScout Systems, Inc. (NTCT): Price and Financial Metrics

NTCT Price/Volume Stats

| Current price | $20.04 | 52-week high | $30.37 |

| Prev. close | $20.37 | 52-week low | $17.10 |

| Day low | $19.79 | Volume | 857,100 |

| Day high | $20.51 | Avg. volume | 721,941 |

| 50-day MA | $19.15 | Dividend yield | N/A |

| 200-day MA | $20.87 | Market Cap | 1.43B |

NTCT Stock Price Chart Interactive Chart >

NetScout Systems, Inc. (NTCT) Company Bio

NetScout Systems designs, develops, manufactures, markets, licenses, sells, and supports network, application, and service assurance solutions in the United States, Europe, Asia, and internationally. It offers performance analytics and operational intelligence solutions that facilitate the evolution toward new computing paradigms, such as virtualization, mobility, and cloud. The company was founded in 1984 and is based in Westford, Massachusetts.

Latest NTCT News From Around the Web

Below are the latest news stories about NETSCOUT SYSTEMS INC that investors may wish to consider to help them evaluate NTCT as an investment opportunity.

We Like These Underlying Return On Capital Trends At NetScout Systems (NASDAQ:NTCT)There are a few key trends to look for if we want to identify the next multi-bagger. Amongst other things, we'll want... |

7 Cybersecurity Stocks to Exit ASAPCybersecurity is a fast-growing business, but not everyone can be a winner in this competitive space. |

12 Best Tech Stocks To Buy On the DipIn this article, we discuss the 12 best tech stocks to buy on the dip. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Tech Stocks To Buy On the Dip. Technology stocks were the winners of the pandemic, climbing to record highs during lockdowns as businesses scrambled […] |

DPI Consortium Provides Deep Packet Inspection Training Program to USPTOWESTFORD, Mass., December 07, 2023--The DPI Consortium, an independent, non-profit organization committed to providing educational resources regarding the history of Deep Packet Inspection (DPI) technology and development, recently conducted a technical training for the United States Patent & Trademark Office (USPTO) as part of the USPTO’s Patent Examiner Technical Training Program (PETTP). The training featured the DPI Consortium’s Advisory Board, a panel of leading technologists, inventors, an |

Shareholders in NetScout Systems (NASDAQ:NTCT) are in the red if they invested a year agoInvestors can approximate the average market return by buying an index fund. While individual stocks can be big... |

NTCT Price Returns

| 1-mo | 10.72% |

| 3-mo | 0.70% |

| 6-mo | -10.85% |

| 1-year | -28.99% |

| 3-year | -30.15% |

| 5-year | -23.72% |

| YTD | -8.70% |

| 2023 | -32.48% |

| 2022 | -1.72% |

| 2021 | 20.64% |

| 2020 | 13.92% |

| 2019 | 1.86% |

Continue Researching NTCT

Want to do more research on Netscout Systems Inc's stock and its price? Try the links below:Netscout Systems Inc (NTCT) Stock Price | Nasdaq

Netscout Systems Inc (NTCT) Stock Quote, History and News - Yahoo Finance

Netscout Systems Inc (NTCT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...