Nutrien Ltd. (NTR): Price and Financial Metrics

NTR Price/Volume Stats

| Current price | $52.56 | 52-week high | $60.87 |

| Prev. close | $52.50 | 52-week low | $43.69 |

| Day low | $51.98 | Volume | 1,647,600 |

| Day high | $53.30 | Avg. volume | 2,459,742 |

| 50-day MA | $51.01 | Dividend yield | 4.09% |

| 200-day MA | $48.98 | Market Cap | 25.69B |

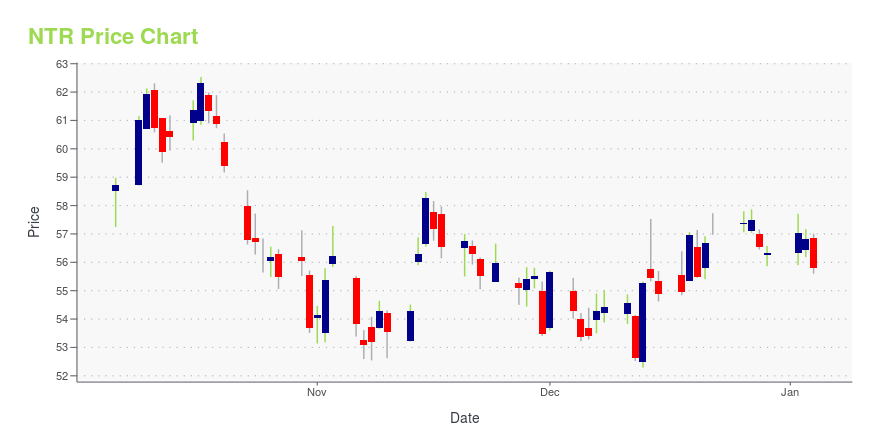

NTR Stock Price Chart Interactive Chart >

Nutrien Ltd. (NTR) Company Bio

Nutrien is a Canadian fertilizer company based in Saskatoon, Saskatchewan. It is the largest producer of potash and the third largest producer of nitrogen fertilizer in the world. It has over 2,000 retail locations across North America, South America, and Australia with more than 23,500 employees. It is listed on the Toronto Stock Exchange (symbol NTR) and New York Stock Exchange (symbol NTR), with a market capitalization of $34 billion as of January 2018. It was formed through the merger of PotashCorp and Agrium, in a transaction that closed on January 1, 2018. (Source:Wikipedia)

NTR Price Returns

| 1-mo | 1.25% |

| 3-mo | 1.04% |

| 6-mo | 12.54% |

| 1-year | 6.23% |

| 3-year | -41.60% |

| 5-year | 86.93% |

| YTD | 18.74% |

| 2024 | -15.22% |

| 2023 | -19.46% |

| 2022 | -0.09% |

| 2021 | 59.08% |

| 2020 | 5.60% |

NTR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...