Natuzzi, S.p.A. (NTZ): Price and Financial Metrics

NTZ Price/Volume Stats

| Current price | $4.57 | 52-week high | $7.60 |

| Prev. close | $4.45 | 52-week low | $4.35 |

| Day low | $4.57 | Volume | 500 |

| Day high | $4.57 | Avg. volume | 4,701 |

| 50-day MA | $5.02 | Dividend yield | N/A |

| 200-day MA | $6.07 | Market Cap | 50.34M |

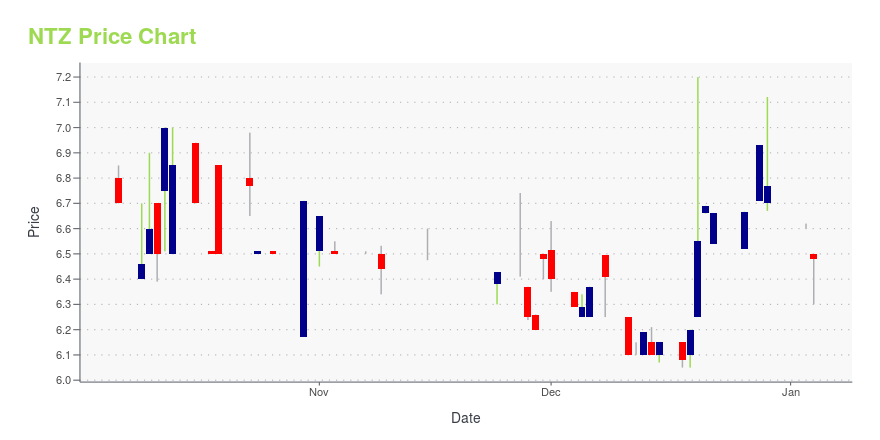

NTZ Stock Price Chart Interactive Chart >

Natuzzi, S.p.A. (NTZ) Company Bio

Natuzzi S.p.A. designs, manufactures, and markets leather and fabric upholstered furniture worldwide. The company was founded in 1959 and is based in Santeramo in Colle, Italy.

Latest NTZ News From Around the Web

Below are the latest news stories about NATUZZI S P A that investors may wish to consider to help them evaluate NTZ as an investment opportunity.

Natuzzi S.p.A. (NYSE:NTZ) Q3 2023 Earnings Call TranscriptNatuzzi S.p.A. (NYSE:NTZ) Q3 2023 Earnings Call Transcript November 27, 2023 Operator: Good day, ladies and gentlemen. Thank you for standing by. Welcome to the Natuzzi 2023 Third Quarter Financial Results Conference Call. As a reminder interested person can join the conference call by dialing plus +412-717-9633 then Passcode 392-52103#. Once again, to dial in […] |

Natuzzi S.p.A.: Shareholder Letter and Financial Results 2023 Third Quarter ResultsSANTERAMO IN COLLE, Bari, Italy, November 24, 2023--Natuzzi S.p.A. (NYSE: NTZ) ("we", "Natuzzi" or the "Company" and, together with its subsidiaries, the "Group"), one of the most renowned brands in the production and distribution of design and luxury furniture, today reported its unaudited financial information for the third quarter and first nine months ended September 30, 2023. |

Natuzzi's (NYSE:NTZ) Returns On Capital Are Heading HigherDid you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world... |

Natuzzi S.P.A. Announces Dates for the Third Quarter 2023 Financial Information and Conference CallSANTERAMO IN COLLE, Bari, Italy, November 15, 2023--Natuzzi S.p.A. (NYSE: NTZ) ("Natuzzi" or the "Company") will disclose its unaudited 2023 third quarter financial information on Friday November 24, 2023, after the market closes. |

Those who invested in Natuzzi (NYSE:NTZ) a year ago are up 27%The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking... |

NTZ Price Returns

| 1-mo | -7.50% |

| 3-mo | -22.54% |

| 6-mo | -29.58% |

| 1-year | -34.72% |

| 3-year | -70.71% |

| 5-year | 124.77% |

| YTD | -32.50% |

| 2023 | -11.96% |

| 2022 | -51.73% |

| 2021 | 26.93% |

| 2020 | 638.24% |

| 2019 | -56.96% |

Continue Researching NTZ

Want to see what other sources are saying about Natuzzi S P A's financials and stock price? Try the links below:Natuzzi S P A (NTZ) Stock Price | Nasdaq

Natuzzi S P A (NTZ) Stock Quote, History and News - Yahoo Finance

Natuzzi S P A (NTZ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...