Novo Nordisk A/S ADR (NVO): Price and Financial Metrics

NVO Price/Volume Stats

| Current price | $126.73 | 52-week high | $148.15 |

| Prev. close | $127.86 | 52-week low | $77.96 |

| Day low | $126.36 | Volume | 3,179,100 |

| Day high | $128.26 | Avg. volume | 4,424,678 |

| 50-day MA | $138.35 | Dividend yield | 1% |

| 200-day MA | $119.53 | Market Cap | 568.70B |

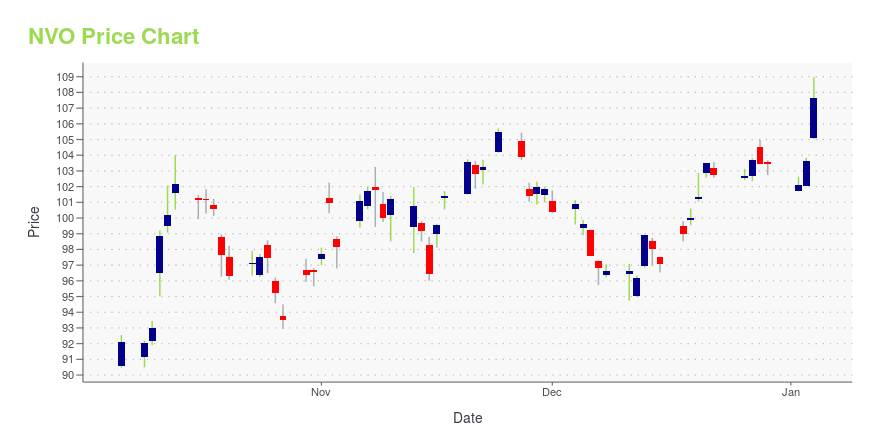

NVO Stock Price Chart Interactive Chart >

Novo Nordisk A/S ADR (NVO) Company Bio

Novo Nordisk A/S is a Danish multinational pharmaceutical company headquartered in Bagsværd, Denmark, with production facilities in nine countries, and affiliates or offices in five countries. Novo Nordisk is controlled by majority shareholder Novo Holdings A/S which holds approximately 25% of its shares and a supermajority (45%) of its voting shares. (Source:Wikipedia)

Latest NVO News From Around the Web

Below are the latest news stories about NOVO NORDISK A S that investors may wish to consider to help them evaluate NVO as an investment opportunity.

2024’s Power Players: 7 Stocks Racing to a Trillion ValuationWhether in 2024, or in the years ahead, each of these seven stocks could become the next trillion dollar companies. |

3 Ken Griffin Stocks to Invest Like CitadelInvest like Citadel founder and billionaire Ken Griffin with these stocks that have strong potential heading into 2024. |

The Zacks Analyst Blog Highlights Novo Nordisk, Walmart, Advanced Micro Devices, Caterpillar and Union PacificNovo Nordisk, Walmart, Advanced Micro Devices, Caterpillar and Union Pacific are part of the Zacks top Analyst Blog. |

Interested in the Weight-Loss Market? Here's 1 Stock to Buy Hand Over Fist in 2024, and 1 to Avoid Like the Plague.While Novo Nordisk dominates the weight-loss market, there are two other stocks to consider as well. |

Novo Nordisk (NVO) Rose on Increased DemandClearBridge Investments, an investment management company, released its “ClearBridge Sustainability Leaders Strategy” third quarter 2023 investor letter. A copy of the same can be downloaded here. The strategy underperformed its benchmark, the Russell 3000 Index, in the quarter. The strategy gained two out of 10 sectors in which it invested during the quarter, on an absolute […] |

NVO Price Returns

| 1-mo | -11.79% |

| 3-mo | -0.09% |

| 6-mo | 17.87% |

| 1-year | 62.90% |

| 3-year | 190.41% |

| 5-year | 450.20% |

| YTD | 23.13% |

| 2023 | 54.01% |

| 2022 | 22.12% |

| 2021 | 62.55% |

| 2020 | 22.56% |

| 2019 | 27.79% |

NVO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NVO

Want to see what other sources are saying about Novo Nordisk A S's financials and stock price? Try the links below:Novo Nordisk A S (NVO) Stock Price | Nasdaq

Novo Nordisk A S (NVO) Stock Quote, History and News - Yahoo Finance

Novo Nordisk A S (NVO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...