Envista Holdings Corp. (NVST): Price and Financial Metrics

NVST Price/Volume Stats

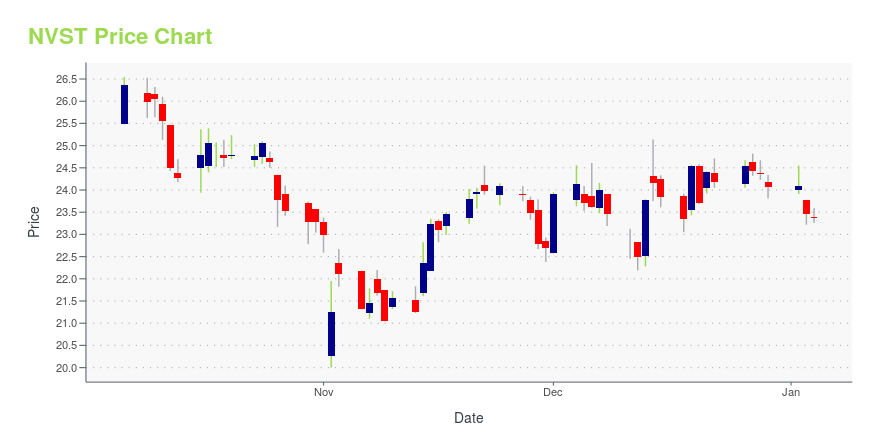

| Current price | $16.31 | 52-week high | $36.14 |

| Prev. close | $16.11 | 52-week low | $15.69 |

| Day low | $15.99 | Volume | 1,351,447 |

| Day high | $16.37 | Avg. volume | 2,381,642 |

| 50-day MA | $17.34 | Dividend yield | N/A |

| 200-day MA | $21.15 | Market Cap | 2.80B |

NVST Stock Price Chart Interactive Chart >

Envista Holdings Corp. (NVST) Company Bio

Envista Holdings Corp. manufactures and markets dental products for diagnosing, treating and preventing dental conditions. The firm operates through the following segments; Specialty Products & Technologies, and Equipment & Consumables. The Specialty Products & Technologies segment develops, manufactures and markets dental implant systems, dental prosthetics and associated treatment software and technologies, as well as orthodontic bracket systems, aligners and lab products. The Equipment & Consumables segments develops, manufactures and markets dental equipment and supplies used in dental offices, including digital imaging systems, software and other visualization/magnification systems; handpieces and associated consumables; treatment units and other dental practice equipment; endodontic systems and related consumables; restorative materials and instruments, rotary burs, impression materials, bonding agents and cements and infection prevention products. It offers dental consumables, equipment, and services to dental professionals. The company was founded on August 29, 2018 and is headquartered in Brea, CA.

Latest NVST News From Around the Web

Below are the latest news stories about ENVISTA HOLDINGS CORP that investors may wish to consider to help them evaluate NVST as an investment opportunity.

New Strong Sell Stocks for December 21stDSKE, NVST and HENKY have been added to the Zacks Rank #5 (Strong Sell) List on December 21, 2023. |

Envista Announces Participation in J.P. Morgan Healthcare ConferenceEnvista Holdings Corporation (NYSE: NVST) ("Envista") today announced that the company will participate in the J.P. Morgan Healthcare Conference on Monday, January 8, 2024 at 3:00 – 3:40 PM PST. There will be an audio-only recording link that can be viewed on Envista's Investor Relations website for up to 30 days post event. |

Envista Holdings Corporation Appoints Three New Members to Leadership TeamEnvista Holdings Corporation (NYSE: NVST) today announced the expansion of its leadership team, with the recent appointments of Robert Befidi as President, Diagnostics; Suraj Satpathy as Chief Human Resources Officer; and Andrew Chen as Chief Information Officer. |

Envista Holdings Corporation's (NYSE:NVST) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?It is hard to get excited after looking at Envista Holdings' (NYSE:NVST) recent performance, when its stock has... |

Envista cut to Sell at Goldman Sachs, CRISPR to Underperform: 4 big analyst cutsHere is your Pro Recap of the biggest analyst cuts you may have missed today: downgrades at Envista, CRISPR Therapeutics, Super Micro Computer, and Vornado Realty Trust. Envista (NYSE:NVST) shares dropped more than 2% pre-market today after Goldman Sachs downgraded the company to Sell from Neutral with a price target of $22.00. |

NVST Price Returns

| 1-mo | -1.21% |

| 3-mo | -20.01% |

| 6-mo | -33.07% |

| 1-year | -52.89% |

| 3-year | -61.09% |

| 5-year | N/A |

| YTD | -32.21% |

| 2023 | -28.54% |

| 2022 | -25.28% |

| 2021 | 33.59% |

| 2020 | 13.80% |

| 2019 | N/A |

Loading social stream, please wait...