NatWest Group PLC ADR (NWG): Price and Financial Metrics

NWG Price/Volume Stats

| Current price | $9.53 | 52-week high | $9.55 |

| Prev. close | $8.82 | 52-week low | $4.30 |

| Day low | $9.31 | Volume | 4,329,965 |

| Day high | $9.55 | Avg. volume | 2,064,301 |

| 50-day MA | $8.32 | Dividend yield | 6.44% |

| 200-day MA | $6.58 | Market Cap | 39.68B |

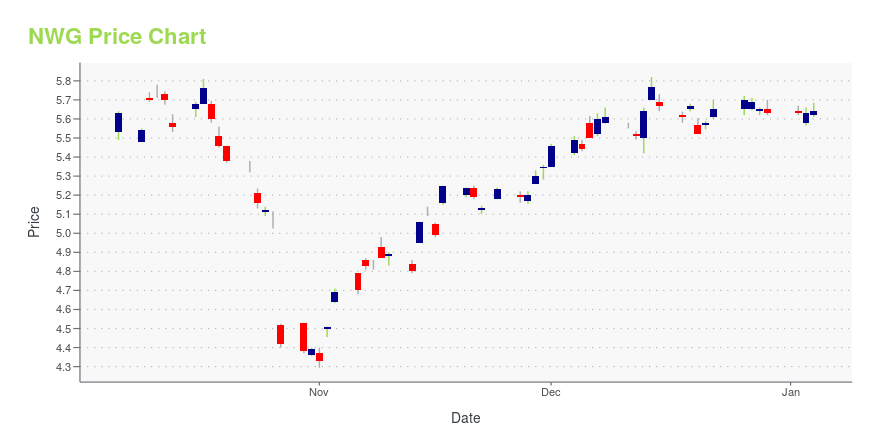

NWG Stock Price Chart Interactive Chart >

NatWest Group PLC ADR (NWG) Company Bio

NatWest Group plc is a British banking and insurance holding company, based in Edinburgh, Scotland. The group operates a wide variety of banking brands offering personal and business banking, private banking, investment banking, insurance and corporate finance. In the United Kingdom, its main subsidiary companies are National Westminster Bank, Royal Bank of Scotland, NatWest Markets and Coutts. The group issues banknotes in Scotland and Northern Ireland; as of 2014, the Royal Bank of Scotland was the only bank in the UK to still print £1 notes. (Source:Wikipedia)

Latest NWG News From Around the Web

Below are the latest news stories about NATWEST GROUP PLC that investors may wish to consider to help them evaluate NWG as an investment opportunity.

City fines fall to seven-year low despite debanking sagaFines issued by the City watchdog have plunged to a seven-year low amid heightened scrutiny of its enforcement action following the NatWest debanking scandal. |

City handed post-Brexit boost as Hunt strikes trade deal with SwitzerlandJeremy Hunt has handed the City a post-Brexit boost by agreeing a trade deal with Switzerland. |

13 Best Holding Company Stocks To Invest InIn this article, we discuss the 13 best holding company stocks to invest in. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Holding Company Stocks To Invest In. The incredible financial stability offered by the post-World War international order has allowed business to thrive across the world, […] |

NatWest debanking findings ‘a work of fiction’, says Nigel FarageNigel Farage has described the latest findings of a review into Coutts’ decision to close his bank accounts as “a work of fiction” after it found no evidence of widespread political discrimination. |

Europe’s Bailed-Out Banks Finally Get Sold a Decade After Crisis(Bloomberg) -- Banks bailed out across Europe more than a decade ago when the financial crisis and a sovereign debt meltdown wreaked havoc on the industry are finally being returned to private ownership.Most Read from BloombergSaudi Arabia Offers Iran Investment to Blunt Gaza WarBanking Escapees Make Billions From Private Credit BoomThese Are the World's Most Expensive Cities to Live In Right NowTesla’s Cheapest Cybertruck Will Cost $60,990 and Be Available in 2025Biggest Blowout in Bonds Since |

NWG Price Returns

| 1-mo | 17.95% |

| 3-mo | 21.56% |

| 6-mo | 72.58% |

| 1-year | 68.76% |

| 3-year | 105.49% |

| 5-year | 132.59% |

| YTD | 76.87% |

| 2023 | -4.95% |

| 2022 | 10.35% |

| 2021 | 39.11% |

| 2020 | -25.43% |

| 2019 | 28.78% |

NWG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...