Northwest Natural Holding Company (NWN): Price and Financial Metrics

NWN Price/Volume Stats

| Current price | $40.71 | 52-week high | $44.76 |

| Prev. close | $40.35 | 52-week low | $34.82 |

| Day low | $40.40 | Volume | 151,700 |

| Day high | $40.87 | Avg. volume | 298,216 |

| 50-day MA | $37.03 | Dividend yield | 4.9% |

| 200-day MA | $37.49 | Market Cap | 1.55B |

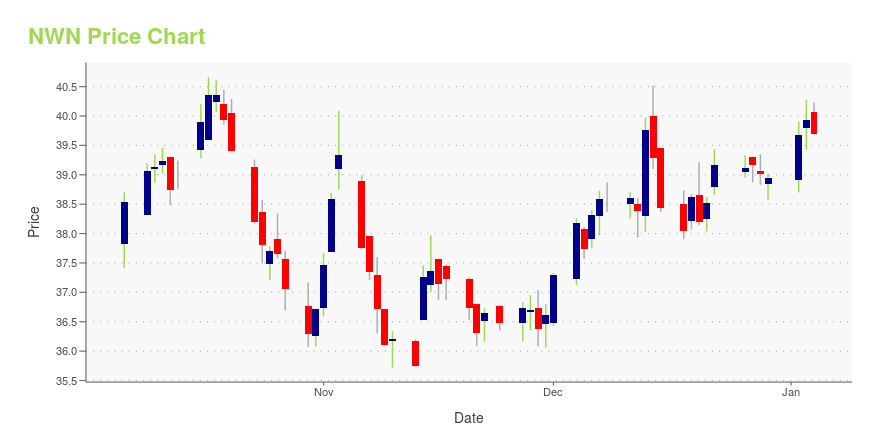

NWN Stock Price Chart Interactive Chart >

Northwest Natural Holding Company (NWN) Company Bio

Northwest Natural Gas Company stores and distributes natural gas in the United States. The local gas distribution business, referred to as the utility segment, serves residential, commercial, and industrial customers in Oregon and southwest Washington; and the gas storage business, referred to as the gas storage segment, provides storage services for utilities, gas marketers, electric generators and industrial users from storage facilities located in Oregon and California. The company was founded in 1859 and is based in Portland, Oregon.

Latest NWN News From Around the Web

Below are the latest news stories about NORTHWEST NATURAL HOLDING CO that investors may wish to consider to help them evaluate NWN as an investment opportunity.

12 High Growth Utility Stocks to BuyIn this article, we will take a look at the 12 high growth utility stocks to buy. To skip our analysis of the recent market trends and activity, you can go directly to see the 5 High Growth Utility Stocks to Buy. The U.S. power and utilities industry maintained its focus on increasing its decarbonization […] |

NW Natural Once Again Among Regional and National Leaders in Customer SatisfactionPORTLAND, Ore., December 06, 2023--For the fourth consecutive year, NW Natural scored second-highest in customer satisfaction among large utilities (500,000 or more customers) in the Western United States, according to J.D. Power’s Gas Utility Residential Customer Satisfaction Study. |

Energy Sector Caution: 3 Natural Gas Stocks Not Worth HoldingThe gloomy market outlook is taking a financial toll on energy companies, especially for these three natural gas stocks to sell. |

Northwest Natural Holding Company (NYSE:NWN) is largely controlled by institutional shareholders who own 76% of the companyKey Insights Given the large stake in the stock by institutions, Northwest Natural Holding's stock price might be... |

12 Best Stocks to Buy and Hold for a LifetimeIn this article, we discuss 12 best stocks to buy and hold for a lifetime. You can skip our detailed analysis of income-generating dividend stocks and their previous performance, and go directly to read 5 Best Stocks to Buy and Hold for a Lifetime. Experienced investors often stress that patience is crucial in investing, and […] |

NWN Price Returns

| 1-mo | 15.20% |

| 3-mo | 7.61% |

| 6-mo | 7.82% |

| 1-year | -2.04% |

| 3-year | -13.98% |

| 5-year | -30.83% |

| YTD | 7.24% |

| 2023 | -14.45% |

| 2022 | 1.49% |

| 2021 | 10.26% |

| 2020 | -35.52% |

| 2019 | 25.46% |

NWN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NWN

Want to see what other sources are saying about Northwest Natural Holding Co's financials and stock price? Try the links below:Northwest Natural Holding Co (NWN) Stock Price | Nasdaq

Northwest Natural Holding Co (NWN) Stock Quote, History and News - Yahoo Finance

Northwest Natural Holding Co (NWN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...