NextGen Healthcare, Inc. (NXGN): Price and Financial Metrics

NXGN Price/Volume Stats

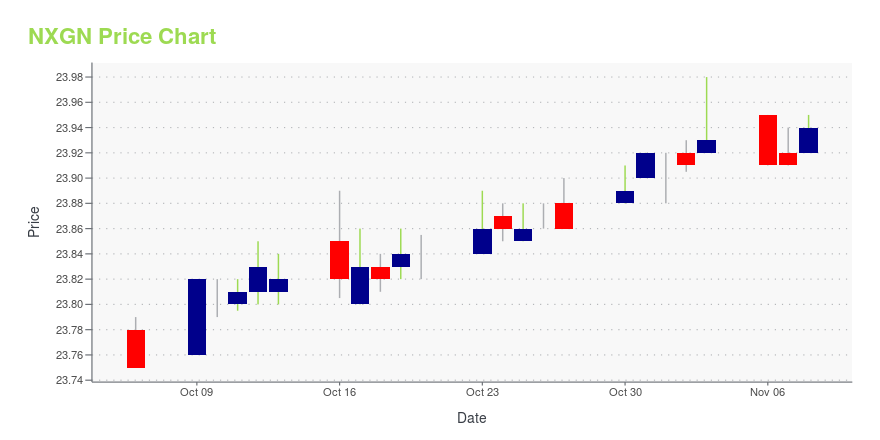

| Current price | $23.94 | 52-week high | $23.98 |

| Prev. close | $23.91 | 52-week low | $15.23 |

| Day low | $23.92 | Volume | 3,498,500 |

| Day high | $23.95 | Avg. volume | 659,586 |

| 50-day MA | $23.39 | Dividend yield | N/A |

| 200-day MA | $18.64 | Market Cap | 1.61B |

NXGN Stock Price Chart Interactive Chart >

NextGen Healthcare, Inc. (NXGN) Company Bio

NextGen Healthcare (formerly Quality Systems) develops and markets computer-based practice management, electronic health records and revenue cycle management applications as well as connectivity products and services for medical and dental group practices and small hospitals. The company was founded in 1974 and is based in Irvine, California.

Latest NXGN News From Around the Web

Below are the latest news stories about NEXTGEN HEALTHCARE INC that investors may wish to consider to help them evaluate NXGN as an investment opportunity.

Core & Main Set to Join S&P MidCap 400; ACI Worldwide to Join S&P SmallCap 600Core & Main Inc. (NYSE:CNM) will replace ACI Worldwide Inc. (NASD:ACIW) in the S&P MidCap 400, and ACI Worldwide will replace NextGen Healthcare Inc. (NASD:NXGN) in the S&P SmallCap 600 effective prior to the opening of trading on Monday, November 13. Thoma Bravo is acquiring NextGen Healthcare in a deal expected to be completed soon, pending final closing conditions. ACI Worldwide is more representative of the small-cap market space. |

Are You a Momentum Investor? This 1 Stock Could Be the Perfect PickThe Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage. |

NextGen (NXGN) Q2 Earnings Top Estimates, Margins DownNextGen's (NXGN) second-quarter fiscal 2024 results reflect strength in its Recurring revenues. |

Here's What Key Metrics Tell Us About Nextgen Healthcare (NXGN) Q2 EarningsAlthough the revenue and EPS for Nextgen Healthcare (NXGN) give a sense of how its business performed in the quarter ended September 2023, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers. |

NextGen Healthcare Inc (NXGN) Reports 10.6% Increase in Total Revenue for Fiscal 2024 Second QuarterRecurring Revenue Also Sees a 12.4% Increase Year Over Year |

NXGN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 48.24% |

| 3-year | 48.24% |

| 5-year | 46.78% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 5.56% |

| 2021 | -2.47% |

| 2020 | 13.50% |

| 2019 | 6.07% |

Continue Researching NXGN

Want to do more research on Nextgen Healthcare Inc's stock and its price? Try the links below:Nextgen Healthcare Inc (NXGN) Stock Price | Nasdaq

Nextgen Healthcare Inc (NXGN) Stock Quote, History and News - Yahoo Finance

Nextgen Healthcare Inc (NXGN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...