New York City REIT (NYC): Price and Financial Metrics

NYC Price/Volume Stats

| Current price | $8.45 | 52-week high | $10.91 |

| Prev. close | $8.46 | 52-week low | $5.46 |

| Day low | $8.21 | Volume | 5,774 |

| Day high | $8.50 | Avg. volume | 5,507 |

| 50-day MA | $9.13 | Dividend yield | N/A |

| 200-day MA | $7.91 | Market Cap | 21.79M |

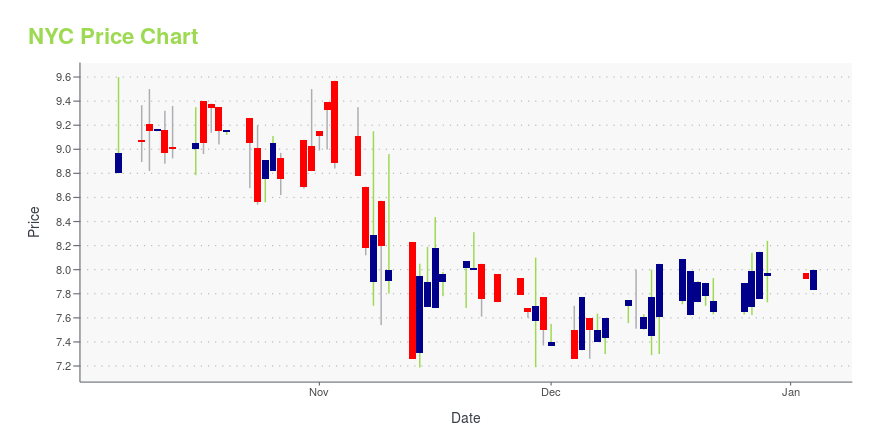

NYC Stock Price Chart Interactive Chart >

New York City REIT (NYC) Company Bio

New York City REIT, Inc. is a public real estate investment trust that owns a portfolio of high-quality commercial real estate located within the five boroughs of New York City, particularly Manhattan.

Latest NYC News From Around the Web

Below are the latest news stories about AMERICAN STRATEGIC INVESTMENT CO that investors may wish to consider to help them evaluate NYC as an investment opportunity.

American Strategic Investment Co. Announces Third Quarter 2023 ResultsNEW YORK, November 09, 2023--American Strategic Investment Co. (NYSE: NYC) ("ASIC" or the "Company"), a company that owns a portfolio of commercial real estate located within the five boroughs of New York City, announced today its financial and operating results for the third quarter ended September 30, 2023. |

BELLEVUE CAPITAL PARTNERS, LLC ANNOUNCES FINAL RESULTS OF TENDER OFFER FOR SHARES OF AMERICAN STRATEGIC INVESTMENT CORP.Bellevue Capital Partners, LLC ("Bellevue") announced today the final results of its tender offer to purchase for cash up to 350,000 shares of American Strategic Investment Co. (NYSE: NYC) ("ASIC") common stock at a price of $10.25 per share (the "Tender Offer"), which expired at 11:59 p.m., New York City time, on October 26, 2023. |

American Strategic Investment Co. Announces Release Date for Third Quarter 2023 ResultsNEW YORK, October 16, 2023--American Strategic Investment Co. (NYSE: NYC) ("ASIC" or the "Company") announced today it will release its financial results as of, and for the third quarter ended, September 30, 2023, on Thursday, November 9, 2023, before the start of trading on the New York Stock Exchange. |

American Strategic Investment Co. Completes Disposition of the Hit FactoryNEW YORK, October 12, 2023--American Strategic Investment Co. (NYSE: NYC) ("ASIC" or the "Company") announced today that it completed the sale of the property it owns at 421 W. 54th Street (the "Hit Factory") for $4.5 million. |

American Strategic Investment Co. Announces Response to Bellevue Capital Partners, LLC Tender OfferNEW YORK, October 10, 2023--American Strategic Investment Co. (NYSE: NYC) ("ASIC" or the "Company") announced today that it has filed with the Securities and Exchange Commission ("SEC") a Solicitation/Recommendation Statement on Schedule 14D-9 and Letter to Stockholders dated October 10, 2023, regarding the tender offer commenced by Bellevue Capital Partners, LLC ("Bellevue") on September 27, 2023, to purchase up to 350,000 shares of the Company’s Class A common stock at a price of $10.25 per sh |

NYC Price Returns

| 1-mo | -6.32% |

| 3-mo | 35.85% |

| 6-mo | 9.65% |

| 1-year | 8.06% |

| 3-year | -91.68% |

| 5-year | N/A |

| YTD | 6.02% |

| 2023 | -43.71% |

| 2022 | -83.03% |

| 2021 | 36.62% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...