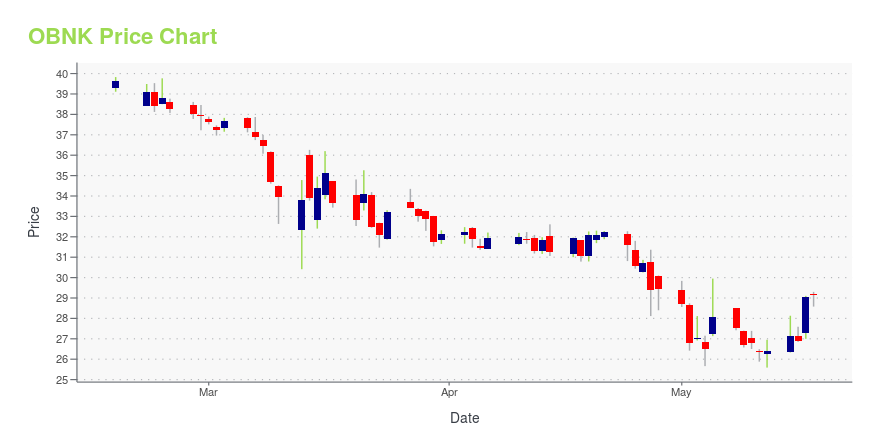

Origin Bancorp, Inc. (OBNK): Price and Financial Metrics

OBNK Price/Volume Stats

| Current price | $28.61 | 52-week high | $47.28 |

| Prev. close | $29.15 | 52-week low | $25.59 |

| Day low | $28.46 | Volume | 136,600 |

| Day high | $30.29 | Avg. volume | 107,928 |

| 50-day MA | $30.82 | Dividend yield | 2.1% |

| 200-day MA | $37.55 | Market Cap | 880.64M |

OBNK Stock Price Chart Interactive Chart >

Origin Bancorp, Inc. (OBNK) Company Bio

Origin Bancorp, Inc. operates as the holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, high net worth individuals, and retail clients in Louisiana, Texas, and Mississippi. The company was founded in 1912 and is based in Ruston, Louisiana.

Latest OBNK News From Around the Web

Below are the latest news stories about ORIGIN BANCORP INC that investors may wish to consider to help them evaluate OBNK as an investment opportunity.

Origin Bancorp, Inc. Announces Transfer of Listing of Common Stock to the New York Stock ExchangeRUSTON, La., May 09, 2023 (GLOBE NEWSWIRE) -- Origin Bancorp, Inc. (NASDAQ: OBNK) (“Origin”), the parent company of Origin Bank, announced today that it is transferring the listing of its common stock to the New York Stock Exchange (“NYSE”) from The Nasdaq Stock Market LLC (“Nasdaq”). Origin’s common stock is expected to begin trading on the NYSE on Monday, May 22, 2023, under the new ticker symbol of “OBK”. Origin expects its common stock to continue to trade on Nasdaq until the close of the ma |

Why You Might Be Interested In Origin Bancorp, Inc. (NASDAQ:OBNK) For Its Upcoming DividendOrigin Bancorp, Inc. ( NASDAQ:OBNK ) is about to trade ex-dividend in the next three days. The ex-dividend date is one... |

Origin Bancorp (NASDAQ:OBNK) Has Affirmed Its Dividend Of $0.15Origin Bancorp, Inc. ( NASDAQ:OBNK ) has announced that it will pay a dividend of $0.15 per share on the 31st of May... |

Origin Bancorp (OBNK) Misses Q1 Earnings and Revenue EstimatesOrigin Bancorp (OBNK) delivered earnings and revenue surprises of -13.19% and 2.22%, respectively, for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock? |

Origin Bancorp, Inc. Reports Earnings for First Quarter 2023RUSTON, La., April 26, 2023 (GLOBE NEWSWIRE) -- Origin Bancorp, Inc. (Nasdaq: OBNK) (“Origin” or the “Company”), the holding company for Origin Bank (the “Bank”), today announced net income of $24.3 million, or $0.79 diluted earnings per share for the quarter ended March 31, 2023, compared to net income of $29.5 million, or $0.95 diluted earnings per share, for the quarter ended December 31, 2022, and compared to net income of $20.7 million, or $0.87 diluted earnings per share for the quarter en |

OBNK Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -27.34% |

| 5-year | -10.72% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -13.31% |

| 2021 | 56.44% |

| 2020 | -25.46% |

| 2019 | 11.86% |

OBNK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OBNK

Want to see what other sources are saying about Origin Bancorp Inc's financials and stock price? Try the links below:Origin Bancorp Inc (OBNK) Stock Price | Nasdaq

Origin Bancorp Inc (OBNK) Stock Quote, History and News - Yahoo Finance

Origin Bancorp Inc (OBNK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...